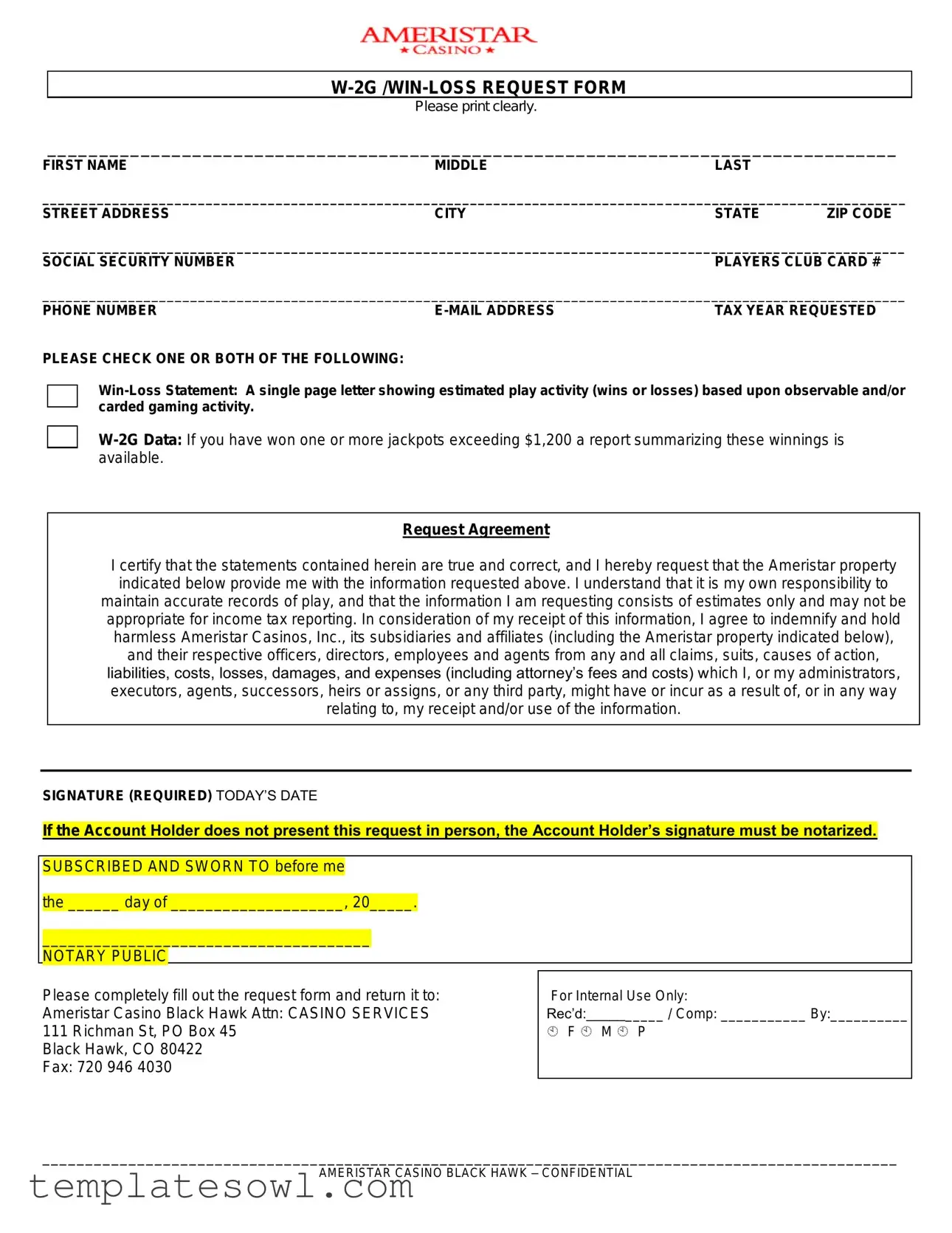

Fill Out Your Win Loss Ameristar Form

The Win-Loss Ameristar form serves as a crucial resource for players who want to track their gaming activities for a specific tax year. This request form is designed for individuals who seek a clear summary of their gambling wins and losses, as well as for those who have won jackpots exceeding $1,200. The document gathers essential personal information including your name, address, Social Security number, and Players Club Card number, ensuring that all data is accurately attributed. Users can request either a Win-Loss Statement, which provides an estimated summary of play activity based on observable or carded gaming engagement, or W-2G data, which summarizes significant jackpot winnings. The form includes an agreement to indemnify Ameristar Casinos, ensuring that players acknowledge the estimates provided are not necessarily suitable for precise tax reporting. Importantly, if an account holder cannot present the request in person, a notarized signature is required to authenticate the submission. Completing this form accurately is not just about securing your win-loss data; it involves a commitment to responsible gambling and understanding of individual record-keeping obligations.

