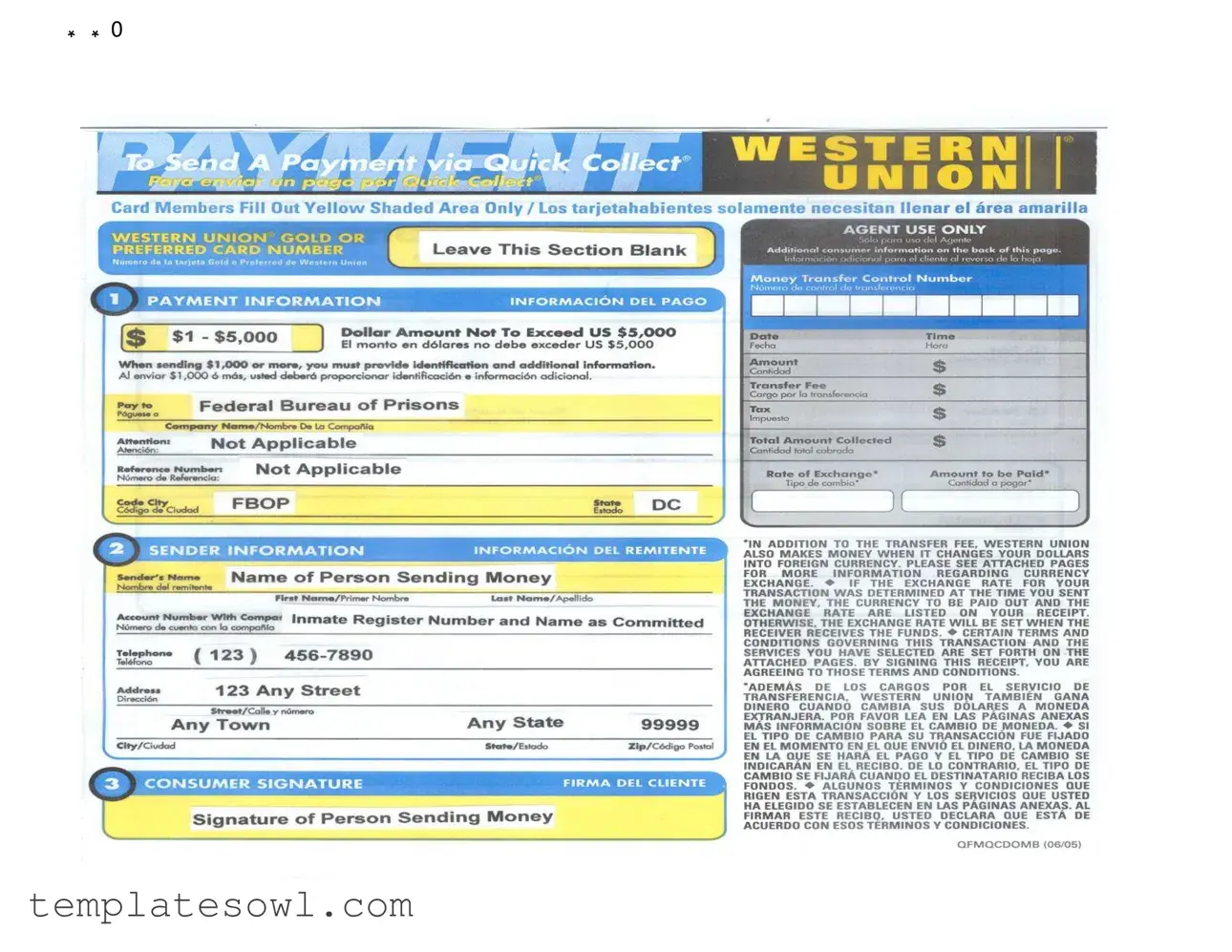

Fill Out Your Western Union America Form

The Western Union America form serves as a crucial tool for individuals engaging in money transfer services. It is designed primarily for the use of both sender and agent, streamlining the process of remitting funds. The form requires card members to focus their attention on the yellow-shaded area, where they input their Western Union Gold or Preferred Card number, thereby ensuring that relevant membership benefits are correctly applied. Mandatory fields include detailed sender information, such as name, address, and contact details, all of which facilitate proper identification and ensure compliance with transactional regulations. Additionally, the form includes sections for recording the money transfer control number, date and time of the transaction, amount sent, applicable transfer fees, taxes, and the total amount collected. This transparency plays an essential role in financial operations. An important element of the transaction is the exchange rate stipulation, which indicates the amount to be paid in the recipient's local currency and the point at which the rate will be determined. Lastly, the form explicitly states that by signing, the sender agrees to the associated terms and conditions of the transaction, underscoring the formal nature of the agreement made during the money transfer process.

