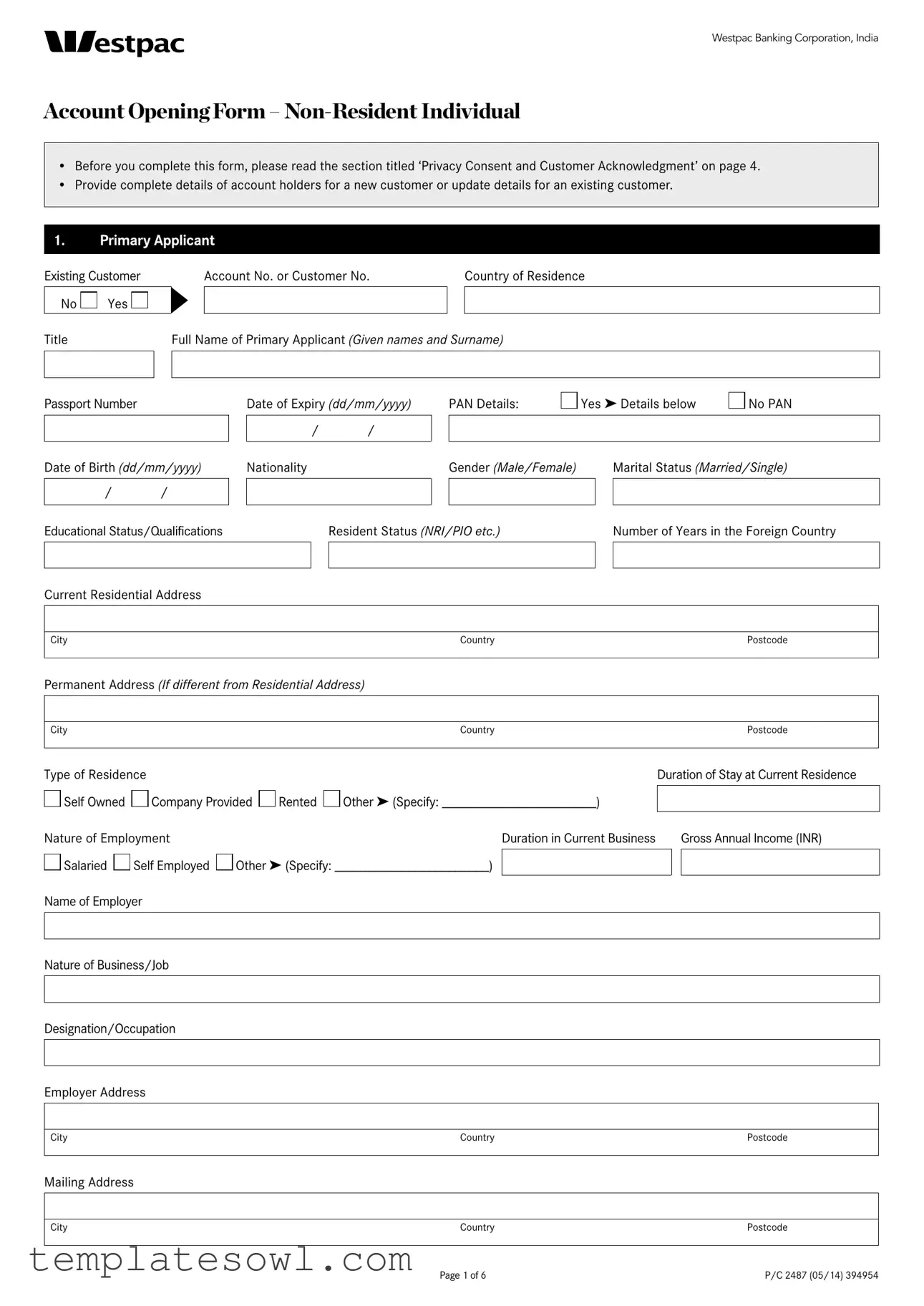

Fill Out Your Westpac New Account Application Form

The Westpac New Account Application form for Non-Resident Individuals in India serves a crucial role for individuals looking to establish a banking relationship with Westpac. This form collects essential information about both primary and joint applicants, including personal details such as full names, passport numbers, nationalities, and contact information. It also requires details about the applicant's residency status and employment. The form provides options to choose different types of accounts, such as NRO and NRE accounts, along with the nature of the account and the expected turnover. Additional sections request information on funding sources, banking preferences, and privacy consent. Review the 'Privacy Consent and Customer Acknowledgment' section carefully, as it outlines how your information may be used and shared. Not only does this ensure compliance with legal obligations, but it also safeguards your privacy. As you fill out this application, remember to provide accurate and complete information since discrepancies can impact account operations later on.

Westpac New Account Application Example

Westpac Banking Corporation, India

Account Opening Form –

•Before you complete this form, please read the section titled ‘Privacy Consent and Customer Acknowledgment’ on page 4.