Win Loss Ameristar Example

Please print clearly.

__________________________________________________________________________________

FIRST NAMEMIDDLELAST

_______________________________________________________________________________________________________________

STREET ADDRESSCITYSTATE ZIP CODE

_______________________________________________________________________________________________________________

SOCIAL SECURITY NUMBERPLAYERS CLUB CARD #

_______________________________________________________________________________________________________________

PHONE NUMBER |

TAX YEAR REQUESTED |

PLEASE CHECK ONE OR BOTH OF THE FOLLOWING:

Request Agreement

I certify that the statements contained herein are true and correct, and I hereby request that the Ameristar property indicated below provide me with the information requested above. I understand that it is my own responsibility to maintain accurate records of play, and that the information I am requesting consists of estimates only and may not be appropriate for income tax reporting. In consideration of my receipt of this information, I agree to indemnify and hold harmless Ameristar Casinos, Inc., its subsidiaries and affiliates (including the Ameristar property indicated below), and their respective officers, directors, employees and agents from any and all claims, suits, causes of action, liabilities, costs, losses, damages, and expenses (including attorney’s fees and costs) which I, or my administrators, executors, agents, successors, heirs or assigns, or any third party, might have or incur as a result of, or in any way relating to, my receipt and/or use of the information.

SIGNATURE (REQUIRED) TODAY’S DATE

If the Account Holder does not present this request in person, the Account Holder’s signature must be notarized.

SUBSCRIBED AND SWORN TO before me

the ______ day of ____________________, 20_____.

______________________________________

NOTARY PUBLIC

Please completely fill out the request form and return it to: |

For Internal Use Only: |

Ameristar Casino Black Hawk Attn: CASINO SERVICES |

Rec’d:__________ / Comp: ___________ By:__________ |

111 Richman St, PO Box 45 |

F M P |

Black Hawk, CO 80422 |

|

Fax: 720 946 4030 |

|

|

|

___________________________________________________________________________________________________

AMERISTAR CASINO BLACK HAWK – CONFIDENTIAL

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The Win-Loss Ameristar form is used to request a summary of gaming activity, including a Win-Loss Statement and W-2G data for tax purposes. |

| Information Provided | The form allows users to obtain two types of information: a Win-Loss Statement based on observable gaming data and a report of winnings for jackpots over $1,200. |

| Signature Requirement | A signature is needed from the account holder. If the request is not presented in person, notarization of the signature is mandatory. |

| Filing Responsibility | It is the requester’s responsibility to maintain accurate records, as the information provided is only an estimate and may not be suitable for income tax reporting. |

| Governing Law | The form complies with Colorado state laws, particularly those governing the operation of casinos in the state. |

Guidelines on Utilizing Win Loss Ameristar

To successfully complete the Win Loss Ameristar form, careful attention to detail is required. Following these steps will help ensure that all necessary information is correctly submitted, allowing for a smooth processing of your request. Gather your documents, locate a quiet space, and begin filling out the form with these clear instructions.

- Print the Form: Start by ensuring you have a legible copy of the Win Loss Ameristar form in front of you.

- Fill in Personal Information: Clearly write your first, middle, and last name in the designated spaces.

- Provide Address Details: Fill in your street address, city, state, and zip code.

- Enter Social Security Number: Write your Social Security Number accurately.

- Player's Club Card Number: If applicable, complete the Players Club Card # section.

- Contact Information: Include your phone number and e-mail address for any necessary communication.

- Select Tax Year: Specify the tax year requested for the win-loss statement.

- Check Options: Indicate whether you want a Win-Loss Statement, W-2G Data, or both by checking the appropriate box(es).

- Read Request Agreement: Carefully read through the Request Agreement section to understand your responsibilities and indemnification.

- Sign the Form: Provide your signature in the designated area to confirm the truthfulness of your statement.

- Date the Form: Next to your signature, include today’s date.

- Notarization: If the request is not submitted in person, ensure your signature is notarized. Fill in the date and name of the Notary Public as required.

- Submit the Form: Return the completed form to Ameristar Casino Black Hawk via mail or fax to the provided address or fax number.

Following these steps will ensure your form is filled out correctly and submitted properly. Each piece of information you provide is crucial for accurately processing your request, so take care to double-check your entries before sending the form off.

What You Should Know About This Form

What is the Win Loss Ameristar form?

The Win Loss Ameristar form is a document that allows players to request a Win-Loss Statement and W-2G data from Ameristar Casino. This form helps you keep track of your gaming activity, and the information provided can assist in evaluating your wins and losses for any given tax year.

Who can request the Win Loss statement?

