Fill Out Your Wire Transfer Form

When you need to initiate a wire transfer, having the correct Wire Transfer form is essential to ensure your payment is processed smoothly and efficiently. This form includes several key sections designed to capture all necessary information for both the beneficiary and interim banks involved in the transaction. First, there are clear instructions guiding you on how to use the form, including attaching it to your payment request. If assistance is required, specific contacts in Accounts Payable are available to help. Notably, the form requires special information for international transfers, such as CLABE numbers for transfers to Mexico, account numbers and sort codes for the United Kingdom, and detailed requirements for transfers to China. The section for the beneficiary bank must be filled out accurately, including the payee’s exact name on the bank account and the bank's location. Additionally, if an intermediary bank is involved, that information must also be provided. Completing the Wire Transfer form correctly is crucial, as it directly influences the success of your transaction.

Wire Transfer Example

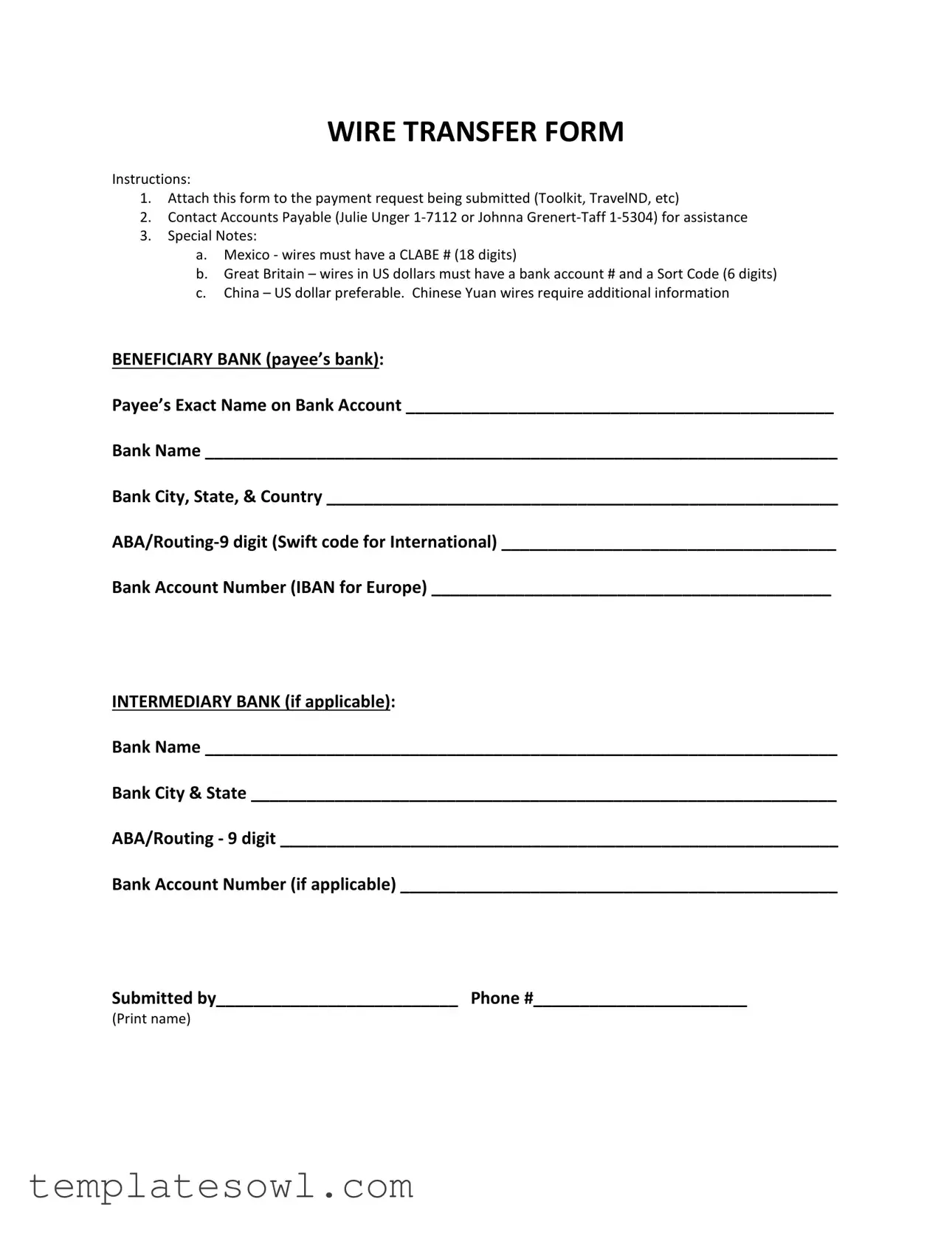

WIRE TRANSFER FORM

Instructions:

1.Attach this form to the payment request being submitted (Toolkit, TravelND, etc)

2.Contact Accounts Payable (Julie Unger

3.Special Notes:

a.Mexico - wires must have a CLABE # (18 digits)

b.Great Britain – wires in US dollars must have a bank account # and a Sort Code (6 digits)

c.China – US dollar preferable. Chinese Yuan wires require additional information

BENEFICIARY BANK (payee’s bank):

Payee’s Exact Name on Bank Account ______________________________________________

Bank Name ____________________________________________________________________

Bank City, State, & Country _______________________________________________________

Bank Account Number (IBAN for Europe) ___________________________________________

INTERMEDIARY BANK (if applicable):

Bank Name ____________________________________________________________________

Bank City & State _______________________________________________________________

ABA/Routing - 9 digit ____________________________________________________________

Bank Account Number (if applicable) _______________________________________________

Submitted by__________________________ Phone #_______________________

(Print name)

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of the Form | The Wire Transfer Form is used to initiate electronic funds transfers, allowing for the quick movement of money between banks. |

| Required Attachments | This form must be attached to the payment request being submitted, such as Toolkit or TravelND. |

| Contact for Assistance | For questions or help, reach out to Accounts Payable personnel, Julie Unger or Johnna Grenert-Taff. |

| International Requirements | Different countries have specific requirements, such as a CLABE number for wires to Mexico and a Sort Code for Great Britain. |

| Bank Information | Complete and accurate beneficiary bank details are essential, including the bank's name, location, and account information. |

| Intermediary Bank | If applicable, include information for the intermediary bank, which can facilitate the transfer when direct routes are unavailable. |

| Beneficiary Details | The payee’s exact name on the bank account must be precisely stated to avoid delays in processing the transfer. |

| Routing Numbers | Provide the ABA or routing number (a 9-digit number) and the bank account number to ensure successful transactions. |

| Submitted By | The person initiating the request should print their name and provide a contact number on the form. |

| Governing Law | State-specific forms may be subject to local banking regulations; check with state laws for compliance. |

Guidelines on Utilizing Wire Transfer

Once you have gathered all necessary information, you are ready to fill out the Wire Transfer form. Make sure to input accurate details to avoid any delays in processing. After completing the form, submit it alongside your payment request for the next steps to be taken.

- Begin by attaching the Wire Transfer form to your payment request, whether that’s through Toolkit, TravelND, or another platform.

- If you need help while filling out the form, reach out to Accounts Payable. Contact Julie Unger at 1-7112 or Johnna Grenert-Taff at 1-5304.

- Fill in the payee’s exact name as it appears on their bank account in the designated space.

- Enter the bank name of the beneficiary in the next line.

- Provide the city, state, and country of the bank where the payee's account is held.

- Input the ABA/Routing number, which is a 9-digit code used for processing the transfer. If this is an international transaction, include the Swift code instead.

- For the bank account number, enter the IBAN if it’s a transaction to Europe.

- If needed, fill in the intermediary bank details. Start with the bank name.

- Include the city and state of the intermediary bank, if applicable.

- Provide the 9-digit ABA/Routing number for the intermediary bank.

- If there is an intermediary bank account number, enter it in the provided space.

- In the space for the submitter's information, print your name and include your phone number for any follow-up.

What You Should Know About This Form

What is the purpose of the Wire Transfer Form?

The Wire Transfer Form is designed to facilitate the electronic transfer of funds from one bank account to another. It requires detailed information regarding the beneficiary bank, including the payee's exact name, bank account number, and routing information. Additionally, this form must be submitted along with the payment request to ensure proper processing and allocation of funds.

What information is required to complete the form?

To complete the Wire Transfer Form, you need to provide specific details about both the beneficiary bank and, if necessary, an intermediary bank. This includes the payee's exact name on the bank account, the bank's name, city, state, and country. You must also include the ABA/routing number, bank account number, and any other required information based on the destination country, such as a CLABE number for transfers to Mexico or a Sort Code for transfers to Great Britain.