•Provide complete details of account holders for a new customer or update details for an existing customer.

1.Primary Applicant

Existing Customer |

|

|

Account No. or Customer No. |

|

Country of Residence |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No |

Yes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title |

|

|

Full Name of Primary Applicant (Given names and Surname) |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Passport Number |

|

|

|

|

Date of Expiry (dd/mm/yyyy) |

PAN Details: |

Yes ➤ Details below |

No PAN |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Date of Birth (dd/mm/yyyy) |

|

Nationality |

|

|

Gender (Male/Female) |

|

|

Marital Status (Married/Single) |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Educational Status/Qualifications |

|

|

|

Resident Status (NRI/PIO etc.) |

|

|

Number of Years in the Foreign Country |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Residential Address

|

|

|

City |

Country |

Postcode |

|

|

|

Permanent Address (If different from Residential Address)

CityCountryPostcode

Type of Residence |

|

|

|

|

Duration of Stay at Current Residence |

|||

Self Owned |

Company Provided |

Rented |

Other ➤ (Specify: _______________________) |

|

|

|

||

|

|

|

||||||

Nature of Employment |

|

|

|

Duration in Current Business |

|

|

Gross Annual Income (INR) |

|

|

|

|

|

|

|

|

||

Salaried |

Self Employed |

Other ➤ (Specify: _______________________) |

|

|

|

|

||

Name of Employer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nature of Business/Job

Designation/Occupation

Employer Address

|

|

|

City |

Country |

Postcode |

|

|

|

Mailing Address |

|

|

|

|

|

|

|

|

City |

Country |

Postcode |

|

|

|

Page 1 of 6 |

P/C 2487 (05/14) 394954 |

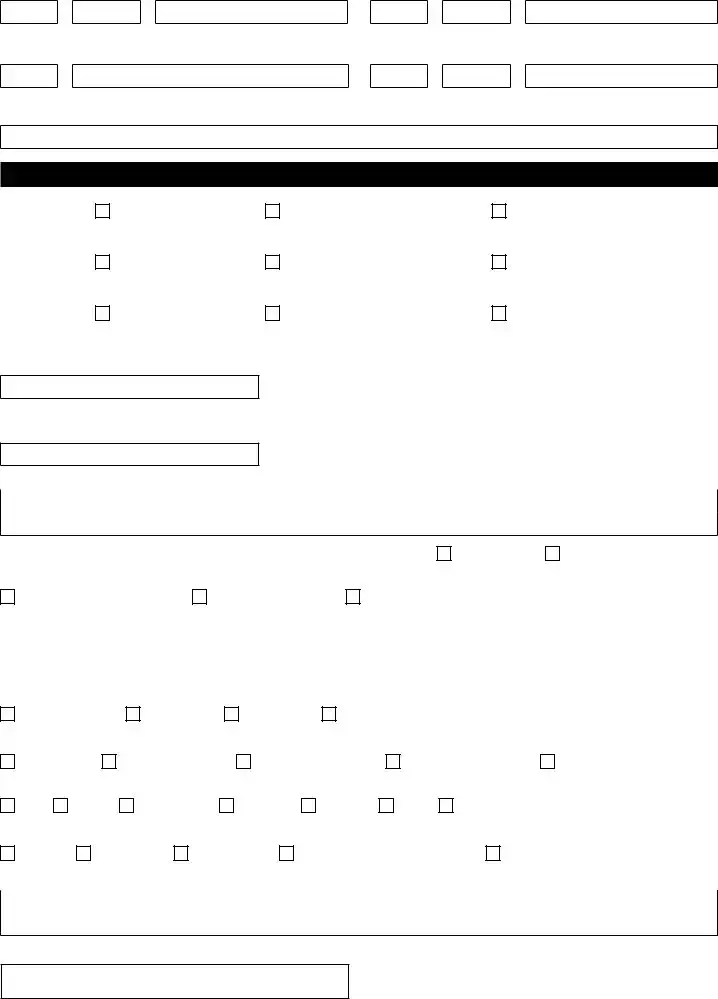

Telephone Numbers (Country and STD Mandatory)

Residence

+

Country Code |

STD |

Mobile Phone

+

Country Code

Email Address

Office

+

Country Code STD

Fax

+

Country Code |

STD |

2.Type of Account Required

NRO |

Current Account |

Savings Account |

Other (Please Specify) |

Account |

|

|

|

|

|

|

|

|

|

|

|

NRE |

Current Account |

Savings Account |

Other (Please Specify) |

Account |

|

|

|

|

|

|

|

|

|

|

|

Term |

NRO Deposit |

NRE Deposit |

Other (Please Specify) |

Deposit |

|

|

|

|

|

|

|

Currency

Details for Term Deposit

Amount (In Figures)

Amount (In Words )

