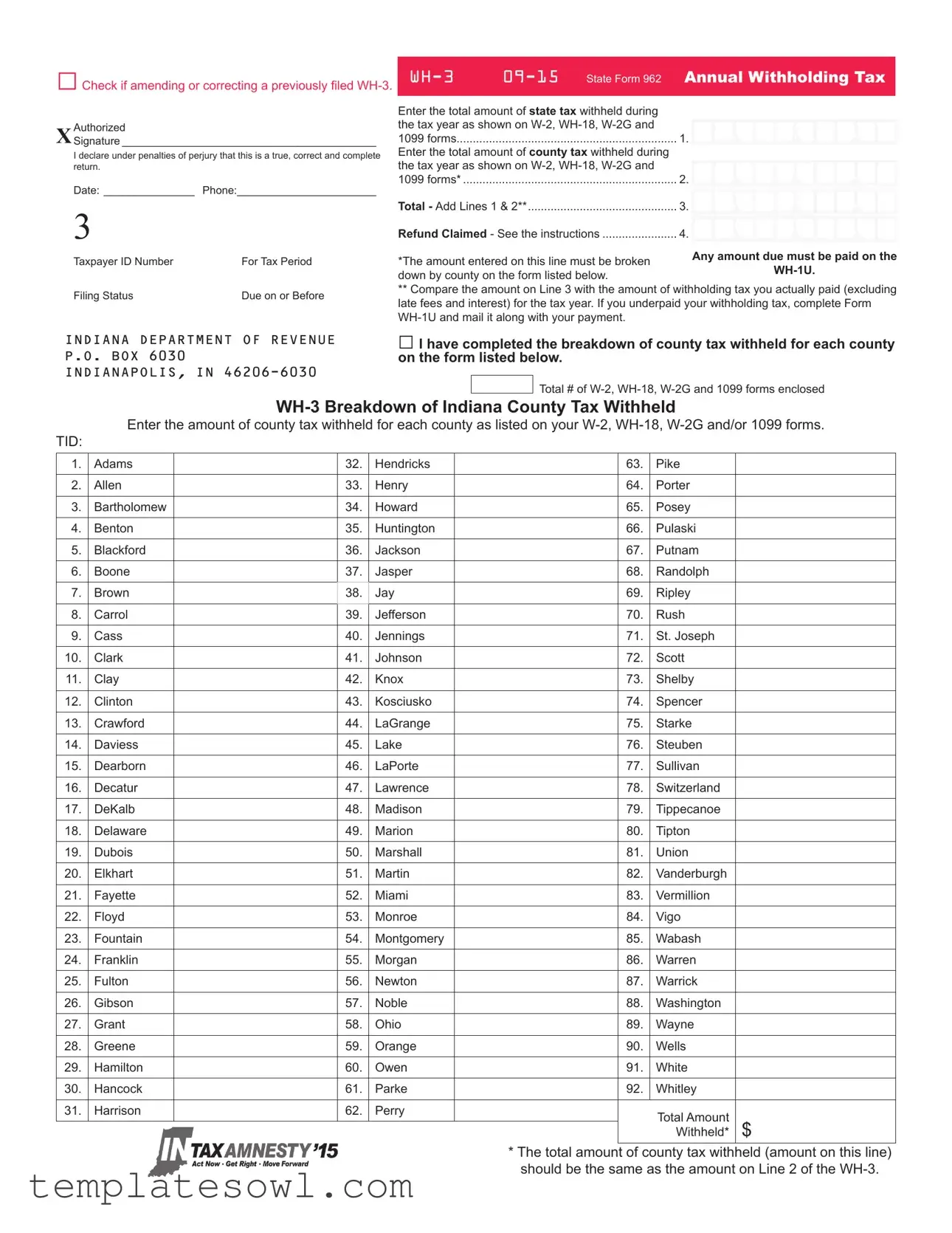

Fill Out Your Wh 3 Form

The WH-3 form serves a vital function in the annual reconciliation of withholding tax for employers in Indiana. This state-specific form must be filed by businesses to report the total amount of state and county income tax withheld from employees' wages over the previous tax year. It requires detailed information, including the total state tax withheld, the total county tax withheld for each county, and the taxpayer identification number. Alongside these figures, employers must indicate whether they are amending a previous filing. Furthermore, if an overpayment has occurred, the employer can claim a refund by providing the necessary details under the appropriate line. If withholding amounts are underpaid, the form offers guidance on how to address these discrepancies through Form WH-1U. With its specific requirements and structured layout, the WH-3 form plays an essential role in ensuring compliance with Indiana’s tax regulations while facilitating accurate reporting for businesses. Completing the form correctly will help companies avoid penalties and streamline the process of reconciling their withholding tax obligations.

Wh 3 Example

□Check if amending or correcting a previously filed |

Authorized

XSignature __________________________________________

I declare under penalties of perjury that this is a true, correct and complete return.

Date: _______________ Phone:_______________________

Enter the total amount of state tax withheld during |

|

the tax year as shown on |

|

1099 forms |

1. |

Enter the total amount of county tax withheld during |

|

the tax year as shown on |

2. |

1099 forms* |

3

Taxpayer ID Number |

For Tax Period |

Filing Status |

Due on or Before |

INDIANA DEPARTMENT OF REVENUE P.O. BOX 6030 INDIANAPOLIS, IN

Total - Add Lines 1 & 2** |

3. |

Refund Claimed - See the instructions |

4. |

*The amount entered on this line must be broken down by county on the form listed below.

** Compare the amount on Line 3 with the amount of withholding tax you actually paid (excluding late fees and interest) for the tax year. If you underpaid your withholding tax, complete Form

□ I have completed the breakdown of county tax withheld for each county on the form listed below.

Total # of

Total # of

Enter the amount of county tax withheld for each county as listed on your

TID:

1. |

Adams |

32. |

Hendricks |

63. |

Pike |

2. |

Allen |

33. |

Henry |

64. |

Porter |

3. |

Bartholomew |

34. |

Howard |

65. |

Posey |

4. |

Benton |

35. |

Huntington |

66. |

Pulaski |

5. |

Blackford |

36. |

Jackson |

67. |

Putnam |

6. |

Boone |

37. |

Jasper |

68. |

Randolph |

7. |

Brown |

38. |

Jay |

69. |

Ripley |

8. |

Carrol |

39. |

Jefferson |

70. |

Rush |

9. |

Cass |

40. |

Jennings |

71. |

St. Joseph |

10. |

Clark |

41. |

Johnson |

72. |

Scott |

11. |

Clay |

42. |

Knox |

73. |

Shelby |

12. |

Clinton |

43. |

Kosciusko |

74. |

Spencer |

13. |

Crawford |

44. |

LaGrange |

75. |

Starke |

14. |

Daviess |

45. |

Lake |

76. |

Steuben |

15. |

Dearborn |

46. |

LaPorte |

77. |

Sullivan |

16. |

Decatur |

47. |

Lawrence |

78. |

Switzerland |

17. |

DeKalb |

48. |

Madison |

79. |

Tippecanoe |

18. |

Delaware |

49. |

Marion |

80. |

Tipton |

19. |

Dubois |

50. |

Marshall |

81. |

Union |

20. |

Elkhart |

51. |

Martin |

82. |

Vanderburgh |

21. |

Fayette |

52. |

Miami |

83. |

Vermillion |

22. |

Floyd |

53. |

Monroe |

84. |

Vigo |

23. |

Fountain |

54. |

Montgomery |

85. |

Wabash |

24. |

Franklin |

55. |

Morgan |

86. |

Warren |

25. |

Fulton |

56. |

Newton |

87. |

Warrick |

26. |

Gibson |

57. |

Noble |

88. |

Washington |

27. |

Grant |

58. |

Ohio |

89. |

Wayne |

28. |

Greene |

59. |

Orange |

90. |

Wells |

29. |

Hamilton |

60. |

Owen |

91. |

White |

30. |

Hancock |

61. |

Parke |

92. |

Whitley |

31. |

Harrison |

62. |

Perry |

|

Total Amount |

|

|

|

|

|

|

|

|

|

|

|

Withheld* $ |

|

|

|

|

* The total amount of county tax withheld (amount on this line) |

|

|

|

|

|

should be the same as the amount on Line 2 of the |

|

For Amnesty Filing Only

Instructions for Completing Annual Reconciliation Form

Line 1 − Enter the total Indiana state income tax withheld as shown on Forms

Line 2 − Enter the total Indiana county income tax withheld as shown on Forms

All entries on this line must be broken down on Form

Line 3 − Add Lines 1 and 2; and enter the total here. If your account has been overpaid, continue to Line 4. If you have underpaid the withholding tax, see instructions for underpayment of Indiana withholding.

Line 4 − Complete this line only if your account has been overpaid and you are claiming a refund. Enter the amount of your overpayment on Line 4. No refund will be issued unless all areas of the Form

Note: Remittance must be made with the

together.

Underpayment of Indiana Withholding Filing Instructions

If you have underpaid the withholding tax, you must remit the amount due. If you normally remit by check, you must use

Form

If you are making the underpayment remittance late, penalty and interest are due. If you are paying the underpayment by check, include the penalty and interest on Line B. *Penalty is 10 percent of Line A or $5, whichever is greater. The total Does Not Apply

