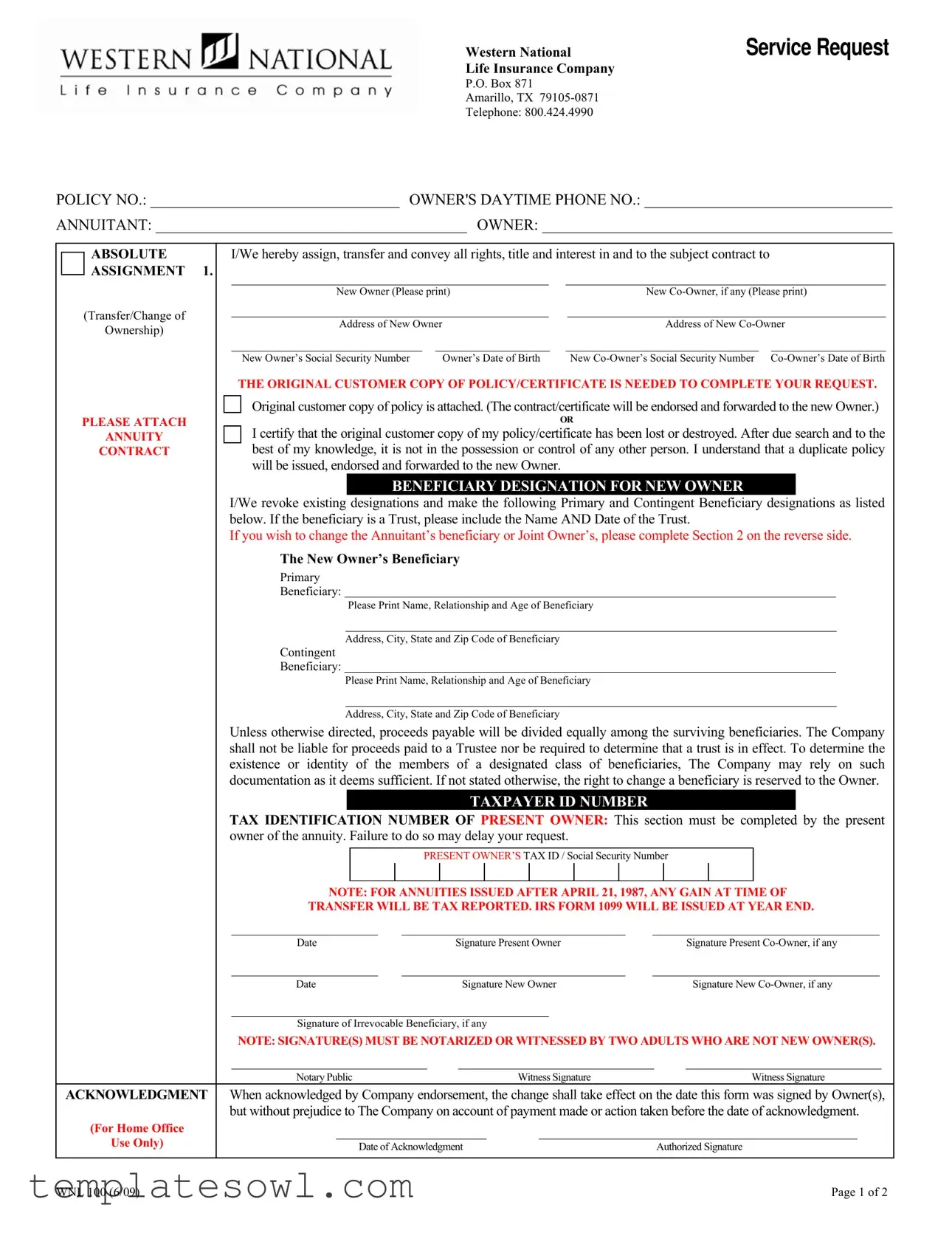

Fill Out Your Western National Insurance Form

The Western National Insurance form serves as a vital document for individuals engaged in annuity contracts and related transactions. This form facilitates the transfer of ownership or changes to beneficiary designations, ensuring that policyholders can efficiently manage their insurance plans. Collecting crucial information, it requires details about the existing owner, new owner, and annuitant, along with their respective Social Security numbers and dates of birth. This ensures a clear identification chain, aiding in the accurate processing of requests. Beneficiary designations can also be modified by revoking previous choices, allowing flexibility for policyholders to adapt to changing life circumstances. For those applying for a duplicate policy, the form accounts for lost or destroyed contracts, streamlining the replacement process. Notably, it contains sections where immediate and contingent beneficiaries can be detailed, with provisions for trusts if applicable. Accuracy in completing these sections is paramount, as these designations dictate how benefits will be distributed in the future. Completing the form involves not just the signatures of the current and new owners, but also requires witnessing or notarization, adding a layer of validation to the transaction. Familiarity with this form is essential for anyone invested in an annuity with Western National, as it empowers them to retain control over their policy and its ramifications.

Western National Insurance Example

Western National

Life Insurance Company

Service Request

P.O. Box 871

Amarillo, TX

Telephone: 800.424.4990

Overnight Mailing Address

Annuity Administration

205 E. 10th Avenue

Amarillo, TX

POLICY NO.: ________________________________ OWNER'S DAYTIME PHONE NO.: ________________________________

ANNUITANT: ________________________________________ OWNER: _____________________________________________

|

|

ABSOLUTE |

|

I/We hereby assign, transfer and convey all rights, title and interest in and to the subject contract to |

|||||||||

|

|

|

|||||||||||

|

|

ASSIGNMENT |

1. |

|

|

|

|

. |

|||||

|

|

|

|

|

|

|

|

||||||

|

|

|

|

New Owner (Please print) |

|

|

New |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Transfer/Change of |

|

|

|

|

|

. |

|||||

|

|

Ownership) |

|

Address of New Owner |

|

|

|

Address of New |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

New Owner’s Social Security Number |

Owner’s Date of Birth |

|

|

New |

|||||

THE ORIGINAL CUSTOMER COPY OF POLICY/CERTIFICATE IS NEEDED TO COMPLETE YOUR REQUEST.

Original customer copy of policy is attached. (The contract/certificate will be endorsed and forwarded to the new Owner.)