Western Union America Example

Form Characteristics

| Fact Name | Details |

|---|---|

| Yellow Shaded Area | Card members only need to fill out the yellow shaded area of the form. |

| Agent Use | Some sections are designated for agent use only, and the sender should leave them blank. |

| Transfer Control Number | A money transfer control number is provided for tracking the transaction. |

| Sender Information | The sender must provide personal details, including name, address, and phone number. |

| Signature Requirement | A signature from the sender is required, affirming acknowledgment of fees and terms. |

| Exchange Rate | The exchange rate will be determined when the funds are received unless specified otherwise. |

| Transfer Fee | A transfer fee is charged, in addition to the currency exchange service fee. |

| Governing Law | The laws governing transactions may vary by state; be sure to check local regulations. |

| Information Accessibility | Additional consumer information is available on the back of the form for further details. |

Guidelines on Utilizing Western Union America

Once you’ve gathered all necessary information, you can proceed to complete the Western Union America form. By following these steps closely, you will ensure that all required details are correctly filled out, making your transaction smoother and more efficient.

- Locate the Yellow Shaded Area: If you are a card member, start by finding the yellow shaded area of the form.

- Enter Your Card Information: Fill in your Western Union Gold or Preferred Card number in the designated space.

- Leave Agent Use Section Blank: Do not fill in the section that is marked for agent use only.

- Fill Out the Money Transfer Section: Write in the Money Transfer Control Number, date, time, amount, transfer fee, tax, and total amount collected.

- Indicate the Rate of Exchange: Specify the rate of exchange and the amount to be paid.

- Provide Sender Information: Under Sender Information, fill in the first and last name of the person sending the money.

- Complete Address Details: Input the complete address, including street, city, state, and ZIP code.

- Sign the Form: Finally, make sure to sign the form to confirm that you agree with the terms and conditions outlined.

What You Should Know About This Form

What information should I fill out on the Western Union America form?

On the Western Union America form, you must fill out specific areas pertinent to your transaction. If you are a cardholder with a Gold or Preferred card, only the yellow shaded area needs to be completed. Provide your card number in the designated field. The rest of the form, which includes details such as the amount you're sending and fees associated with the transaction, needs to be accurately filled out based on your choice of services.

What is the Money Transfer Control Number?

The Money Transfer Control Number (MTCN) is a unique identifier assigned to your transaction. It is essential for tracking your money transfer and should be kept safe. You will be provided with this number on your receipt, which can be used by the recipient to claim the funds. Be aware that this number is crucial if there are any issues during the transfer or if the recipient needs to inquire about the status of the funds.

Are there additional fees besides the transfer fee?

Yes, along with the transfer fee that varies based on the amount sent and the destination, additional charges may apply when converting your money into foreign currency. Western Union earns revenue from the currency exchange, and the rate can fluctuate—thus, it is recommended to check the rates listed on your receipt. It’s important to review the attached information regarding currency exchange for further details.

What happens to my exchange rate if I send money?

The exchange rate for your transaction may be determined at the time you send the money. If this occurs, the specific currency to be paid out and the exchange rate will be reflected on your receipt. However, if the exchange rate is not fixed upfront, it will be established when the recipient retrieves the funds. Be sure to understand how exchange rates can impact the amount they receive.

What do I need to sign on the form?

Your signature is required on the Western Union America form to confirm that you acknowledge and agree to the terms and conditions governing the transaction. This includes your acceptance of all charges involved, including transfer fees and any applicable charges for currency exchange. Ensure that you read the attached pages for detailed terms before signing.

What should I do if I experience issues with my transaction?

