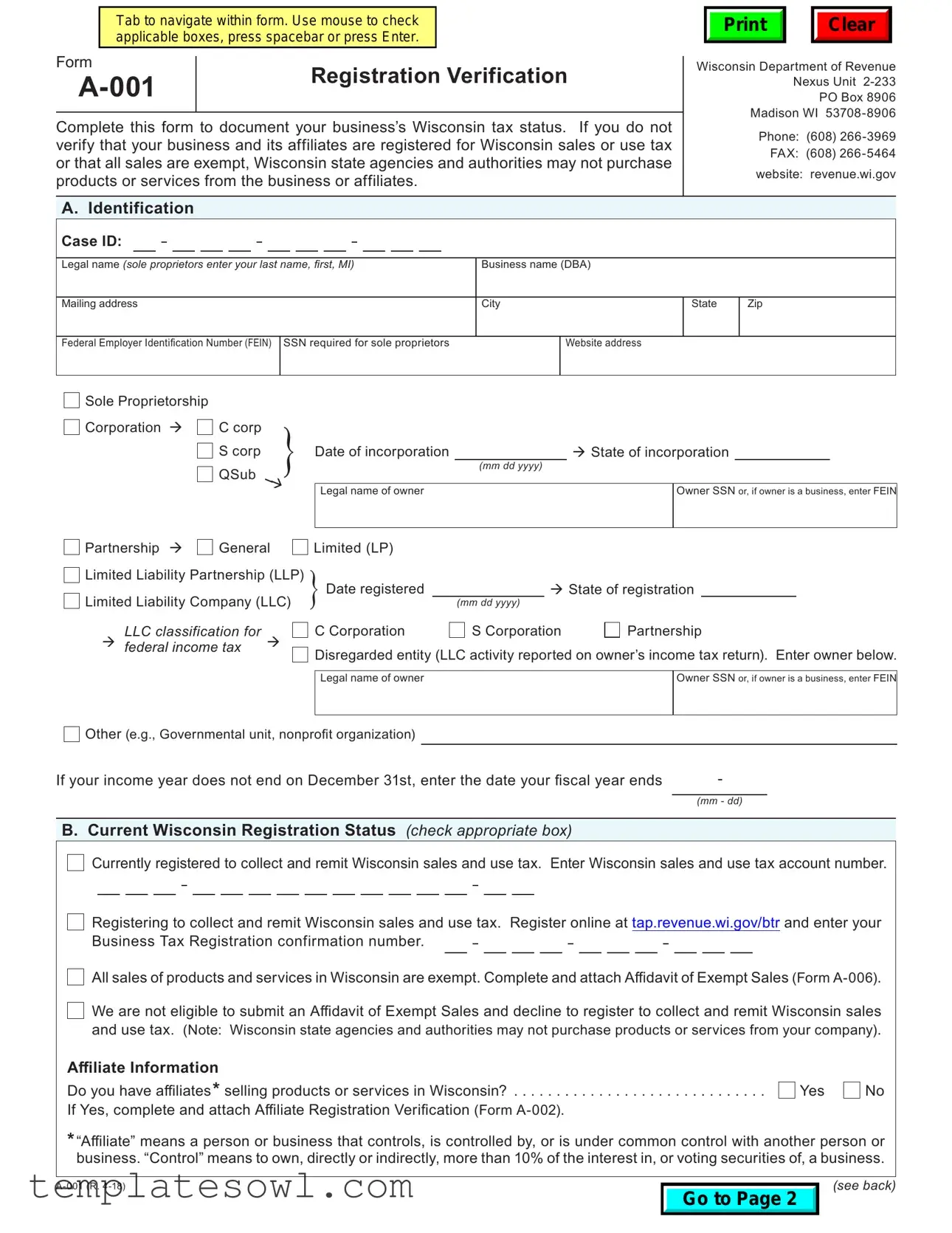

Fill Out Your Wisconsin Verification Form

Navigating the world of business in Wisconsin requires an understanding of various compliance forms, one of the most essential being the Wisconsin Verification form. This important document serves as a means for businesses to confirm their registration status regarding sales and use tax in the state. By completing the form, businesses help ensure that they are in good standing with Wisconsin tax regulations, which is crucial for maintaining eligibility to conduct transactions with state agencies and authorities. The form requires key identification information, such as the legal name, mailing address, business name, and relevant tax identification numbers, whether it's for sole proprietorships, partnerships, or corporations. Additionally, businesses must detail their current registration status—whether they are already registered, in the process of registering, or claim all their sales as exempt. The form also prompts users to provide insight into any affiliates that may be selling products or services in Wisconsin. More than just a bureaucratic requirement, the Wisconsin Verification form plays a vital role in fostering responsible business practices while protecting the interests of both the state and its taxpayers.