PLEASE ATTACH |

|

|

OR |

|

|

I certify that the original customer copy of my policy/certificate has been lost or destroyed. After due search and to the |

|

ANNUITY |

|

|

|

CONTRACT |

|

|

best of my knowledge, it is not in the possession or control of any other person. I understand that a duplicate policy |

|

|

|

will be issued, endorsed and forwarded to the new Owner. |

|

|

|

|

|

|

|

BENEFICIARY DESIGNATION FOR NEW OWNER |

|

|

|

|

|

||||||||||||||||||

|

I/We revoke existing designations and make the following Primary and Contingent Beneficiary designations as listed |

|||||||||||||||||||||||||||||

|

below. If the beneficiary is a Trust, please include the Name AND Date of the Trust. |

|||||||||||||||||||||||||||||

|

If you wish to change the Annuitant’s beneficiary or Joint Owner’s, please complete Section 2 on the reverse side. |

|||||||||||||||||||||||||||||

|

|

The New Owner’s Beneficiary |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

Primary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Beneficiary: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

||||||||||

|

|

|

|

|

Please Print Name, Relationship and Age of Beneficiary |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|||||||

|

|

|

|

Address, City, State and Zip Code of Beneficiary |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

Contingent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Beneficiary: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

||||||||||

|

|

|

|

Please Print Name, Relationship and Age of Beneficiary |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|||||||

|

|

|

|

Address, City, State and Zip Code of Beneficiary |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

Unless otherwise directed, proceeds payable will be divided equally among the surviving beneficiaries. The Company |

|||||||||||||||||||||||||||||

|

shall not be liable for proceeds paid to a Trustee nor be required to determine that a trust is in effect. To determine the |

|||||||||||||||||||||||||||||

|

existence or identity of the members of a designated class of beneficiaries, The Company may rely on such |

|||||||||||||||||||||||||||||

|

documentation as it deems sufficient. If not stated otherwise, the right to change a beneficiary is reserved to the Owner. |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

TAXPAYER ID NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

TAX IDENTIFICATION NUMBER OF PRESENT OWNER: This section must be completed by the present |

|||||||||||||||||||||||||||||

|

owner of the annuity. Failure to do so may delay your request. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