amount due should be entered on Line C. Call (317)

If you normally remit by EFT, make a supplemental payment for the final period of the year. Your supplemental payment together with all your other credits should equal the amount on Line 3 of the

State of Indiana Electronic Filing Instructions |

Filing Status ALL |

Any employer that files more than 25

For more than 3,500

Note: If you are under the mandated threshold of 25

An external label must be affixed to each CD or DVD containing the following information:

External Label for CDs or DVDs −File Name: W2REPORT

−State Taxpayer Identification Number (TID) −Submitter or Company Name −Complete Mailing Address

−Contact Name and Phone Number

Underpayment of Withholding Tax

State Form 49170

_______________________________________________________ |

|

|

|

Signature of Officer |

Title |

W |

|

Date: _____________ Telephone Number ____________________ |

Underpayment Amount...........A. |

||

Taxpayer ID Number |

Due Date |

|

|

Calendar Year Ending

INDIANA DEPARTMENT OF REVENUE P.O. BOX 6030 INDIANAPOLIS, IN

Penalty & Interest Due |

B. |

Amount Being Paid |

C. |

s,

s,

s,

s.

s.

Does, Not, Apply.

s s

s

s

s,

s,

s,

.

.

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The WH-3 form is used for annual reconciliation of Indiana withholding tax, allowing employers to report the total state and county taxes withheld from employees for the tax year. |

| Filing Requirements | Employers that file more than 25 W-2, WH-18, W-2G, and 1099 forms within a calendar year must electronically file the WH-3 and related documents. |

| Governing Law | This form is governed by the Indiana Department of Revenue regulations regarding withholding tax, in accordance with Indiana state tax law. |

| Refund Clauses | If an employer has overpaid, they may claim a refund on Line 4 of the WH-3, provided that all corresponding documents are submitted. |

| Amendments | If corrections are needed, the form allows for amendments; employers can indicate corrections by checking the corresponding box on the form. |

Guidelines on Utilizing Wh 3

After gathering the necessary information, it is important to fill out the WH-3 form accurately to ensure proper filing. Review the instructions included in the form carefully for specific details about what to enter and where. The following steps outline how to complete the WH-3 form.

- Begin by entering your Taxpayer ID Number in the designated section.

- Provide the tax period for which you are filing the form, clearly indicating the year.

- Select your filing status by checking the appropriate box.

- If you are amending or correcting a previously filed WH-3, check the corresponding box.

- Enter the total amount of state tax withheld during the tax year as reported on your W-2, WH-18, W-2G, and 1099 forms in Line 1.

