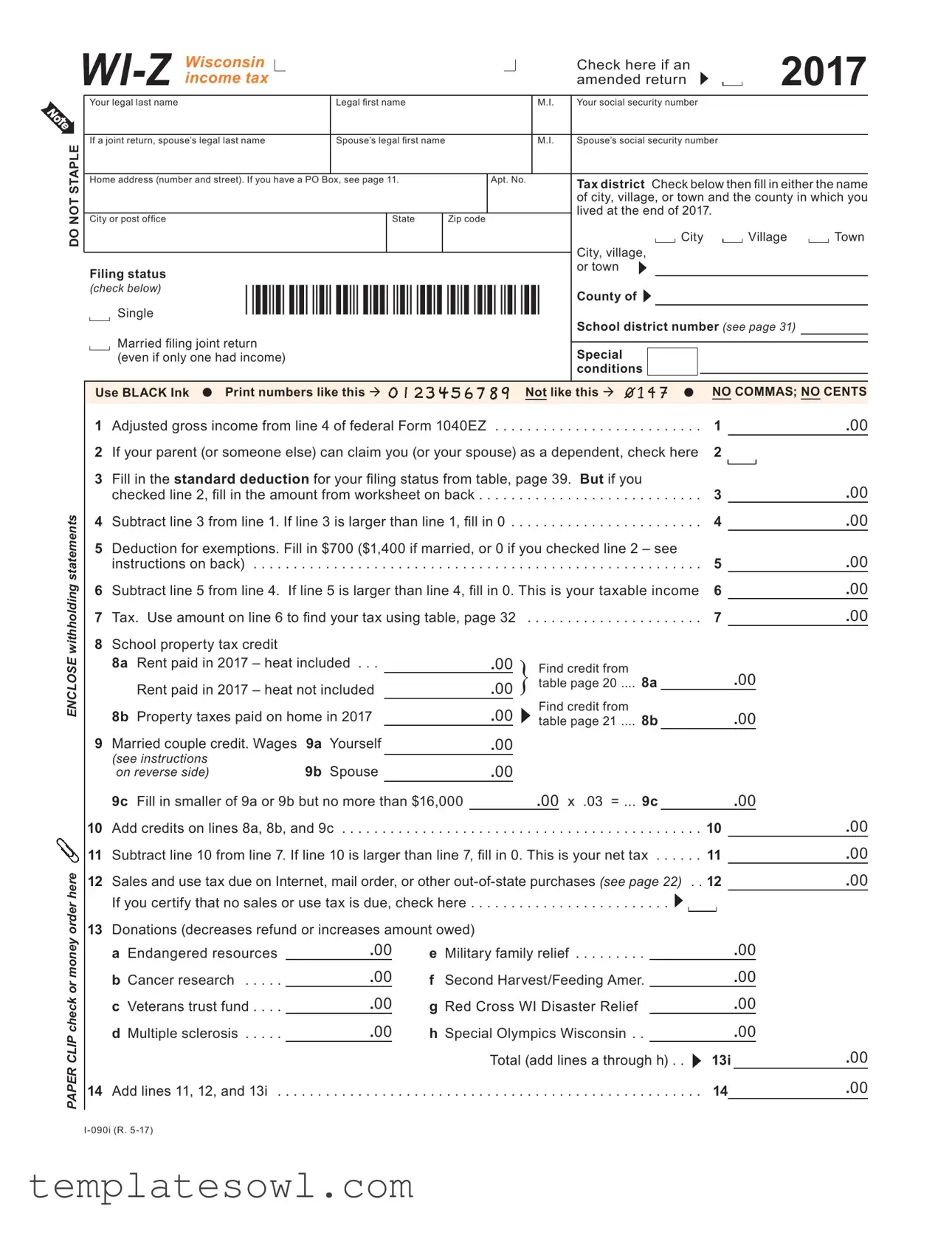

Fill Out Your Wisconsin Wi Z Form

The Wisconsin Wi Z form is an essential document for individuals filing their state income tax returns. This form applies to those whose financial situation is relatively straightforward and allows for a simpler filing process. Within it, taxpayers will detail their adjusted gross income, claim any applicable deductions, and calculate their taxable income. Specific line items help individuals report withholding amounts, potential tax credits, and any additional sales and use tax due. Notably, the form includes sections to indicate if it is an amended return, allowing individuals to make corrections if previously filed information was inaccurate. Instructions are provided to assist filers in completing each section accurately, including how to handle dependent statuses and various credits available to taxpayers. A clear understanding of these components is necessary for ensuring compliance and maximizing potential refunds or minimizing owed taxes.