PRESENT OWNER’S TAX ID / Social Security Number |

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOTE: FOR ANNUITIES ISSUED AFTER APRIL 21, 1987, ANY GAIN AT TIME OF |

||||||||||||||||||||||||||||

|

|

TRANSFER WILL BE TAX REPORTED. IRS FORM 1099 WILL BE ISSUED AT YEAR END. |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|||||||||

|

|

Date |

|

|

|

|

|

Signature Present Owner |

|

|

|

Signature Present |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|||||||||

|

|

Date |

|

|

|

|

|

|

Signature New Owner |

|

|

|

Signature New |

|||||||||||||||||

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

Signature of Irrevocable Beneficiary, if any |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

NOTE: SIGNATURE(S) MUST BE NOTARIZED OR WITNESSED BY TWO ADULTS WHO ARE NOT NEW OWNER(S). |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|||||||

|

|

Notary Public |

|

|

|

|

|

|

|

Witness Signature |

|

|

|

|

Witness Signature |

|||||||||||||||

ACKNOWLEDGMENT |

When acknowledged by Company endorsement, the change shall take effect on the date this form was signed by Owner(s), |

|||||||||||||||||||||||||||||

|

but without prejudice to The Company on account of payment made or action taken before the date of acknowledgment. |

|||||||||||||||||||||||||||||

(For Home Office |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|||||||

Use Only) |

|

|

|

|

|

Date of Acknowledgment |

|

Authorized Signature |

||||||||||||||||||||||

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WNL 100 (6/09) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 1 of 2 |

|||||||||

Western National

Life Insurance Company

P.O. Box 871

Amarillo, TX

Telephone: 800.424.4990

Service Request

POLICY NO.: ________________________________ OWNER'S DAYTIME PHONE NO.: ________________________________

ANNUITANT: ________________________________________ OWNER: _____________________________________________

|

|

|

|

BENEFICIARY |

|

|

I/We revoke existing designations and subject to any existing assignment, make the following Primary and Contingent |

||||||||||||||||||||||

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

CHANGE |

2. |

|

Beneficiary designations as listed below: |

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

**If the Beneficiary is being changed to a TRUST, please include the Name AND Date of the TRUST** |

|||||||||||||||||||

|

|

|

|

|

|

|

The Annuitant’s Beneficiary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

Primary Beneficiary: |

|

|

|

|

|

|

|

. |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Please Print Name, Relationship and Age of Beneficiary |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Address, City, State and Zip Code of Beneficiary |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

Contingent Beneficiary: |

|

|

|

|

|

|

|

. |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Please Print Name, Relationship and Age of Beneficiary |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Address, City, State and Zip Code of Beneficiary |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

The Joint Owner’s Beneficiary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

Primary Beneficiary: |

|

|

|

|

|

|

|

. |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Please Print Name, Relationship and Age of Beneficiary |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Address, City, State and Zip Code of Beneficiary |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

Contingent Beneficiary: |

|

|

|

|

|

|

|

. |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Please Print Name, Relationship and Age of Beneficiary |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Address, City, State and Zip Code of Beneficiary |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

The Owner’s Beneficiary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

Primary Beneficiary: |

|

|

|

|

|

|

|

. |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Please Print Name, Relationship and Age of Beneficiary |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Address, City, State and Zip Code of Beneficiary |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

Contingent Beneficiary: |

|

|

|

|

|

|

|

. |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Please Print Name, Relationship and Age of Beneficiary |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Address, City, State and Zip Code of Beneficiary |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

Unless otherwise directed, proceeds payable will be divided equally among the surviving beneficiaries. The Company |

||||||||||||||||||||||

|

|

|

|

|

|

|

shall not be liable for proceeds paid to a Trustee nor be required to determine that a trust is in effect. To determine the |

||||||||||||||||||||||

|

|

|

|

|

|

|

existence or identity of the members of a designated class of beneficiaries, The Company may rely on such |

||||||||||||||||||||||

|

|

|

|

|

|

|

documentation as it deems sufficient. If not stated otherwise, the right to change a beneficiary is reserved to the Owner. |