Deposit Term: _______Years _______Months _______Days |

|

Interest Payment: |

Credit to Account |

Capitalise with Principal |

||||||||

Maturity Instructions |

|

|

|

|

|

|

|

|

|

|

|

|

Rollover Principal and Interest |

|

Rollover Principal Only |

Do not Renew Deposit (Credit Settlement Account) |

|||||||||

Settlement Account (Principal, Interest and Maturity Proceeds) |

|

|

|

|

|

|||||||

Account Number |

|

|

|

Account Type |

|

|

|

|

Bank Details |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purpose of Account |

|

|

|

|

|

|

|

|

|

|

|

|

Savings Account |

Transactions |

Investments |

Other ➤ (Specify:__________________________________________________ ) |

|||||||||

Expected Turnover in the Account (INR) |

|

|

|

|

|

|

|

|

|

|

||

0 – 500,000 |

500,001 – 1,000,000 |

1,000,001 – 5,000,000 |

5,000,001 – 10,000,000 |

> 10,000,000 |

||||||||

Source of Funding |

|

|

|

|

|

|

|

|

|

|

|

|

Salary |

Business |

Sale of Property |

Investments |

|

Inheritance |

Savings |

Other ➤ (Specify:______________________________ ) |

|||||

Mode of Funding |

|

|

|

|

|

|

|

|

|

|

|

|

Cheque |

Bank Cheque |

Wire Transfer |

Account with Westpac, Mumbai |

|

Other ➤ (Specify:______________________ ) |

|||||||

Details of Funding (Provide details such as Cheque Number / Reference Number / Westpac Account Number, Amount and Currency)

Signature of Primary Applicant

7

Page 2 of 6 |

P/C 2487 (05/14) 394954 |

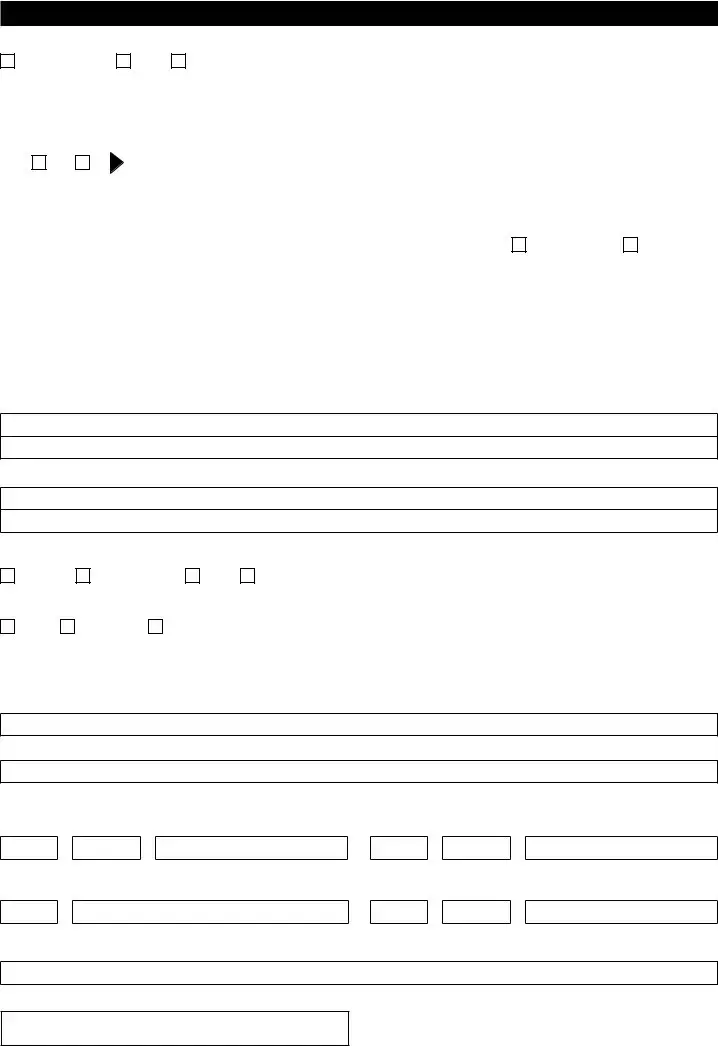

3.Joint Applicant

Mode of Operation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Either or Survivor |

|

Joint |

|

|

Other ➤ (Specify:____________________________________________________________________________ ) |

||||||||||||||||

Relationship to Primary Applicant |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Existing Customer |

|

|

Account No. or Customer No. |

|

|

|

Country of Residence |

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No |

Yes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title |

|

|

|

Full Name of Joint Applicant (Given names and Surname) |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

ID Document/Passport Number |

|

|

Date of Expiry of Passport (dd/mm/yyyy) |

PAN Details (If Available): |

Yes ➤ Details below |

No➤ PAN |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Date of Birth (dd/mm/yyyy) |

|

Nationality |

|

|

Gender (Male/Female) |

|

Marital Status (Married/Single) |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Educational Status/Qualifications |

|

|

|

|

Resident Status (NRI/PIO etc.) |

|

|

Number of Years in the Foreign Country |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Residential Address