Wisconsin Wi Z Example

Check here if an |

2017 |

amended return |

DO NOT STAPLE

ENCLOSE withholding statements

PAPER CLIP check or money order here

Your legal last name |

|

Legal irst name |

|

|

M.I. |

Your social security number |

|

|

|

|

|

|

|

||||||||

If a joint return, spouse’s legal last name |

Spouse’s legal irst name |

|

|

M.I. |

Spouse’s social security number |

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Home address (number and street). If you have a PO Box, see page 11. |

|

Apt. No. |

|

Tax district Check below then ill in either the name |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

of city, village, or town and the county in which you |

||||||||||||

City or post ofice |

|

|

State |

|

Zip code |

|

|

lived at the end of 2017. |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

Village |

|

|

Town |

|

|

|

|

|

|

|

|

|

|

City, village, |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Filing status |

|

|

|

|

|

|

|

or town |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

(check below) |

|

|

|

|

|

|

|

County of |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Single |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

School district number (see page 31) |

|

|

|

|||||||||

|

Married iling joint return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Special |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

(even if only one had income) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

conditions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Use BLACK Ink |

Print numbers like this |

|

Not like this |

NO COMMAS; NO CENTS |

|||||||||||||||||

1 Adjusted gross income from line 4 of federal Form 1040EZ |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

1 |

|

|

|

.00 |

|||||||||||||||

2 If your parent (or someone else) can claim you (or your spouse) as a dependent, check here |

2 |

|

|

|

|

|

|

||||||||||||||

3Fill in the standard deduction for your iling status from table, page 39. But if you

checked line 2, ill in the amount from worksheet on back |

3 |

.00 |

. . . . . . . . . . . . . . . . . . . . . . . .4 Subtract line 3 from line 1. If line 3 is larger than line 1, ill in 0 |

4 |

.00 |

5Deduction for exemptions. Fill in $700 ($1,400 if married, or 0 if you checked line 2 – see

|

instructions on back) |

5 |

.00 |

6 |

Subtract line 5 from line 4. If line 5 is larger than line 4, ill in 0. This is your taxable income |

6 |

.00 |

7 |

Tax. Use amount on line 6 to ind your tax using table, page 32 |

7 |

.00 |

8School property tax credit

|

8a Rent paid in 2017 – heat included . . . |

|

.00 |

|

Find credit from |

|

|

|

|

|

|

|

|

||

|

Rent paid in 2017 – heat not included |

|

.00 } table page 20 .... |

8a |

|

|

|

|

|

.00 |

|

||||

|

|

|

|

|

|

|

|

||||||||

|

8b Property taxes paid on home in 2017 |

|

.00 |

|

Find credit from |

|

|

|

|

|

|

.00 |

|

||

|

|

table page 21 .... |

8b |

|

|

|

|

|

|||||||

9 |

Married couple credit. Wages |

9a Yourself |

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

(see instructions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9b Spouse |

|

.00 |

|

|

|

|

|

|

|

|

|

|

||

|

on reverse side) |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9c Fill in smaller of 9a or 9b but no more than $16,000 |

|

|

.00 x .03 = ... |

9c |

|

|

|

|

.00 |

|

||||

10 |

. . . . . . . . . . . . . . . . . . . . . . . .Add credits on lines 8a, 8b, and 9c |

|

. . . |

. . . . . . . . . . |

. . . |

. . . |

. 10. |

|

.00 |

||||||

11 |

. . . .Subtract line 10 from line 7. If line 10 is larger than line 7, ill in 0. This is your net tax |