Wisconsin Verification Example

Tab to navigate within form. Use mouse to check applicable boxes, press spacebar or press Enter.

Clear |

Form |

|

Registration Verification |

Wisconsin Department of Revenue |

|

|

||||

|

Nexus Unit 2‑233 |

|||

|

|

PO Box 8906 |

||

|

|

|

Madison WI |

|

Complete this form to document your business’s Wisconsin tax status. If you do not |

||||

Phone: (608) 266‑3969 |

||||

verify that your business and its affiliates are registered for Wisconsin sales or use tax |

||||

FAX: (608) 266‑5464 |

||||

or that all sales are exempt, Wisconsin state agencies and authorities may not purchase |

||||

website: revenue.wi.gov |

||||

products or services from the business or affiliates. |

||||

A. Identification

Case ID:

Legal name (sole proprietors enter your last name, first, MI)

Business name (DBA)

Mailing address

City

State

Zip

Federal Employer Identification Number (FEIN)

SSN required for sole proprietors

Website address

Sole Proprietorship |

|

} Date of incorporation |

|

|

|

|

|

|

|

|

||||

Corporation |

|

C corp |

|

|

|

|

|

|

|

|

||||

|

|

QSubS corp |

|

|

State of incorporation |

|

|

|

||||||

|

|

(mm dd yyyy) |

|

|

|

|||||||||

|

|

|

|

|

Legal name of owner |

|

|

|

Owner SSN or, if owner is a business, enter FEIN |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Partnership |

|

General |

Limited (LP) |

|

|

|

|

|

|

|

|

|||

Limited Liability Partnership (LLP) |

} Date registered |

|

|

State of registration |

|

|

|

|

||||||

Limited Liability Company (LLC) |

|

|

|

|

||||||||||

|

(mm dd yyyy) |

|

||||||||||||

LLC classification for |

|

|

C Corporation |

S Corporation |

Partnership |

|||||||||

federal income tax |

|

|

Disregarded entity (LLC activity reported on owner’s income tax return). Enter owner below. |

|||||||||||

|

|

|

|

|

||||||||||

Legal name of owner

Owner SSN or, if owner is a business, enter FEIN

Other (e.g., Governmental unit, nonprofit organization)

Other (e.g., Governmental unit, nonprofit organization)

If your income year does not end on December 31st, enter the date your fiscal year ends |

- |

|

|

|

(mm - dd) |

B. Current Wisconsin Registration Status (check appropriate box)

Currently registered to collect and remit Wisconsin sales and use tax. Enter Wisconsin sales and use tax account number.

Currently registered to collect and remit Wisconsin sales and use tax. Enter Wisconsin sales and use tax account number.

Registering to collect and remit Wisconsin sales and use tax. Register online at tap.revenue.wi.gov/btr and enter your Business Tax Registration confirmation number.

Registering to collect and remit Wisconsin sales and use tax. Register online at tap.revenue.wi.gov/btr and enter your Business Tax Registration confirmation number.

All sales of products and services in Wisconsin are exempt. Complete and attach Affidavit of Exempt Sales (Form A‑006).

All sales of products and services in Wisconsin are exempt. Complete and attach Affidavit of Exempt Sales (Form A‑006).

We are not eligible to submit an Affidavit of Exempt Sales and decline to register to collect and remit Wisconsin sales and use tax. (Note: Wisconsin state agencies and authorities may not purchase products or services from your company).

We are not eligible to submit an Affidavit of Exempt Sales and decline to register to collect and remit Wisconsin sales and use tax. (Note: Wisconsin state agencies and authorities may not purchase products or services from your company).

Affiliate Information

Do you have affiliates* selling products or services in Wisconsin? |

Yes |

No |

If Yes, complete and attach Affiliate Registration Verification (Form A‑002). |

|

|

*“Affiliate” means a person or business that controls, is controlled by, or is under common control with another person or business. “Control” means to own, directly or indirectly, more than 10% of the interest in, or voting securities of, a business.

Go to Page 2

(see back)

C.Wisconsin Business Activity

1.Describe all products sold, rented or leased to Wisconsin customers.

2.Describe all services sold or provided to Wisconsin customers.