If you encounter problems with your transaction, you should contact Western Union’s customer service as soon as possible. Use the Money Transfer Control Number to provide them with the necessary information regarding your transaction. Additionally, retaining a copy of your receipt will facilitate the process, as it includes essential details needed to address your concerns efficiently.

Common mistakes

When filling out the Western Union America form, individuals can easily make mistakes that may lead to delays or complications. One common error occurs when the sender overlooks the yellow shaded area, which is specifically designated for Western Union Gold or Preferred Card numbers. It’s essential to enter this information if applicable, as failing to do so can cause processing issues.

Another frequent mistake is omitting important information in the sender's details section. The form requires both first and last names of the sender. Some may forget to fill out either field, which can hinder the transaction. Ensuring that names are complete and accurate is necessary for a successful money transfer.

People sometimes skip the address section or provide incomplete address information. The form requests a full mailing address, including the street, city, state, and zip code. Inaccurate or missing details can create complications, especially when trying to reach the sender for any follow-up.

A crucial mistake happens when individuals do not carefully review the total amount collected and the fees. It’s essential to calculate the transfer fee and tax correctly, as errors in these calculations can lead to misunderstandings or disputes with Western Union. Double-checking all numerical entries can save time and frustration.

Some senders fail to provide a correct and functional phone number. This information is required not only for Western Union’s records but also in case they need to contact the sender for any further requirements or clarifications. Entering a valid number helps ensure smooth communication throughout the transaction.

People frequently forget to sign the form. The signature of the person sending money is critical as it confirms authorization for the transaction. A missing signature can completely halt the money transfer process, leading to delays and potential inconvenience.

Inattention to the exchange rate section can also pose a challenge. It is vital to note whether the rate was set at the time of sending or will be determined later. Understanding this can have significant implications on how much the receiver ultimately gets.

Finally, ignoring the terms and conditions attached to the transaction is another mistake that can have consequences. By signing the receipt, the sender agrees to those terms. Familiarizing yourself with this information is vital to avoid surprises later on. Taking a moment to read through these details fosters transparency and understanding in the transaction process.

Documents used along the form

The Western Union America form is commonly used for transferring money, but it often comes alongside other documents to ensure proper processing and security. Below are four forms that may be used in conjunction with the Western Union America form.

- Money Transfer Receipt: This document serves as a proof of transaction. It contains important details such as the transaction number, amount sent, recipient information, and the fees charged. Recipients should keep this receipt for their records and in case any issues arise.

- Currency Exchange Rate Disclosure: This form provides a detailed explanation of the exchange rates that apply to the transaction. Customers can understand how much they will receive based on the current rates. It outlines any potential fluctuations that may occur between the time the money is sent and the time it is received.

- Customer Identification Form: In some cases, customers may need to fill out this form to provide valid identification. This enhances security and ensures compliance with financial regulations. It typically requests details such as name, address, date of birth, and identification numbers.

- Service Agreement: This document outlines the terms and conditions associated with using Western Union services. It addresses the rights and responsibilities of both the sender and the recipient. By signing this form, customers confirm their understanding and agreement with the specified terms.

Using these forms and documents helps facilitate smooth transactions while ensuring compliance with regulations and protecting all parties involved. Therefore, understanding each document's purpose is essential for a successful money transfer experience.

Similar forms

- Money Transfer Receipt: Similar to the Western Union America form, a Money Transfer Receipt includes details about the transaction, including the amount sent, fees, and the sender’s information. Both documents serve as proof of the transaction for the sender.

- Wire Transfer Form: A wire transfer form also collects sender and receiver details, along with transaction amounts and fees. Like the Western Union form, it captures essential data necessary to execute the transfer and ensure regulatory compliance.

- Remittance Form: The remittance form is used for sending money, often internationally. It captures sender information and transaction specifics, much like the Western Union America form, providing a clear record of the transfer.

- Currency Exchange Agreement: This document outlines the details of how currency is exchanged during transfers. Similar to the Western Union form, it includes information about the exchange rate applied and serves to inform the sender of potential costs.

- Transaction Consent Form: A transaction consent form requires a sender's signature to validate the transaction. Like the signature section of the Western Union America form, it signifies the sender's agreement to terms and conditions involved in the transaction.