City |

Country |

Postcode |

Permanent Address (If different from Residential Address)

CityCountryPostcode

Type of Residence |

|

|

|

|

Duration of Stay at Current Residence |

|||

|

|

|

|

|

|

|

|

|

Self Owned |

Company Provided |

Rented |

Other ➤ (Specify: _______________________) |

|

|

|

||

Nature of Employment |

|

|

|

Duration in Current Business |

|

Gross Annual Income (INR) |

||

|

|

|

|

|

|

|||

Salaried |

Self Employed |

Other ➤ (Specify: _______________________) |

|

|

|

|||

Name of Employer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nature of Business/Job

Designation/Occupation

Telephone Numbers (Country and STD Mandatory)

Residence

+

Country Code |

STD |

Office

+

Country Code |

STD |

Mobile Phone

+

Country Code

Fax

+

Country Code |

STD |

Email Address

Signature of Joint Applicant

7

Page 3 of 6 |

P/C 2487 (05/14) 394954 |

4.Statements and Cheque Book

Cheque Book Details

Number of Leaves |

25 |

50 |

Crossed Account Payee |

Yes |

No |

Account Statement Details

Mode of Delivery |

By Post |

By Email (Terms apply) |

|

|

|

Statement Delivery |

Quarterly |

Monthly |

Frequency |

|

|

|

|

|

|

|

|

5.Details of Accounts with Other Banks (Required only when opening a Current Account)

Name of the Bank and Address |

Type of Facility |

Details of Credit Facilities |

|

(Description and Amount) |

|||

|

|

||

|

|

|

|

|

Current Account |

|

|

|

Credit Facility |

|

|

|

|

|

|

|

Current Account |

|

|

|

Credit Facility |

|

|

|

|

|

|

|

Current Account |

|

|

|

Credit Facility |

|

|

|

|

|

|

|

Current Account |

|

|

|

Credit Facility |

|

|

|

|

|

|

|

Current Account |

|

|

|

Credit Facility |

|

|

|

|

|

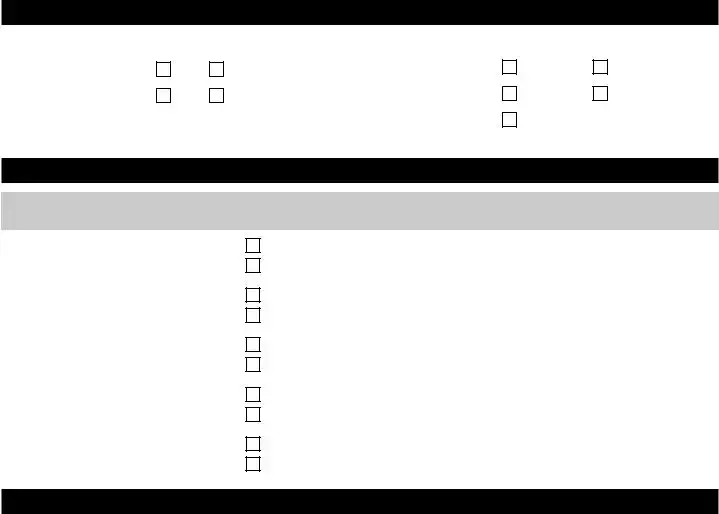

6.Privacy Consent & Customer Acknowledgement

I/We agree that the Bank (and any other members of the Westpac Group) (the ‘Parties’) may disclose information about me/us or my/our accounts or any product/services/transactions I/we acquire from the Bank (for example, but not limited to, my/our account number(s), the amount of payments including interest paid or credited to the account(s), the account balance(s) or value(s), my/our name, address, country of residence and my/our social security number/taxpayer identification number or similar data (if applicable), and as made available to them (‘Information’):

•to each other, any service provider engaged by a Party (a ‘Service Provider’), or a person who acts on my/our behalf in relation to any product (such as my/our adviser);

•to domestic and overseas regulators or other government agencies;

•as required or permitted by any law in any jurisdiction or under any treaty or other agreement entered into by the Bank (or other member of the Westpac Group) with authorities in any jurisdiction; or

•with my/our consent.

I/We acknowledge that sometimes the person that my/our Information is disclosed to may be located outside India, such as (but not limited to), in the United States of America, Singapore and Australia. If a Party transfers my/our Information to a country that does not require a level of data protection that is equivalent to the protection provided under the laws in my/our country, the Party will implement and will procure that its Service Providers implement additional safeguards in order to adequately protect the privacy and security of my/our Information.