- For Line 2, input the total amount of county tax withheld, ensuring this amount is broken down by county, which you will detail later in the form.

- Add the amounts from Line 1 and Line 2 together, placing the total in Line 3.

- If you are claiming a refund because of overpayment, specify the amount on Line 4.

- Complete the breakdown section by entering amounts for county tax withheld for each applicable county.

- List the total number of W-2, WH-18, W-2G, and 1099 forms you are submitting with the form.

- Sign and date the form in the provided space to declare its accuracy.

- Ensure your contact phone number is included for any follow-up if necessary.

What You Should Know About This Form

What is the WH-3 form and who needs to file it?

The WH-3 form is an Annual Withholding Tax Reconciliation form required by the Indiana Department of Revenue. Primarily, employers who have withheld Indiana state and county income taxes during the tax year must file this form. It allows employers to reconcile the total amount of state and county taxes that were withheld from employees' wages with the actual amounts reported on W-2, WH-18, W-2G, and 1099 forms.

When is the WH-3 form due?

The WH-3 must be filed annually. Generally, the due date is on or before the last day of January following the close of the tax year. For example, for the tax year ending December 31, 2023, the form is due by January 31, 2024. It’s important to file on time to avoid penalties and interest.

What information do I need to complete on the WH-3?

To complete the WH-3 form, you'll need to provide details such as the total amount of state tax withheld (Line 1), total county tax withheld (Line 2), and any refunds claimed (Line 4 if applicable). Additionally, you’ll need to break down the county tax withheld for each specific county you withheld for. Make sure to check the total amount on Line 3 to ensure it matches what you actually paid during the year.

What do I do if I underpaid my withholding tax?

If you find that you underpaid your withholding tax after completing the WH-3, you must remit the amount due using Form WH-1U. This is important to address as penalties and interest may apply for late payments. Ensure that you include any applicable penalty or interest when submitting your payment to avoid further charges.

How do I claim a refund on the WH-3?

If you’ve overpaid your withholding tax, the WH-3 allows you to claim a refund. This is done by completing Line 4 of the form where you enter the amount of overpayment. Just remember, you must submit all necessary W-2, WH-18, W-2G, and 1099 forms along with it, as the refund will not be processed without this information.

Can I file the WH-3 electronically?

Yes, electronic filing is mandatory for employers who file more than 25 W-2, WH-18, W-2G, and 1099 forms in a calendar year. If you fall into this category, you'll want to visit the Indiana Department of Revenue website for more information about the electronic filing process. For those with fewer forms, it's still advisable to check for any updated electronic filing options that may be available.

What happens if I don’t file the WH-3?

Failing to file the WH-3 can result in penalties and interest, as it is your responsibility as an employer to report withholding accurately. Additionally, if the form and other required documents are not submitted, your filings may be returned as “cannot be processed,” delaying any refunds owed or increasing the potential for additional fees.

Common mistakes

Filling out the WH-3 form can seem daunting, but avoiding some common mistakes can streamline the process. One significant error people make is failing to report the correct amounts for state and county taxes withheld. Ensure that totals entered reflect the actual figures from all relevant documents like W-2 forms. Having accurate, complete data is crucial.

Another frequent mistake is neglecting to break down the county tax withheld on Line 2. Each entry on this line must correspond to specific counties. If this breakdown is missing or inaccurate, it could lead to delays or issues with your filing. Always double-check that these amounts match the figures on your forms.

Some filers forget to amend or correct previously filed WH-3 forms when necessary. If there's an error, it's essential to check the box indicating a correction. Ignoring this step can cause confusion and might even result in penalties. Always keep your filings up to date.

Providing an inaccurate tax ID number is another common pitfall. This number must be correct for the forecasted amounts to be applied correctly. Verify your Taxpayer ID Number before submission. It’s a simple step but can save you from significant headaches.