||||||||||||||||||||||

|

|

|

|

ADDRESS |

|

|

Previous |

|

|

|

|

|

|

|

|

|

|

|

Current |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

CHANGE |

3. |

|

Address: |

|

|

|

|

|

|

|

. |

|

|

Address: |

. |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

. |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

. |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

NAME |

|

|

|

Annuitant |

|

|

|

Owner |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

CHANGE |

4. |

|

From: |

|

|

|

|

|

|

|

|

|

|

|

To: |

. |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

ATTACH |

|

|

Reason: |

Marriage |

Divorce |

|

Other (explain below) |

||||||||||||||||||

|

|

DOCUMENTATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

DUPLICATE |

|

|

I/We certify the subject contract has been lost or destroyed and request that a duplicate be issued. If a duplicate is issued, |

||||||||||||||||||||||

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

CONTRACT |

|

|

the original shall be null and void. The contract has not been sold, assigned or pledged to any person or organization. |

||||||||||||||||||||||

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

REQUEST |

5. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

WITNESSED |

|

|

|

|

|

|

|

ALL REQUESTS OR CHANGES REQUIRE WITNESSED SIGNATURE(S) |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

SIGNATURE(S) |

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

(Complete This Section |

|

|

|

|

|

Date |

|

|

|

|

|

|

|

Witness Signature |

|

|

Owner Signature |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

||||||

|

|

|

For All Requests |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

Witness Signature |

|

|

|||||||||||

|

|

|

|

EXCEPT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|||

|

|

Ownership Changes.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

Witness Signature |

|

|

Signature of Irrevocable Beneficiary, if any |

|||||||||||

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

ACKNOWLEDGMENT |

When acknowledged by Company endorsement, the change shall take effect on the date this form was signed by Owner(s), |

|||||||||||||||||||||||||||

|

|

|

|

|

|

but without prejudice to The Company on account of payment made or action taken before the date of acknowledgment. |

|||||||||||||||||||||||

|

|

|

|

(For Home Office |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

||

|

|

|

|

Use Only) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Acknowledgment |

|

|

|

|

Authorized Signature |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WNL 100 (6/09) |

Page 2 of 2 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Company Information | Western National Life Insurance Company is located at P.O. Box 871, Amarillo, TX 79105-0871. For inquiries, contact them at 800.424.4990. |

| Service Request Purpose | This form serves as a service request for changes in ownership, beneficiary designations, and duplicate policy requests. |

| Ownership Transfer | Owners can assign their rights in the contract to a new owner through this form, which requires their signature and notarization. |

| Beneficiary Designation | Existing beneficiary designations can be revoked; new primary and contingent beneficiaries must be named in the form. |

| Tax Information | The present owner’s Tax Identification Number is required to process the request. Failure to provide this may lead to delays. |

| Document Requirements | A completed copy of the original policy or a certification of loss must accompany the request for ownership transfer or changes. |

| Notarization Requirement | All signatures on the form must be notarized or witnessed by two adults who are not new owners, reinforcing the form's validity. |

| Governing Law | This service request form is governed by Texas laws, as indicated by the address of Western National Life Insurance Company. |

Guidelines on Utilizing Western National Insurance

Completing the Western National Insurance form is a straightforward process. By carefully following the steps outlined below, you can ensure that all necessary information is accurately provided. This helps facilitate a smooth transition and keeps everything organized for future reference.

- Begin by writing your Policy Number in the designated space.

- Fill in your Daytime Phone Number to enable easy communication.

- Provide the Annuitant's Name and the Owner's Name in the respective fields.

- Indicate whether you are assigning a new owner, co-owner, or making a change of ownership by providing the new owner’s details. Include their Name, Address, Social Security Number, and Date of Birth.

- If applicable, indicate that the customer copy of the policy is attached, or certify that it has been lost or destroyed.

- List both the Primary and Contingent Beneficiaries for the new owner. Include their Name, Relationship, Age, and Address.

- Fill in the Tax Identification Number for the present owner to avoid any delays.

- Provide the signatures of both the present owner and the new owner, as well as any co-owners and irrevocable beneficiaries, if applicable.

- Ensure that all signatures are either notarized or witnessed by two adults who are not the new owners.

- Finally, leave the acknowledgment section blank. This will be filled out by the company.