I/We hereby declare that if my/our account is established I/We agree;

•to my/our Information being disclosed to the persons described in the manner set out in this section, including by transferring my/our Information to a person outside of India;

•to provide any additional information or documents the Bank requests from me/us in order to comply with a Party’s reporting obligations pursuant to law;

•that my/our Information may be used by the above persons for account administration, planning, product development and research purposes;

•to waive any rights to limit or prevent disclosure to tax authorities, under applicable data protection, bank secrecy or similar laws, rules and regulations in respect of the information a Party reports to comply with its reporting obligations;

•that to the greatest extent permitted by applicable law (including applicable rules and regulations), a Party will not be liable to me/us for any loss I/ we may suffer as a result of the Party complying with legislation or agreements with governments or tax authorities in accordance with this condition, unless that loss is caused by the Party’s wilful default of this section or fraud;

•that this consent will override any inconsistent term or consent provided by me/us under any agreement with the Bank, whether before or after the date hereof.

•that if I/we do not provide a Party with information or documents the Party needs or do not provide a waiver of confidentiality rights where needed, the Bank may (i) withhold amounts, including interest, to be paid or credited to me/us; or (ii) close my/our account, terminate or redeem or determine my/our product/services and/or end the Bank’s contractual or other relationship with me/us;

•that if none of the foregoing is acceptable to me/us, I/we accept that the Bank will not be able to take further steps in respect of an account with the Bank, with no liability in that regard.

I/We understand that I/we can access most personal information that the Parties hold about me/us (sometimes there will be a reason why that is not possible, in which case I/we will be told why).

Page 4 of 6 |

P/C 2487 (05/14) 394954 |

To find out what sort of personal information the Parties have about you, or to make a request for access, please contact your Relationship Manager. The Westpac Group means Westpac Banking Corporation and its related bodies corporate. I/We agree:

•to be bound by the terms and conditions which apply from time to time to this account opened by me/us with the Bank;

•the Bank may charge to this or any other account(s) I/we may conduct with the Bank or recover from me/us any bank fees, government charges, taxes or duties imposed on transactions on/or which relate to my/our account(s); and

•that documents presented for identification purposes may be verified by the Bank with an appropriate authority.

7.Our Reporting Obligations on US Persons

The Bank is required to identify certain US persons in order to meet account information reporting requirements under local and international laws.

US Tax Residents (Please tick where applicable.)

Individual: |

I/We certify that I am/we are a US tax resident or US citizen; or |

Entity: |

I/We certify that the entity or any office bearer* or any individual who holds an interest in the entity of more than 25% (a “Controlling |

|

Person”) is/are a US tax resident or US citizen. |

Where I/we have not certified that I/we are a US tax resident (by ticking one of the above boxes), by completing this application I/we certify that I/we or (where I/we are applying on behalf of an entity) the entity and/or any Controlling Person is/are not a US citizen or US tax resident.

I/we acknowledge and agree that I/we may be contacted to provide the Bank with further information.

If at any time after account opening, information in the Bank’s possession suggests that I/we, the entity and/or any Controlling Person may be a US citizen or US tax resident, I/we may be contacted to provide further information on my/our US tax status and/or the US tax status of the entity and/or any Controlling Person. Failure to respond may lead to certain reporting requirements applying to the account.

*Director of a company, partner in a partnership, trustee of a trust, chairman, secretary or treasurer of an association or

8.Declarations for Account Opening

I/We, the undersigned (‘Customer’) certify and declare that all information provided in this application form is true, correct and accurate to the best of knowledge and belief of the Customer. The Customer hereby undertakes to, forthwith, inform Westpac Banking Corporation (‘the Bank’) in writing of any changes to the information provided in this application form or otherwise. The Customer understands and agrees that the banking accounts (‘Accounts’) are being opened by the Bank on the basis of the statements/declarations made in this application form. If any of the statements/ declarations made herein or otherwise are found to be incorrect, false, untrue or misleading in any manner whatsoever, the Bank shall be entitled to exercise, in its sole discretion, any rights and remedies available to the Bank including but not limiting to closing the Account, suspending operations in the Accounts,

The Customer hereby declares that they have read and understood the terms and conditions applicable to the Accounts as specified in the account terms and conditions document (a copy of which has been sent to the Customer and is in Customer’s possession). The Customer accepts and agrees to be bound by the said terms and conditions including those excluding/limiting the Bank's liability. I/We understand that the Bank may, at its absolute discretion, discontinue any of the services completely or partially with notice (personal or public) to the Customer.

Further, the Customer hereby declares that he/she is a non resident Indian or a resident joint holder in case of NRO accounts and the Customer is not resident of any jurisdiction where opening or maintaining of the Account is prohibited by law or regulations of such jurisdiction and by laws and regulation of India.

The Customer hereby declares that he/she is permitted by laws and regulations to open, hold and maintain the Accounts and is legally competent to execute, contract and carry out all banking transactions. The obligations with respect to the Account and operations of the Account are subject to all applicable laws (including, without limitation, any governmental acts, orders, decrees, guidelines, rules and regulations including Reserve Bank of India (‘RBI’) regulations, fiscal exchange control regulations, Foreign Exchange Management Act, 1999, Foreign Contribution Regulation Act etc). The Customer understands and confirms that the Bank will be entitled at all times, to act in accordance with applicable laws, without requiring to provide prior intimation of such actions to the Customer. Any and all limits/constraints imposed by applicable law shall apply to the Account and related facilities/services.