3. |

Do you sell products or services in Wisconsin to customers that are not governmental units? |

Yes |

No |

4. |

Are all of your sales in Wisconsin exempt from sales and use tax? |

Yes |

No |

Why are all sales exempt? (check all that apply)

Sales to governmental units

Sales to governmental units

Sales for resale

Sales for resale

Sales are not taxable. Exemption certificates provided by customers or nontaxable services

Sales are not taxable. Exemption certificates provided by customers or nontaxable services

Other (describe)

Other (describe)

5. Do salespersons or representatives visit Wisconsin for any business purpose? |

Yes |

No |

If yes, explain? |

|

|

6. |

Do you license software or intangible assets, such as trademarks, customer lists, etc., in Wisconsin? . |

Yes |

No |

7. |

Do you provide services outside Wisconsin for which the benefits are received in Wisconsin? . . . . |

Yes |

No |

8. |

What year did you start selling products/services to Wisconsin customers? |

|

|

I certify that, to the best of my knowledge, the above information is accurate and complete.

Completed by (type or print)

Signature

( )

Telephone number

Title

Date

Email address

- 2 - |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of the Form | This form is used to document a business's tax status in Wisconsin, ensuring compliance for sales and use tax regulations. |

| Governing Law | The form adheres to Wisconsin state tax laws, specifically those related to sales and use tax registration and exemptions. |

| Affiliates Declaration | Businesses must disclose if they have affiliates selling in Wisconsin; this impacts their eligibility for tax exemptions. |

| Registration Status | It is essential to indicate whether the business is currently registered, in the process of registering, or if all sales are exempt. |

Guidelines on Utilizing Wisconsin Verification

Once you have gathered the necessary information about your business, you’re ready to fill out the Wisconsin Verification form. This process will provide the documentation required for your business’s Wisconsin tax status, which is crucial for maintaining eligibility to conduct business within the state.

- Begin by obtaining the Wisconsin Verification form. You can access it online or request a physical copy from the Wisconsin Department of Revenue.

- In section A, provide your identification details. Enter your Case ID, legal name (sole proprietors should list last name first), business name (DBA), and mailing address, including city, state, and zip code.

- Include your Federal Employer Identification Number (FEIN) or Social Security Number (SSN) if you are a sole proprietor.

- Specify your business structure (e.g., corporation, partnership, LLC) and include the date of incorporation or registration.

- For partnerships or other ownership structures, provide the legal name of the owner along with their SSN or FEIN.

- If applicable, indicate the end date of your fiscal year in mm-dd format.

- Move to section B. Check the appropriate box to confirm your current Wisconsin registration status.

- If you are registering to collect and remit Wisconsin taxes, follow the instructions to register online and provide the necessary confirmation number.

- Answer the query regarding affiliate relationships. If you have affiliates selling in Wisconsin, check 'Yes' and prepare to attach form A-002.

- Proceed to section C. Describe the products and services your business sells or provides to Wisconsin customers.

- Indicate whether your sales in Wisconsin are exempt from sales and use tax by answering the relevant questions.

- Clarify if you have salespeople visiting Wisconsin for business purposes and whether you license any software or intangible assets in the state.

- Mark the year you started selling to Wisconsin customers.

- Complete the certification section by typing or printing your name, signing, and providing your contact information.

What You Should Know About This Form

What is the Wisconsin Verification form and why do I need it?

The Wisconsin Verification form is a crucial document designed to confirm your business's tax status in Wisconsin. It is required for businesses that want to engage in sales or provide services in the state. Without this verification, state agencies and authorities may be prohibited from purchasing your products or services. This form helps ensure compliance with Wisconsin's sales and use tax regulations, allowing your business to operate smoothly within the state's tax framework.

How do I complete the Wisconsin Verification form?

Completing the Wisconsin Verification form involves several steps. Start by filling in your business identification details, such as the legal name, business name, mailing address, and Federal Employer Identification Number (FEIN). Next, indicate your current registration status regarding Wisconsin sales and use tax. You’ll need to check the appropriate box based on whether you’re currently registered, are in the process of registering, or verify that all your sales are exempt from tax. Make sure to provide accurate details about your business activities and any affiliates selling in Wisconsin. Remember, clarity and accuracy in your responses will facilitate the process and help prevent delays.

What should I do if I have affiliates selling products in Wisconsin?

If your business has affiliates selling products or services in Wisconsin, you must indicate this on the form. You should check 'Yes' and complete the Affiliate Registration Verification (Form A-002) for each affiliate. Affiliates are defined as entities or individuals that control, are controlled by, or share common control with your business. This means any business relationships affecting control should be disclosed to maintain transparency with Wisconsin tax authorities.

What happens if I do not verify my business’s tax status?