Line 4 on the form, which is for claiming any refund, is often overlooked or miscalculated. It’s vital to ensure that this line is filled correctly and matches the amounts stated elsewhere in your filing. Mistakes here can lead to refunds being delayed or denied.

Moreover, many fail to enclose all required documents. To avoid processing issues, include all W-2, WH-18, W-2G, and 1099 forms. If these documents are missing, the department may reject your submission, forcing you to resubmit everything.

Some individuals also miscalculate their refund claims by failing to compare the amounts on Line 3 with what they actually paid throughout the year. If discrepancies arise, it’s essential to correct those before submitting the form.

Lastly, a significant number of people overlook the importance of signing the WH-3 before submission. A neglected signature renders the form incomplete, resulting in it being sent back for correction. Always remember to sign and date your filings.

Documents used along the form

The WH-3 form is essential for Indiana employers to report income tax withholdings for their employees. However, it is not the only document that often accompanies this form. Understanding the additional paperwork required in conjunction with the WH-3 can help ensure compliance with tax reporting obligations.

- WH-1U Form: This form is used to report underpayment of withholding tax. If an employer has underpaid their tax liabilities, they must submit this form along with their payment.

- W-2 Form: Employers provide this form to report wages paid to employees and the taxes withheld. It serves as a summary of an employee’s earnings and tax withholdings for the year.

- W-2G Form: Used for reporting gambling winnings and taxes withheld on such winnings. This form is necessary for individuals who have received substantial gambling payouts.

- WH-18 Form: This form is specific to the state of Indiana, used to report locations where employees work and the associated tax obligations. It helps clarify the breakdown of local taxes withheld for various counties.

- 1099 Form: This document is used to report various types of income other than wages, salaries, and tips. Independent contractors and freelancers typically receive 1099 forms to report their earnings.

- IT-40 Form: Indiana residents use the IT-40 form to file their individual income tax returns. Individuals often complete this form based on the information provided in the WH-3 and other withholding documents.

- IT-9 Form: This form helps taxpayers claim an exemption from withholding if their income falls below a certain threshold. Employers may need this form to adjust withholding amounts accordingly.

- Taxpayer Identification Number (TIN): Employers must include their TIN on many documents, including the WH-3. This number is crucial for correctly identifying the taxpayer in tax records.

Each of these forms plays a role in the larger picture of tax compliance in Indiana. By understanding their purposes and how they work together with the WH-3, employers can effectively manage their withholding tax responsibilities and avoid potential penalties.

Similar forms

- Form W-2: This form reports wages paid to employees and the taxes withheld from them. Like the WH-3, it summarizes withholding over the tax year.

- Form 1099: Similar to the WH-3, this form is used for reporting various types of income other than wages. It includes details about amounts subject to withholding.

- Form WH-18: This form also reports Indiana state income tax withheld. It serves a similar purpose to the WH-3, focusing on the tax withheld from payments made.

- Form W-2G: This form is used to report gambling winnings. It provides figures related to withholding, similar to the summary format of the WH-3.

- Form WH-1U: This form is specifically for reporting underpayment of withholding tax. It is closely tied to the WH-3 in terms of tax calculation and remittance duties.

- Form 940: This report is for federal unemployment tax. While it covers different taxes, it requires total withholding calculations, similar to the WH-3.

- Form 941: This is the employer's quarterly tax return for federal income tax and FICA withholdings. Like the WH-3, it summarizes amounts withheld over a period.

- Form 945: This form covers federal tax withheld from non-payroll payments. The summary nature is akin to the WH-3, focusing on withheld amounts.

- State Tax Reconciliation Forms: Many other states have similar forms for reconciling annual withholding. They often match the total withheld amounts for state taxes, just like the WH-3.

Dos and Don'ts

When completing the WH-3 form, attention to detail is crucial to ensure accuracy and compliance. Below are important dos and don'ts to consider.

- Do review the form instructions thoroughly before starting.

- Don’t forget to check the box if you are amending or correcting a previously filed WH-3.

- Do enter the total amount of state tax withheld accurately on the specified lines.