In the event of any change in the residential status of the Customer, the Bank reserves the right to close the Account after giving notice to the Customer.

The Customer agrees to deposit into the Account only such monies that the Customer is legally entitled to deposit and are allowed to be deposited in the Accounts in accordance with prevalent laws and regulations.

The Customer hereby understands and acknowledges that the Bank is entitled to information with regard to source of any monies being deposited in the Account. The Customer undertakes to on demand, without demur or protest, inform the Bank of the source of any monies.

The Customer hereby declares that the transactions relating to foreign exchange routed through the Bank do not involve, and are not designed for the purpose of any contravention or evasion of the provisions of Foreign Exchange Management Act, 1999 or of any rule, regulation, notification, direction or order made there under. The Customer also hereby agrees and undertakes to give such information/documents as will reasonably satisfy the Bank about the transactions in terms of above declaration.

Nomination required: |

No |

|

Yes |

|

(If yes, please submit the nomination form) |

|

|

Page 5 of 6 |

P/C 2487 (05/14) 394954 |

I/We acknowledge that I/we have received a copy of:

•the terms and conditions that apply to this account; and

•the fees and charges that apply to this account.

I/We believe the details on the pages of this form to be true and correct.

Mode of Operation |

|

|

Either or Survivor |

Joint |

Other ➤ (Specify:_________________________________________________________________________________ ) |

Sign Across Photo

By (Signature – Primary Applicant)

7

Full Name of Primary Applicant (Given names and Surname)

Date (dd/mm/yyyy)

/ /

Introduction

Sign Across Photo

By (Signature – Joint Applicant)

7

Full Name of Joint Applicant (Given names and Surname)

Date (dd/mm/yyyy)

/ /

Title |

|

Full Name of Introducer (Westpac Banking Corporation Customer) (Given names and Surname) |

|

|

|

|

|

|

Account No. or Customer No.

I confirm that I have been an account holder with Westpac Banking Corporation for over 6 months. I confirm that I personally know the applicant(s) detailed above for more than six months and confirm his/her identity, occupation and address.

Date (dd/mm/yyyy) |

|

|

|

|

By (Signature – Introducing Customer) |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

/ |

/ |

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank Use Only |

|

|

|

|

|

|

|

|

|

|

|

Branch Number |

|

|

Account Number |

|

Relationship Management Type |

|

Special Condition Group |

|

|||

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

||||

Account Classification |

|

Statement Cycle |

|

Next Statement Date |

|

Manager Number |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Have all account authorities been completed? |

No |

Yes |

Have all account signatories been identified? |

No |

Yes |

I certify that the procedures to open this account have been complied with.

Application form completed by:

Name |

Salary Number |

If ‘No’, any cheque books ordered must be returned to the branch for collection. These must be held until all relevant account authorities are provided and/or signatory identification requirements have been changed.

Date (dd/mm/yyyy) |

Signature |

/ / |

|

7 |

|

|

|

Page 6 of 6 |

P/C 2487 (05/14) 394954 |

Form Characteristics

| Fact | Description |

|---|---|

| Privacy Consent | Applicants must read and agree to the privacy and customer acknowledgment section before completing the form. |

| Personal Information | Applicants are required to provide complete details, including personal identification and residential information. |

| Type of Account | Applicants can choose between various account types such as NRO or NRE Current and Savings accounts. |

| Governing Law | The application is governed by applicable Indian laws, including the Foreign Exchange Management Act and Reserve Bank of India regulations. |

Guidelines on Utilizing Westpac New Account Application

After completing the Westpac New Account Application form, submit it to the appropriate Westpac branch or financial center. Ensure all required documents and identification are included with your submission to avoid delays.

- Read the 'Privacy Consent and Customer Acknowledgment' section on page 4 before proceeding.

- Provide the details for the primary applicant including:

- Account Number or Customer Number (if existing customer).

- Country of Residence.

- Title and Full Name.

- Passport Number and its Expiry Date.

- PAN details (if applicable).

- Date of Birth, Nationality, Gender, and Marital Status.

- Current and Permanent Residential Addresses.

- Type of Residence and Duration of Stay.

- Nature of Employment and Gross Annual Income.

- Name of Employer and Nature of Business.

- Contact details including all telephone numbers and email address.

- Select the type of account required, indicating if it is NRO or NRE, and specify additional details if needed.

- Fill in deposit details if applicable, including the amount (both in figures and words) and deposit term.

- Include information regarding the purpose of the account and expected turnover.

- Provide details of any existing accounts held with other banks (for Current Account applications only).

- Complete the joint applicant section if applicable, providing their personal and contact details.

- Indicate how you want to receive statements and chequebooks, including preferences for delivery.