Failing to verify your business’s tax status can lead to significant consequences, particularly if you intend to work with Wisconsin state agencies or authorities. Without proper verification, these entities may not be able to purchase your goods or services. This could limit your business opportunities and adversely affect your revenue. Therefore, it’s essential to complete the verification as soon as possible to avoid these complications.

How can I contact the Wisconsin Department of Revenue if I have further questions?

If you have any questions or require assistance while completing the Wisconsin Verification form, you can reach out to the Wisconsin Department of Revenue. Their phone number is (608) 266-3969, and you can also send a fax to (608) 266-5464. For more information, visit their website at revenue.wi.gov. They are equipped to help you with any inquiries you may have regarding the tax verification process or tax registration in general.

Common mistakes

Filling out the Wisconsin Verification form accurately is crucial for any business wishing to maintain good standing with state tax authorities. However, many people make simple but significant mistakes that can lead to delays or complications. Understanding these common errors can help streamline the process and ensure compliance.

One frequent mistake is improperly entering the business's legal name. This is particularly important for sole proprietors who must provide their last name, followed by their first name and middle initial, if applicable. Missing or misplacing any part of this information can result in mismatches in state records, potentially affecting the business's ability to operate legally.

Another error often seen is neglecting to provide the correct Federal Employer Identification Number (FEIN). This number is essential for tax identification purposes. Sole proprietors are also required to provide their Social Security Number (SSN). Failing to include one or the other can cause the application to be deemed incomplete.

Many users also overlook the section asking for current Wisconsin registration status. Selecting the wrong option here can misrepresent the business's tax obligations. For instance, if a business is currently registered but marks it as "not eligible to submit an Affidavit of Exempt Sales," it could lead to penalties or the rejection of transactions by state agencies.

Furthermore, individuals often forget to address the section on affiliate information. If the business has affiliates selling products or services in Wisconsin, this disclosure is mandatory. Without completing this section or providing the required Affiliate Registration Verification form, the main application may be rejected.

An essential aspect that gets neglected is specifying the nature of business activities conducted in Wisconsin. The form requires detailed descriptions of products or services sold. Insufficient details can raise questions about the business's tax obligations or eligibility for specific exemptions.

Another common oversight involves answering questions about whether all sales in Wisconsin are exempt. Providing incomplete or unclear responses can lead to further inquiries from tax authorities. If exemptions are claimed, the business must check all applicable reasons to substantiate this status.

Lastly, many people fail to sign or date the form, which is critical for validating the submission. Even if the rest of the form is filled out correctly, an unsigned or undated application can be returned, causing unnecessary delays.

By being mindful of these mistakes, businesses can more effectively manage their compliance with Wisconsin tax regulations. Taking the time to carefully review and fill out the Verification form can save significant headaches and ensure smooth operations within the state.

Documents used along the form

The Wisconsin Verification Form is essential for businesses seeking to document their tax status in the state. Accompanying this form are several other documents that assist in establishing compliance with Wisconsin's sales and use tax requirements. Below is a list of these important forms and documents, along with a brief description of each.

- Affidavit of Exempt Sales (Form A-006): This form is used by businesses claiming that all their sales are exempt from Wisconsin sales and use tax. Completing it is necessary for businesses that wish to confirm their exempt status and avoid potential tax liabilities.

- Affiliate Registration Verification (Form A-002): If a business has affiliates operating in Wisconsin, this form must be completed. It validates the affiliate relationship and ensures that all parties are registered appropriately with the Wisconsin Department of Revenue.

- Business Tax Registration (BTR): This is the online registration form that businesses complete to obtain a sales and use tax account number. This number is crucial for collecting and remitting taxes in Wisconsin.

- Certificate of Exempt Use (Form S-211): This document allows businesses to certify that they are using or selling exempt products or services. It helps clarify for vendors that no tax needs to be collected on these exempt transactions.

- Sales Tax Exemption Certificate: Used by purchasers to claim an exemption on certain products or services, this certificate must be presented to vendors during a transaction. It indicates that the buyer qualifies for a sales tax exemption under specific circumstances.

Each of these forms plays a crucial role in establishing the legitimacy of business operations in Wisconsin. Understanding their purpose and ensuring compliance can significantly impact a business's ability to function smoothly within the state's regulatory framework.

Similar forms

-

Business Registration Form: Similar to the Wisconsin Verification form, this document collects comprehensive details about a business, focusing on its legal structure, identification, and tax compliance status.

-

State Sales Tax Permit Application: Like the Verification form, this application is used by businesses to register for collecting sales tax, ensuring they are recognized by state authorities as tax compliant.

-

IRS Form SS-4: This form is utilized to apply for an Employer Identification Number (EIN). It serves a similar purpose in that it verifies the business's identity to federal tax authorities.