- Don’t provide a total for county tax without breaking it down by county.

- Do sign and date the form to certify the accuracy of your submission.

- Don’t send the WH-3 form without including all required W-2, WH-18, W-2G, and 1099 forms.

- Do make sure that the total amount withheld on Line 2 matches the breakdown on the form.

- Don’t staple the documents together, as this may complicate processing.

- Do contact the Indiana Department of Revenue if you have questions or need assistance.

Misconceptions

The WH-3 form is an important document for employers in Indiana, used for annual reconciliation of state and county income taxes. However, there are several misconceptions about it that can lead to confusion. Understanding the truth behind these misconceptions is essential for compliance and accurate reporting.

- Misconception 1: The WH-3 form is used to report individual income tax liabilities.

- Misconception 2: Employers do not need to file a WH-3 if they do not withhold any taxes.

- Misconception 3: The WH-3 can be submitted without accompanying W-2 or 1099 forms.

- Misconception 4: Employers can remit underpayments using the WH-3 form.

- Misconception 5: There is no need to break down county taxes by specific counties.

- Misconception 6: The WH-3 filing deadline is the same as the income tax filing deadline for individuals.

- Misconception 7: Only large businesses are required to file electronically.

- Misconception 8: Completing the WH-3 is a one-time task.

This form is specifically for employers to report withholding amounts, not to detail personal income tax responsibilities of individuals.

Even if no taxes were withheld, employers may still need to file the form to indicate that there were no withholdings. Failing to file can lead to penalties.

The WH-3 must be submitted along with all relevant W-2, WH-18, W-2G, and 1099 forms. Incomplete submissions will not be processed.

Underpayments must be remitted using the separate WH-1U form. The WH-3 is solely for reporting and reconciling tax amounts.

Employers are required to break down county tax amounts on the WH-3 for accurate reporting. This ensures proper allocation of funds to respective counties.

The deadline for the WH-3 is specific to employers and often differs from personal tax deadlines. Employers should pay close attention to the correct due date.

Employers who file more than 25 W-2 or similar forms must file electronically, regardless of their size. Smaller employers need to comply as well if they exceed this threshold.

This form is part of an annual reporting process. Employers must complete it each year and ensure they address any changes or updates in tax law.

Awareness of these misconceptions can help employers fulfill their tax obligations accurately and avoid unnecessary penalties.

Key takeaways

Filling out the WH-3 form is an essential task for employers in Indiana to ensure compliance with state tax regulations. Below are key takeaways to consider when completing this form:

- Accurate Reporting: Employers must ensure that the total state and county tax withheld is accurately reported. Line 1 and Line 2 require the total amounts from W-2, WH-18, W-2G, and 1099 forms.

- Breakdown by County: If applicable, a detailed breakdown of county tax withheld must accompany Line 2. This line should clearly list the amounts broken down by each county.

- Amending Forms: If correcting a previously filed WH-3, check the designated box to indicate this amendment. This ensures proper processing and maintains accurate records.

- Filing Deadline: It's critical to submit the WH-3 form by the designated deadline, ensuring all required information is complete. Late submissions may incur penalties.

- Refund Claims: If applicable, employers must complete Line 4 to claim a refund, which requires all related forms to be enclosed. Incomplete submissions will result in delayed processing.

- Penalties for Underpayment: If the withholding tax is underpaid, payment must be made using Form WH-1U. Late payments incur penalties, so timely remittance is crucial.

- Electronic Filing Requirements: Employers filing more than 25 W-2 forms are required to file electronically. Adhere to the guidelines on the Indiana Department of Revenue's website to complete electronic submissions properly.

Attention to detail in completing the WH-3 form can significantly impact compliance with tax obligations and avoid unnecessary penalties. Ensure all forms are accurately filled out and submitted on time.

Browse Other Templates

Forbearance Plan - Page layout provides clear instructions for completing the form.

Corrective Action Procedure - The Sample CAP Format serves as a helpful guide for creating tailored corrective actions.