- Review the Privacy Consent and Customer Acknowledgment and verify that you understand the terms.

- Sign the application, ensuring both the primary and joint applicants (if applicable) have signed.

What You Should Know About This Form

What is the Westpac New Account Application form?

The Westpac New Account Application form is a document used by individuals who wish to open a new bank account with Westpac Banking Corporation. It collects essential information about the applicant, including personal details, employment status, and account preferences. This form is designed for both resident and non-resident individuals and serves as a crucial step in the account-opening process.

What information do I need to provide as part of the application?

You will need to provide various details such as your full name, passport number, date of birth, nationality, current residential address, and employment information. Additionally, if applying for a joint account, details about the joint applicant will also be required. Be prepared to share your financial information, including your annual income and the expected turnover in the account, to complete the application accurately.

Can I update existing account details using this form?

Yes, this form can also be used to update existing customer information. If you are an existing customer of Westpac and need to change any details like your address or contact information, you can fill out the necessary sections and submit the form. Make sure to check the applicable boxes indicating whether you are a new or existing customer.

What types of accounts can I open with this application?

This application allows you to open various types of accounts, including NRO and NRE current accounts, savings accounts, and term deposits. You can specify the type of account and other preferences directly in the form. Make sure to indicate the purpose of the account and funding sources as well, as this information is essential for processing your application.

Is there a need for a privacy consent statement?

Yes, the form includes a section titled 'Privacy Consent and Customer Acknowledgment.' By signing the form, you agree that Westpac can disclose information about you to various parties, including regulators and service providers, to comply with legal obligations. It is important to read and understand this section, as it outlines how your data may be used and shared.

What should I do if I don’t provide all the required information?

If you fail to provide all necessary information or documents, it may lead to delays in processing your application or even the refusal to open an account. The bank may also close the account if any information is found to be incorrect or misleading. Therefore, ensure you complete the application thoroughly and truthfully to avoid any complications.

Common mistakes

When filling out the Westpac New Account Application form, many people encounter common pitfalls. Avoiding these mistakes can streamline the application process and prevent delays. One significant error occurs when applicants forget to provide complete personal information. For example, if the passport number or date of expiry is missing, the form may be deemed incomplete, leading to rejection. Always double-check that all required fields are filled accurately.

Another frequent mistake is neglecting to specify the correct account type. Applicants often choose “Other” without providing detailed descriptions, causing confusion. It is vital to clearly indicate the type of account being requested, whether it is a Savings Account, Current Account, or something else. Providing specifics helps the bank process your application efficiently.

Many applicants fail to disclose their source of funding accurately. This section requires individuals to indicate how they will fund their new account. Incomplete information here can raise red flags for the bank. Applicants should aim for transparency about their sources of income, such as salary or investments. Clearly stating this information facilitates a smoother account setup.

Some individuals experience difficulty in providing correct contact information. Missing or incorrect phone numbers and email addresses can lead to communication issues with the bank. Ensure that all contact details are accurate and up to date, as the bank will rely on this information for future correspondence.

Finally, applicants sometimes overlook the "Privacy Consent and Customer Acknowledgment" section. This is a crucial part of the application process. Failing to read and understand this section can result in unintended consequences regarding how personal information is used. It is essential to take the time to review this section carefully and consent accordingly to avoid any compliance issues later.

Documents used along the form

When applying for a Westpac account, several supporting documents may also be necessary. Each of these documents plays a crucial role in ensuring the successful establishment of your account. Below is a list of common forms and documents that often accompany the Westpac New Account Application form.

- Identification Document: A government-issued photo ID, such as a passport or driver's license, is needed. This document verifies your identity and is essential for compliance with banking regulations.

- Proof of Address: Utility bills, lease agreements, or bank statements that display your name and current address help establish your residency. This information provides the bank with an accurate picture of your current living situation.

- PAN Card (Permanent Account Number): Particularly for non-resident Indians, providing your PAN card assists in tax identification and is crucial for regulatory purposes. It's an integral part of your financial identity in India.

- Source of Funds Documentation: This may include proof of income or business ownership. You could provide tax returns, employment verification letters, or financial statements to demonstrate how you intend to fund the account.

- Tax Residence Certification: If applicable, a document affirming your tax residency status is required. This helps the bank adhere to international tax compliance laws.

- Account Agreement: This document outlines the terms and conditions you agree to when opening the account. It’s essential to understand these terms to avoid any potential legal complications in the future.

- Nomination Form: If you choose to have a nominee for your account, this form must be filled out. It designates a person who would inherit the account assets in case of unforeseen circumstances.

These supporting documents work together with the Westpac New Account Application form to provide a comprehensive overview of your identity and financial circumstances. Ensuring all paperwork is complete and accurate will facilitate a smoother account opening process.

Similar forms

- Bank of America New Account Application: Similar to the Westpac form, this application requires personal information such as full name, address, Social Security number, and identification details. Both documents ensure compliance with federal regulations by asking about the account holder's employment status and source of income.