Any player who has signed up for a Players Club Card at Ameristar Casino can submit this request. You must fill out the form completely, including personal details such as your full name, address, Social Security number, and any relevant account information to process your request effectively.

What information do I need to provide on the form?

You'll need to provide your first, middle, and last name, street address, city, state, ZIP code, Social Security number, Players Club Card number, phone number, email address, and the tax year for which you are requesting information. It’s crucial to print all information clearly to avoid processing delays.

What is the difference between a Win-Loss Statement and W-2G Data?

A Win-Loss Statement provides a summary of your estimated gambling activity—either your wins or losses—based on your play and any carded gaming activity. W-2G Data, however, is specific to jackpot winnings, summarizing any winnings that exceeded $1,200. You can request one or both types of information on the form.

How accurate is the information provided in the statement?

The information you receive should be viewed as estimates of your gaming activity. While the casino-based data is generally reliable, it may not be fully accurate for income tax reporting. Players should keep their own records for precise tracking.

Do I need to sign the form?

Yes, you must provide your signature on the form to validate your request. If you are unable to present the request in person, your signature must be notarized to ensure the authenticity of the request.

Where do I send the completed form?

You should return the completed form to Ameristar Casino Black Hawk. Mailing the form to: Attn: CASINO SERVICES, 111 Richman St, PO Box 45, Black Hawk, CO 80422, or you can send it via fax to 720-946-4030. Make sure to keep a copy for your own records.

How long will it take to receive my Win Loss statement?

While processing times can vary, you can generally expect to receive your information within a few weeks. If you have not received it after a reasonable period, it’s advisable to follow up with the casino’s customer service department for assistance.

What happens if I have questions about the information received?

If you require further clarification or have questions regarding the Win Loss statement or any reported winnings, you can directly contact Ameristar Casino's customer service department. They will be able to assist you with any concerns you may have.

Common mistakes

Filling out the Win Loss Ameristar form can seem straightforward, but many people make common mistakes that can delay processing or lead to incorrect information. Here are nine mistakes that are often encountered.

1. Illegible handwriting: It is crucial to print clearly when completing the form. If the handwriting is difficult to read, the staff may struggle to process the request accurately. Errors due to misinterpretation can lead to unnecessary delays.

2. Missing information: Every required field must be filled out. Omitting even one piece of information, such as a social security number or phone number, could result in the form being returned for completion before processing can begin.

3. Incorrect tax year: Double-check the tax year requested. Many individuals accidentally choose the wrong year, which complicates their request significantly. Take time to ensure that the correct tax year aligns with your gaming activity.

4. Failing to sign: A signature is mandatory. Once the form is completed, it must be signed to validate the request. Without a signature, the form cannot be processed.

5. Not notarizing when necessary: For requests made by someone other than the account holder, notarization is required. Forgetting this step can halt the entire process, requiring the form to be resubmitted with a valid notarized signature.

6. Neglecting to check both options: The form allows for a Win-Loss statement and W-2G data to be selected. Many people only check one option, potentially limiting the information they receive. Exploring both can provide a more comprehensive picture of gaming activity.

7. Not providing a valid email address: If an email address is not included or is incorrectly entered, it can hinder communication. This mistake may result in missing out on important updates or documentation regarding your request.

8. Ignoring the request agreement: Failing to read and understand the request agreement can be problematic. The agreement outlines responsibilities and legal implications, so understanding this section is crucial before submitting the form.

9. Sending the form to the wrong address: Ensure you are aware of where to send the completed form. Sending it to the wrong location can create additional delays. Always verify the contact details to ensure the form reaches the correct department.

By avoiding these common mistakes, individuals can ensure a smoother experience when requesting their Win Loss statements from Ameristar. Taking a little extra time to review the completed form can save headaches down the line.

Documents used along the form

The Win Loss Ameristar form is a valuable tool for individuals seeking to document their gaming activity for tax purposes. However, several other forms and documents are frequently used in conjunction with it. These additional resources can help clarify your financial situation related to gaming activities, ensuring that you have all the necessary information for record-keeping and reporting.

- W-2G Form: This document reports gambling winnings of $1,200 or more from a single transaction. It includes the amount won, federal income tax withheld, and other important information. The W-2G is sent to the winner and the IRS, making it essential for tax reporting.

- Player’s Club Membership Application: This application allows a player to join a casino's loyalty program. By signing up, players can earn benefits based on their gaming activity. Documentation from this application can serve to support claims of gaming activity that the Win Loss form reflects.

- IRS Form 1040: This is the U.S. Individual Income Tax Return form. When reporting income from gambling, the Win Loss information may need to be included with your Form 1040 to accurately reflect your total income, winnings, and any losses claimed.