What You Should Know About This Form

What information do I need to provide on the Western National Insurance form?

You will need to provide your policy number, your daytime phone number, the names of the annuitant and the owner, along with their Social Security numbers and dates of birth. Additionally, you must indicate any new owners or co-owners, as well as information about your beneficiaries. Details about the original policy, including if it has been lost or destroyed, should also be included.

How do I assign a new owner for my policy?

To assign a new owner, fill out the section on the form designated for assignments. Clearly print the name and address of the new owner and, if applicable, the co-owner. Remember, the current customer copy of your policy must be attached, or you need to certify that it is lost or destroyed. Signatures from all current and new owners are required, and those signatures must be notarized or witnessed by two adults who are not new owners.

What happens if I lose my original policy?

If you lose your original policy, you will need to certify that it has been lost or destroyed on the form. Doing this means you will request a duplicate, which will be issued. Keep in mind that the original policy will be considered void once the duplicate is created.

How do I update my beneficiaries?

To update your beneficiaries, fill out the sections for Primary and Contingent Beneficiaries on the form. You will need to provide the names, relationships, ages, and addresses of each beneficiary. If a beneficiary is a Trust, be sure to include both the name and date of the Trust. Once completed, this section replaces any previous beneficiary designations.

What should I do if I’m changing my address?

If you're changing your address, complete the address change section of the form. You will provide both your previous and current address. Additionally, specify the reason for the change, such as marriage, divorce, or other circumstances. Make sure to sign the document as required.

Is there a benefit to having multiple beneficiaries?

Yes, having multiple beneficiaries can ensure that the benefits are distributed according to your wishes. If you do not specify otherwise, the proceeds will be divided equally among the surviving beneficiaries. This can help to avoid disputes and ensure fairness among your loved ones.

What if I want to make changes that require a witness?

If you need to make changes that require a witnessed signature, such as ownership changes, make sure to have two adults witness the signatures of the owner and any co-owners. Both witnesses should not be new owners. Their signatures should also appear on the document where indicated.

Common mistakes

Filling out the Western National Insurance form can be complex, and mistakes can lead to delays or complications in processing your request. One common error is leaving the POLICY NO. section blank. This number is crucial for identifying your account and ensuring your request is handled correctly. Without it, your submission may not be processed in a timely manner.

Another frequent mistake involves omitting the Social Security Number of both the new owner and any co-owner. This information is required to verify identity and ownership. Neglecting to include this data can cause unnecessary delays in the approval of your request.

Furthermore, failing to provide complete and accurate beneficiary designations is a significant oversight. Ensure that all beneficiaries, both primary and contingent, are clearly identified with their names, relationships, and ages. Incomplete information can lead to confusion about who should receive benefits.

Lastly, many people forget to obtain the necessary witness signatures or notarization on the form. This requirement is vital, especially when ownership changes are involved. Without the appropriate signatures, the request may be invalid, resulting in more time being spent to correct the oversight.

Documents used along the form

When dealing with the Western National Insurance form, several other documents may also be required. These documents help streamline the process of managing your insurance or annuity contract. Here is a list of common forms and their descriptions:

- Beneficiary Change Form: This form allows the policy owner to update or change the beneficiaries on their policy. It specifies who will receive benefits in the event of the policyholder's death, ensuring the desired individuals are recognized.

- Change of Ownership Form: This document is used when transferring ownership of an insurance policy from one individual to another. It requires information about the current owner and the new owner to effect the change.

- Request for Duplicate Policy Form: In cases where the original policy is lost or destroyed, this form is utilized to request a duplicate. The original policy will be voided once the duplicate is issued.

- Tax Identification Number Form: This form collects the tax identification numbers or Social Security numbers of policy owners. Completing this section is crucial to avoid delays in processing requests.

- Address Change Form: Policyholders need this form to update their address with the insurance company. Keeping address information current ensures that all correspondence and policy documents are sent to the right location.

- Withdrawal Request Form: This document is used when the policyholder wishes to withdraw funds from their policy or annuity. It specifies the amount being withdrawn and the reason for the withdrawal.

Having these documents ready can make managing your insurance policies much easier. Make sure to understand the significance of each form and fill them out accurately to ensure a smooth processing experience.