Who should I contact if I have questions about completing the form?

If you have questions or need assistance with completing the Wire Transfer Form, you should contact the Accounts Payable department. You can reach Julie Unger at extension 1-7112 or Johnna Grenert-Taff at extension 1-5304. They are available to provide guidance and clarify any doubts regarding the transfer process.

Are there any special requirements for wiring funds to specific countries?

Yes, certain countries have unique requirements for wire transfers. For example, when sending money to Mexico, a CLABE number (18 digits) must be included. For transfers to Great Britain in US dollars, a bank account number and a 6-digit Sort Code are necessary. If you are sending funds to China, it is preferable to wire in US dollars, but if you choose to wire in Chinese Yuan, additional information may be needed to complete the transaction.

What should I do after completing the Wire Transfer Form?

After completing the Wire Transfer Form, it should be attached to the payment request you are submitting. Ensure that all information is accurate and complete to avoid delays. If you require further assistance, don’t hesitate to reach out to the Accounts Payable department for support throughout the submission process.

Common mistakes

When completing a wire transfer form, errors can lead to significant delays, unexpected fees, or even lost funds. Here are eight common mistakes people often make, which can complicate the process.

One frequent issue arises from incorrect beneficiary information. People often overlook the necessity of providing the payee’s exact name as it appears on their bank account. A simple typo or a mismatch can result in the bank rejecting the wire transfer outright, leaving the sender frustrated and without recourse.

Another common error is failing to provide the correct bank account number. This is a crucial piece of information. If the account number is wrong, the money may be sent to the wrong account. For international transfers, using the wrong format or not including the IBAN can create even more complications.

Sometimes, senders neglect to include essential information specific to various countries. For example, wires sent to Mexico require a CLABE number, which is 18 digits long. Without this, the payment may face delays. Similarly, wires to Great Britain in US dollars must include both a bank account number and a Sort Code (6 digits). Failing to provide this can lead to cancellation of the transaction.

Confusion can arise over the intermediary bank section. If the payment involves an intermediary bank, it must be filled out accurately. Omitting this or mistakenly filling it in can result in further delays and potential lost funds.

Another issue includes not double-checking the routing number. This number should be nine digits long. An incorrect or outdated routing number can stall the transfer, leaving you to navigate a web of confusion while trying to trace your funds.

Additionally, many people forget to attach the wire transfer form to their payment request. It might seem trivial, but without this attached documentation, the payment is likely to be processed slowly, or not at all. Proper submission is essential for timely transfers.

Finally, many overlook contacting Accounts Payable for guidance. It’s vital to reach out to the designated contacts, such as Julie Unger or Johnna Grenert-Taff, before hitting submit. They can provide clarity on requirements or any recent updates, ensuring a smoother transaction.

Avoiding these mistakes can save a lot of head-scratching later on. It’s best to take your time, review each field carefully, and when in doubt, ask for help. A little attention at the outset can lead to a seamless wire transfer experience.

Documents used along the form

When initiating a wire transfer, several other documents and forms may accompany the Wire Transfer form. Each of these documents serves a unique purpose, ensuring the transfer is executed smoothly and aligned with both institutional and regulatory requirements. Below are a few key forms often used in conjunction with the Wire Transfer form.

- Payment Request Form: This document provides details about the purpose of the payment. It typically outlines what services or goods are being paid for, and it may require signatures from relevant authority figures within the organization. The payment request helps ensure that funds are being used appropriately and within budget constraints.

- W-9 Form: If the payment is being made to an individual or entity that is a U.S. taxpayer, a W-9 form may be required. This form collects pertinent taxpayer identification information, ensuring accurate reporting to the Internal Revenue Service. It is essential for proper tax compliance, particularly in cases where nonemployee compensation or other taxable payments are made.

- Invoice: Typically submitted by the payee, this document outlines the specific amounts due for goods or services rendered. It includes details such as item descriptions, quantities, and unit prices. Invoices serve as a formal request for payment and are critical in record-keeping for both the payer and payee.

- Authorization Approval: Organizations often require a document that indicates approval for the wire transfer. This may include signatures from management or finance department personnel, authorizing the allocation of funds. Having such approval helps prevent unauthorized transactions and ensures accountability in financial operations.

These documents are essential components of the wire transfer process. Each one plays a critical role in ensuring clarity and compliance, protecting both the sender and the recipient throughout the transaction. Proper documentation ultimately aids in reducing errors and enhancing transparency in financial dealings.