- Transaction Logs: These are records kept by casinos detailing a player’s gaming activity, including win/loss history and play records. Obtaining these logs can provide further verification of the gameplay reported on the Win Loss form.

- State-Specific Tax Forms: Depending on where you live, additional state tax forms may be required for reporting gambling winnings. Each state has its own rules and documentation requirements, which could include specific forms for reporting gambling income and losses.

Understanding these auxiliary documents in relation to the Win Loss Ameristar form can simplify the tax preparation process and improve one’s financial record keeping. Keep these forms in mind as you collect and report your gaming activity.

Similar forms

The Win Loss Ameristar form is similar to several other documents commonly used in financial and tax reporting. Below are six such documents and how they relate to the Win Loss Ameristar form.

- W-2 Form: This form reports wages paid to employees and the taxes withheld. Like the Win Loss form, it serves as an official record for income and can be used for tax purposes.

- 1099-MISC Form: Used to report income received by non-employees, such as independent contractors. Similar to the Win Loss statement, it provides a summary of financial activity but for different types of earnings.

- K-1 Form: Issued for partnerships, showing each partner's share of income, deductions, and credits. The K-1 is like the Win Loss statement in that it summarizes a specific individual's financial status from a collective source.

- Gain or Loss Report: This report details profits or losses from sales of assets. Like the Win Loss form, it provides a snapshot of financial performance, particularly in relation to gambling activities.

- Bank Statement: A monthly record from a financial institution showing all transactions. The Win Loss statement is similar in that both give a summary of activity over a specified period.

- Lottery Winnings Report: This document itemizes winnings from lottery and gambling tickets. It is akin to the W-2G Data portion of the Win Loss Ameristar form, detailing winnings and potentially taxable amounts.

Dos and Don'ts

When filling out the Win Loss Ameristar form, it is essential to proceed with care. Here are some important tips to consider.

- Do print your information clearly to avoid any misunderstandings.

- Do ensure all required fields are completed before submitting the form.

- Do review your information for accuracy, especially your Social Security number and address.

- Do submit the form to the correct Ameristar property as indicated on the document.

- Don't leave out any essential information, as this may delay the process.

- Don't include additional documents that are not requested in the form.

- Don't forget to sign the form, as it is a necessary requirement.

- Don't submit the form without notarization if you are not presenting it in person.

Following these guidelines can help ensure a smooth and efficient processing of your request. Your care in completing the form reflects your commitment to maintaining accurate records.

Misconceptions

Many people have misunderstandings about the Win Loss Ameristar form. Below are six common misconceptions, along with clarifications to help address them.

- The form guarantees accurate records of gambling activity. The information provided in the Win-Loss statement is based on estimates. It may not be suitable for official income tax reporting.

- Anyone can request their information without restrictions. Only account holders can request their own data. If the account holder is not present, a notarized signature is required.

- The form only applies to significant wins. The Win-Loss statement covers all play activity, including both wins and losses. It is not exclusively for large jackpots.

- The W-2G Data includes all gambling winnings. The W-2G report only summarizes jackpots that exceed $1,200. Smaller winnings are not documented in this format.

- Filming or recording my play helps in creating accurate records. While recordings can assist, the casino's provided Win-Loss statement is still subject to the limitations of casino tracking systems.

- The form releases the casino from any obligation. By signing the form, you acknowledge that the casino provides this information with disclaimers and is not liable for inaccuracies.

Understanding these points can help clarify what the Win Loss Ameristar form provides and the responsibilities attached to using this information.

Key takeaways

Filling out the Win Loss Ameristar form can be straightforward if you keep a few key points in mind. Here are some essential takeaways to help guide you through the process.

- Print Clearly: Make sure to write legibly. This ensures that all your information is accurately captured.

- Complete All Sections: Fill out every part of the form without leaving any sections blank to avoid delays in processing your request.

- Verify Your Information: Double-check your names, address, and Social Security number. Errors may lead to complications.

- Tax Year Request: Indicate the specific tax year for which you are requesting the win-loss statement or W-2G data.

- Understand the Information: The win-loss statement is an estimate based on your gaming activity. It may not be suitable for tax reporting purposes.

- Indemnity Clause: Be aware that by signing the form, you agree to hold the casino harmless for any claims related to the information provided.

- Notarization Required: If you do not submit the form in person, your signature needs to be notarized to verify your request.

Following these points can help streamline your process in obtaining the necessary information. Taking these steps ensures that your request is processed smoothly and efficiently.

Browse Other Templates

Wawa Employment - Ensure accuracy in all entries, as they affect your membership status.

Ach Routing Document - Changes or cancellations to authorizations must be communicated in writing to BECU.

Nypd Pension - This form directs the NYC Police Pension Fund to update payment methods immediately.