-

Affidavit of Exempt Sales (Form A-006): This document complements the Verification form by providing proof that specific sales are exempt from sales tax, detailing the nature of those exemptions.

-

Uniform Commercial Code (UCC) Filing: Common in business registrations, UCC filings protect secured interests in collateral and serve a similar verification role regarding business entities.

-

Partnership Registration Form: Like the Wisconsin Verification form, this document establishes the legal existence of a partnership, including details about the partners and the business structure.

-

Corporation Articles of Incorporation: This form, required when forming a corporation, similarly verifies the business's name and structure, ensuring compliance with state regulations.

-

Operating Agreement for LLCs: This internal document outlines the management structure and operating procedures for a Limited Liability Company, confirming its compliance and organizational framework.

-

Nonprofit Organization Registration: For nonprofit entities, this registration verifies their status, similar to how the Verification form confirms a business’s tax status in Wisconsin.

-

Application for Certificate of Authority: This document is needed for out-of-state businesses wishing to operate in Wisconsin. It verifies their authority to do business in the state, analogous to the Verification form.

Dos and Don'ts

When filling out the Wisconsin Verification form, here are some important things to keep in mind. Follow these guidelines to ensure your submission is correct.

- Do: Use your legal name as it appears on official documents.

- Do: Double-check your Wisconsin sales and use tax account number.

- Do: Attach any necessary additional forms, like the Affidavit of Exempt Sales if applicable.

- Do: Clearly describe your business activities and services provided in Wisconsin.

- Do: Include a reliable contact number and email address.

- Do: Sign and date the form to confirm the accuracy of the information provided.

- Don’t: Leave any sections blank; ensure all questions are answered.

- Don’t: Forget to check if you have aliases or "doing business as" names.

- Don’t: Submit the form without reviewing it for errors.

- Don’t: Provide inaccurate information; it could delay processing.

- Don’t: Ignore instructions about submitting additional documentation.

- Don’t: Rely solely on electronic submission without a confirmation of receipt.

By following these dos and don'ts, you can help ensure a smoother process when filling out the Wisconsin Verification form.

Misconceptions

Understanding the Wisconsin Verification form can be challenging. Here are ten misconceptions about this form:

- It’s only for large businesses. Many small businesses also need to fill out this form. Size does not determine your need for compliance.

- Sales tax exemption means no registration is required. Even if sales are exempt, you must still register if your business operates in Wisconsin.

- Filing this form is optional. Completing the form is necessary for maintaining good standing with Wisconsin state agencies.

- Only physical goods are considered. Services provided in Wisconsin also require disclosure on the form, so consider all aspects of your business.

- Your business must be headquartered in Wisconsin to complete the form. Out-of-state businesses also need to verify their tax status if they operate in Wisconsin.

- No need to include affiliate information. You must disclose if you have affiliates selling in Wisconsin, regardless of location.

- This form is only relevant for tax time. Keeping your registration current throughout the year helps avoid issues with state agencies.

- You can skip the description of products and services. Detailed descriptions are necessary to clarify your business activities.

- Once registered, you don’t have to worry about the form again. Regular updates may be required as your business changes or grows.

- Filling out the form guarantees sales tax exemption. Verification does not automatically grant exemption; it merely documents your status.

Understanding these misconceptions can help ensure that your business complies with Wisconsin tax requirements. Proper completion of this form is essential for smooth operations and maintaining eligibility for state contracts.

Key takeaways

Filling out the Wisconsin Verification form requires careful attention to detail to ensure compliance with state regulations.

- Purpose of the Form: This form documents your business’s tax status in Wisconsin. Completing it is essential, as without verification, state agencies may be unable to purchase from your business.

- Completing Identification Sections: Provide accurate identification details. This includes your legal name, business name, and Federal Employer Identification Number (FEIN). Sole proprietors should enter their Social Security Number (SSN).

- Current Registration Status: Indicate your business’s status regarding sales and use tax. You should select one of the options specified, including whether you are currently registered, in the process of registering, or if all sales are exempt.

- Provide Comprehensive Business Activity Information: Detail the products or services offered in Wisconsin. This section includes questions about sales location and exemption status that must be answered thoroughly.

Taking the time to fill out the Wisconsin Verification form accurately will provide clarity regarding tax obligations and enable smoother interactions with state agencies.

Browse Other Templates

How to Fill Out Straight Bill of Lading - This form is a legal document binding the shipper and carrier under specific obligations.

Specialized Loan Servicing Foreclosure Process - Use HUD resources for additional foreclosure alternatives.