Similar forms

-

Payment Request Form: Similar in function to the Wire Transfer Form, the Payment Request Form serves as a means to initiate and document requests for payments. It gathers necessary details about the transaction, making it critical for processing payments accurately.

-

Direct Deposit Authorization Form: This form is used for setting up automatic deposits directly into a bank account. Like the Wire Transfer Form, it requires bank details and account information to ensure funds are routed correctly.

-

Invoice Document: An invoice outlines the details of services rendered or products provided and demands payment. Both documents necessitate clear bank information for finalizing payments, linking service with compensation.

-

Expense Reimbursement Form: Employees use this form to request reimbursement for expenses incurred during work-related activities. Similar to the Wire Transfer Form, it details financial transactions, needing recipient banking information for payment processing.

-

Foreign Currency Exchange Form: This document outlines the details for converting currency for international transactions. Both forms require specific bank details to ensure proper handling of international payments.

-

Loan Application Form: When applying for a loan, applicants must provide personal and banking information. This document parallels the Wire Transfer Form in that it includes critical banking details necessary for financial transactions.

-

Credit Card Authorization Form: Used to obtain permission to charge a credit card for services or products, this form shares similarities with the Wire Transfer Form, as both require authorization and detailed banking information for processing payments.

-

Check Request Form: This document is submitted to request a physical check for payment. Like the Wire Transfer Form, it ensures that the correct recipient receives payment and includes necessary account details to facilitate this.

Dos and Don'ts

When filling out the Wire Transfer form, consider the following guidelines:

- Do: Attach the form to the payment request.

- Do: Contact Accounts Payable for assistance if needed.

- Do: Ensure you provide the payee’s exact name on the bank account to avoid delays.

- Do: Double-check the ABA/Routing number and Bank Account number for accuracy.

- Don’t: Forget to include required details like the CLABE number for transfers to Mexico.

- Don’t: Omit the Sort Code and bank account number when sending funds to Great Britain in US dollars.

- Don’t: Use Chinese Yuan for transfers unless you are prepared to provide additional information.

- Don’t: Submit the form without verifying all information for completeness.

Misconceptions

Understanding the intricacies of wire transfers is important, but there are common misconceptions about the wire transfer form that can lead to confusion. Here are four misconceptions worth addressing:

- Misconception 1: All wire transfers require both beneficiary and intermediary bank information.

- Misconception 2: Wires can only be sent in the native currency of the recipient’s country.

- Misconception 3: Providing incorrect bank information simply delays the transfer.

- Misconception 4: All countries have the same requirements for wire transfers.

Not every wire transfer necessitates details for an intermediary bank. This section is only needed if your transaction involves an intermediary bank, which usually depends on the payee’s bank location and the routing requirements of the transfer.

While many transfers can be made in local currencies, it is often preferable to use U.S. dollars for wires to certain countries, such as China. It's crucial to check the specific requirements for the destination country to avoid complications.

Submitting incorrect details may lead to more significant issues than just delay. Funds can be misdirected, which might result in loss or additional processing times to rectify mistakes, potentially creating financial or legal complications.

Requirements can vary widely by country. For instance, transferring funds to Mexico requires a special CLABE number, while transactions to Great Britain need a bank account number and a Sort Code. Always confirm the specific requirements for the destination country before initiating a transfer.

Key takeaways

When completing the Wire Transfer form, consider the following key takeaways:

- Attach the Form: This form must be attached to your payment request. Ensure that it is included with submissions made via Toolkit, TravelND, or other methods.

- Seek Assistance: If you encounter any issues, contact Accounts Payable. Julie Unger (1-7112) and Johnna Grenert-Taff (1-5304) are available to help.

- Country-Specific Requirements: Be aware of special notes for certain countries. For example, wires to Mexico require a CLABE number, while transfers to Great Britain call for a bank account number and a 6-digit Sort Code.

- Currency Preferences: When sending funds to China, US dollars are preferable. Using Chinese Yuan may require additional information, so please prepare accordingly.

- Fill in All Details: Complete all sections of the form, including beneficiary and intermediary bank information. Accuracy will help ensure a smooth transfer process.

Browse Other Templates

How to Get Child Care License in California - The facility name and address must be clearly included at the top of your sketches.

Do You Have to Have a Front License Plate in Missouri - All parties involved should thoroughly review their obligations on the form.