Similar forms

The Western National Insurance form serves various purposes, including beneficiary designation and ownership change for annuities. Similar documents often share common features, such as beneficiary information and signature requirements. Here are seven documents that are comparable in nature:

- Life Insurance Beneficiary Designation Form: Like the Western National Insurance form, this document specifies primary and contingent beneficiaries, allowing policyholders to choose who will receive benefits upon their death.

- Trust Beneficiary Designation Form: This form allows individuals to designate beneficiaries specifically for a trust. It includes similar sections for names, relationships, and addresses, just as seen in the insurance form.

- Retirement Account Beneficiary Designation Form: Much like the annuity form, this document is used to specify beneficiaries for retirement accounts, which are subject to specific tax regulations and often require detailed beneficiary information.

- Property Deed Transfer Form: This form facilitates the change of ownership for real estate. It shares common elements such as the need for signatures and notarization, similar to the requirements in the insurance form to ensure validity.

- Power of Attorney Document: In this document, individuals designate an agent to act on their behalf. The form requires clear identification of parties involved and often necessitates signatures from witnesses to ensure authenticity.

- Will and Testament: A will specifies how a person's assets will be distributed after their death. It functions similarly to the insurance form by including beneficiary information and often requires signatures for validation.

- Health Care Proxy Form: This document appoints someone to make medical decisions on behalf of another. It contains similar sections for providing names and relationships and requires signatures to establish authority.

In each of these cases, the fundamental goal remains to clearly outline intentions regarding beneficiaries or property ownership, ensuring that the wishes of the individual are honored in legal matters.

Dos and Don'ts

When filling out the Western National Insurance form, it is essential to follow specific guidelines to ensure accuracy and prevent delays. Below is a list of things to do and avoid during this process.

- Do ensure all sections are filled out completely. Missing information can result in processing delays.

- Do double-check the policy number and personal identification numbers. Accuracy is critical for proper identification.

- Do sign the form in the presence of a notary or two witnesses. This step is necessary for validation.

- Do specify primary and contingent beneficiaries clearly. Include their relationships and contact information.

- Do attach any required documentation. This may include identification or support for changes like marriage or divorce.

- Don’t rush the process. Take your time to carefully review all entered information.

- Don’t forget to retain a copy of the completed form for your records. This may be helpful for future reference.

Misconceptions

Misconceptions about the Western National Insurance form can lead to confusion and unnecessary complications. Here are eight common misunderstandings:

- Everyone can change the beneficiary. Only the owner of the policy can change the beneficiary designation. Others do not have this authority unless specified.

- The original policy document is not needed. The form states that the original customer copy of the policy is required. Without it, the request may be delayed.

- Signatures do not require witnesses. The form clearly asks for signatures to be notarized or witnessed by two adults who are not part of the ownership.

- A duplicate policy can be issued without explanation. If the original policy is lost or destroyed, the form requires an affidavit certifying its status.

- Any past designations are automatically honored. Existing beneficiary designations are revoked once new ones are established in the form.

- Only one beneficiary can be named. The form allows for both primary and contingent beneficiaries to be designated, providing flexibility in planning.

- The company does not need additional identification. The tax identification number section must be filled out. Failure to do so may lead to processing delays.

- Changes take effect immediately. Changes are acknowledged by the company's endorsement. Until then, the original terms stay in effect.

Key takeaways

- The form must be completed clearly with all required information, including policy number and contact numbers.

- Ensure all signatures are present. Notarization or signatures from two unrelated witnesses is mandatory.

- The original customer copy of the policy is necessary to process the request. If lost, certification of loss must be provided.

- Beneficiary designations require specific details including name, relationship, and age. Trust beneficiaries need the name and date of the trust.

- Tax identification numbers must be provided by the current owner. Omitting this information can delay processing.

- Changes to ownership or beneficiary designations can take effect only after acknowledgment by the company.

- Any requests or changes will have no effect if not witnessed appropriately as specified in the form.

- For any reportable gains upon transfer for annuities issued after April 21, 1987, IRS Form 1099 will be issued at year-end.

Browse Other Templates

End of Season Player Evaluation Form - Examine proficiency in using the weak hand during play.

Transamerica 401k Withdrawal - If opting for a rollover, ensure you have the account information ready.