- Deposit Slip: Often used in banks, a deposit slip collects information relevant to a money deposit. It shares a similarity with the Western Union form in that it records the amount and provides a receipt for financial transactions.

Dos and Don'ts

When filling out the Western Union America form, consider the following important do's and don'ts:

- Do: Fill out the yellow shaded area accurately.

- Do: Include your Western Union Gold or Preferred Card number if applicable.

- Do: Ensure all personal information, such as your name and address, is complete and correct.

- Do: Double-check the date and time of the transaction.

- Do: Sign the form where indicated to confirm your consent.

- Don't: Leave sections blank that are required to be filled out, especially personal information.

- Don't: Forget to review the terms and conditions that are set forth on the attached pages.

- Don't: Assume that the exchange rate is fixed; it can change upon the recipient's withdrawal.

- Don't: Ignore instructions for agent use; these sections should not be filled out by you.

Misconceptions

Misconceptions about the Western Union America Form

- Only One Section Needs to Be Completed: Many people believe they only need to fill out the yellow shaded area. However, additional information, such as sender details, is essential for processing the transaction.

- Western Union Doesn’t Charge Extra Fees: A common myth is that the transfer fee is the only charge. In reality, there are fees when converting money into foreign currency as well.

- Exchange Rates Are Fixed at the Time of Sending: Some assume that the exchange rate is locked in when the money is sent. This is only true if stated on the receipt; otherwise, it can change when the recipient actually receives the funds.

- The Form Is Only Required in English: Many individuals think the form only needs to be filled out in English. The form is available in both English and Spanish to accommodate a broader audience.

- All Sender Information Is Optional: Some believe that providing sender details is optional. In fact, complete and accurate sender information is critical for successful transactions.

- Only Cash Transactions Are Supported: It's a misconception that Western Union only handles cash. The company also supports electronic transfers and various payment methods.

- Signature Is Unnecessary: There’s a belief that a signature is not required for sending money. This is incorrect—signing the receipt confirms agreement with the terms and conditions.

- Western Union Guarantees Delivery: Many think that sending money through Western Union guarantees its delivery to the recipient. While the service aims for speedy delivery, several factors may affect arrival times.

- Only Friends and Family Can Receive Money: Some assume that only personal contacts are eligible to receive funds. Businesses and authorized individuals can also receive money transfers.

- The Form Is Always the Same: Some believe that the Western Union form remains unchanged. The form may vary based on location and the specific services offered.

Key takeaways

The Western Union America form is an important tool for anyone looking to send money quickly and securely. Here are some key takeaways to help you navigate the process with confidence:

- Fill Out the Yellow Area: If you’re a card member, only the yellow shaded area needs your attention. Make it quick and simple.

- Agent Section: There’s a section labeled “AGENT USE ONLY.” You don’t need to fill it out; just leave it blank.

- Money Transfer Control Number: Make sure to note the Money Transfer Control Number. It helps track your transaction.

- Provide Accurate SENDER INFORMATION: Accuracy matters! Double-check the sender’s name, address, and contact number to avoid any hiccups.

- Signature Required: Don’t forget to sign! Your signature is essential for processing the transaction.

- Be Aware of Fees: Western Union charges transfer fees and currency exchange fees. Familiarize yourself with these costs beforehand.

- Tax and Total Amount Collected: Ensure you fill out the tax and total amount accurately. This helps ensure that the recipient receives the correct amount.

- Exchange Rate Notification: Be aware that the exchange rate can change. Your receipt will specify the rate if it was determined at the time of sending.

- Terms and Conditions: By signing the receipt, you agree to the outlined terms and conditions, which are on the attached pages. Review them carefully!

- Keep Your Receipt: Hold onto your receipt. It’s your proof of transaction and contains vital information for any future inquiries.

Knowing these key points makes the process smoother. Whether you're sending money to family, friends, or business associates, being prepared and informed is essential.

Browse Other Templates

Rue 21 Starting Pay - Applicants must disclose their age and eligibility to work in the United States.

How to Transfer Title After Death - It provides a clear path for minors to inherit vehicle ownership.

Hr Forms Templates - Together, these sections create a holistic view of the employee for HR records.