- Chase Bank Account Opening Form: Like the Westpac application, this form includes sections for identifying applicants, joint account holders, and specific account preferences. Each form emphasizes the importance of providing accurate information and consent for privacy disclosures.

- Citibank International Account Opening Application: This document parallels the Westpac application in that it addresses requirements for non-residents opening an account, including proof of identity and residence. Both forms aim to gather comprehensive financial and employment details to comply with legal standards.

- HSBC Global Banking Account Application: Much like the Westpac form, this application seeks extensive personal and financial information from applicants. Both documents focus on validating the identity of the applicants and understanding the nature of their banking needs, while also ensuring privacy and security protocols are acknowledged by the user.

Dos and Don'ts

When filling out the Westpac New Account Application form, there are several important dos and don'ts to keep in mind. Following these guidelines can help ensure a smooth application process.

- Do read the 'Privacy Consent and Customer Acknowledgment' section carefully before completing the form.

- Do provide complete and accurate information for all required fields.

- Do indicate your country of residence correctly to avoid complications.

- Do use the correct format for dates, particularly if asked for the date of birth or other critical details.

- Do ensure that the provided contact information is current and valid.

- Don't leave any required fields blank; incomplete information may delay your application.

- Don't provide false or misleading information; the bank has the right to close your account if discrepancies are found.

- Don't rush through the process; take your time to review each section of the form.

- Don't forget to sign the application before submission; an unsigned form may be rejected.

- Don't overlook any additional documentation the bank may require to process your application.

Misconceptions

Misconception 1: The Westpac New Account Application form is only for new customers.

In reality, this form serves both new and existing customers. Individuals can use it to open a new account or update their details if they already have an account.

Misconception 2: All fields on the form must be completed in order to submit it.

This is not the case. Certain fields are mandatory, but others may be optional. It is important to follow the instructions regarding which sections must be filled out based on the customer's situation.

Misconception 3: You can submit the application without reading the privacy consent section.

It is crucial to read the 'Privacy Consent and Customer Acknowledgment' section. This informs applicants about how their personal information will be handled and shared. Failing to comprehend this could lead to confusion about privacy rights.

Misconception 4: Only individuals residing in India can open an account using this form.

This form is designed for non-resident Indians (NRIs) and persons of Indian origin (PIOs). They can open accounts while residing outside India, as long as they meet the eligibility criteria set by the bank.

Misconception 5: The bank does not require any identification documentation.

Applicants must provide identification, such as a passport number and details of their Permanent Account Number (PAN). These pieces of information are necessary for verification and compliance with regulations.

Misconception 6: You do not need to specify the expected turnover for the account.

Providing an estimate of expected account turnover is crucial. This information helps the bank understand the account's intended use and manage their risk appropriately.

Misconception 7: Any joint applicant automatically has equal authority over the account.

The mode of operation needs to be specified, whether it is 'either or survivor,' 'joint,' or another option. The chosen mode determines how account access and authority are structured.

Misconception 8: Completion of the application guarantees account approval.

The application must be thoroughly reviewed by the bank. Approval is contingent upon satisfying all criteria, including compliance with applicable regulations and verification of submitted information.

Misconception 9: The bank will not notify customers of any required changes after account opening.

Customers must keep the bank informed of any changes in their circumstances. The application clearly states that failing to do so could lead to issues with account management or even account closure.

Misconception 10: There are no implications for misrepresenting information on the application.

Misrepresentation can have serious consequences. If any details in the application are found to be incorrect or misleading, the bank retains the right to close the account or impose restrictions as deemed necessary.

Key takeaways

Filling out the Westpac New Account Application form requires attention to detail and an understanding of the information required. The following key takeaways will aid in the completion process:

- Review Privacy Consent: Before beginning, read the 'Privacy Consent and Customer Acknowledgment' section to understand how your personal information may be used and shared.

- Accurate Information: Ensure all personal details, including full name, passport number, and residential address, are accurate and complete to avoid delays.

- Account Type Selection: Clearly indicate the type of account you wish to open (e.g., NRO Current Account, NRE Savings Account). This selection is crucial for processing.

- Funding Source Disclosure: Be prepared to specify the source of funding for your account, such as salary, inheritance, or business profits, as this information is mandatory.

- Documentation Requirement: Gather necessary documents like your passport and PAN details (if applicable) to validate your identity and residency status.

- Joint Account Details: If opening a joint account, provide all requested information for the joint applicant, including identification and relationship to the primary applicant.

- Understand Reporting Obligations: Recognize the need to disclose if you are a U.S. tax resident, as specific compliance requirements will apply to your account.

Browse Other Templates

Medicare Part D Notice - The form serves as an official notice from the entity about coverage status and options.

Llc in Tennessee Cost - Business owners should keep a copy of the submitted form for their records.

Ca1 - Providing detailed descriptions can aid in the investigation of the claim.