. 11. |

.00 |

||||||||||||

12 |

Sales and use tax due on Internet, mail order, or other |

. . 12 |

.00 |

||||||||||||

|

If you certify that no sales or use tax is due, check here |

. . . . . . . . |

. . . |

. . . . . . . . . . |

. . . |

. |

|

|

|

|

|

|

|||

13Donations (decreases refund or increases amount owed)

a Endangered resources |

.00 |

e |

Military family relief |

|

|

|

.00 |

|

b Cancer research |

.00 |

f |

Second Harvest/Feeding Amer. |

|

|

|

.00 |

|

c Veterans trust fund . . . . |

.00 |

g |

Red Cross WI Disaster Relief |

|

|

|

.00 |

|

d Multiple sclerosis |

.00 |

h Special Olympics Wisconsin . . |

|

|

|

.00 |

|

|

|

|

|

Total (add lines a through h) . . |

13i |

.00 |

|||

14 Add lines 11, 12, and 13i |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

14 |

|

.00 |

||||

2017 Form

Name

SSN

Page 2 of 2

15 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . .Amount from line 14 |

. . . . . . . . . |

. . |

. . . |

. . . . . . . . . |

. . . .. . . 15 |

|

|

|

|

|

.00 |

|||||

16 |

. .Wisconsin income tax withheld. Enclose withholding statements |

. . |

16 |

|

.00 |

|

|

|

|

|

|

|

|

||||

17 |

AMENDED RETURN ONLY – amount previously paid |

. . . . . . . . . |

. . |

17 |

|

.00 |

|

|

|

|

|

|

|

|

|||

18 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . .Add lines 16 and 17 |

. . . . . . . . . |

. . |

18 |

|

.00 |

|

|

|

|

|

|

|

|

|||

19 |

. . . . .AMENDED RETURN ONLY – amount previously refunded |

. . |

19 |

|

.00 |

|

|

|

|

|

|

|

|

||||

20 |

. . . . . . . . . . . . . . . . . . . . .Subtract line 19 from line 18 |

. . . . . . . . . |

. . |

. . . |

. . . . . . . . . |

. . . 20. . . . |

|

|

|

|

|

.00 |

|||||

21 |

If line 20 is larger than line 15, subtract line 15 from line 20 |

. . |

This is YOUR REFUND 21 |

|

.00 |

||||||||||||

22 |

If line 15 is larger than line 20, subtract line 20 from line 15 . . This is the AMOUNT YOU OWE 22 |

.00 |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Third Do you want to allow another person to discuss this return with the department (see page 30)? |

|

Yes Complete the following. |

|

|

|

No |

|||||||||||

Personal |

|

|

|

|

|

|

|

||||||||||

Party |

Designee’s |

Phone |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

identiication |

|

|

|

|

|

|

|

|||||

Designee name |

no. ( |

) |

|

|

number (PIN) |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sign below Under penalties of law, I declare that this return is true, correct, and complete to the best of my knowledge and belief.

Your signature |

Spouse’s signature (if filing jointly, BOTH must sign) |

Date |

Daytime phone |

|

|

|

|

( |

) |

|

|

|

|

|

Mail your return to: |

Wisconsin Department of Revenue |

|

|

|

If refund or no tax due |

.......PO Box 59, Madison WI |

|

|

|

If tax due |

PO Box 268, Madison WI |

|

|

|

INSTRUCTIONS

Amended Return If you already iled your original return and this is an amended return, place a check mark where indicated at

the top of Form

Filling in Your Return Use black ink to complete the form. Round off cents to the nearest dollar. Drop amounts under 50¢ and increase amounts from 50¢ through 99¢ to the next dollar. If completing the form by hand, do not use commas when illing

in amounts.

Line 2 Dependents Check line 2 if your parent (or someone else) can claim you (or your spouse) as a dependent on his or her return. Check line 2 even if that person chose not to claim you.

Line 3 If you checked line 2, use this worksheet to igure the amount to ill in on line 3.

A. Wages, salaries, and tips included in |

|

|

|

line 1 of Form |

|

|

|

interest income or taxable scholarships |

|

.00 |

|

or fellowships not reported on a |

A. |

|

|

B. Addition amount |

B. |

350.00 |

|

C. Add lines A and B. If total is less |

|

.00 |

|

than $1,050, ill in $1,050 |

C. |

|

|

D. Fill in the standard deduction for your |

|

.00 |

|

iling status using table, page 39 |

D. |

|

|

E. Fill in the SMALLER of line C or D |

|

.00 |

|

here and on line 3 of Form |

E. |

|

|

|

|

|

|

Line 5 If you are single and can be claimed as a dependent, ill in 0 on line 5. If you are married and both spouses can be claimed as a dependent, ill in 0 on line 5. If you are married and only one of you can be claimed as a dependent, ill in $700 on line 5.

Lines 8a and 8b School Property Tax Credit See the instructions for lines 20a and 20b of Form 1A. The total credits on lines 8a and 8b cannot exceed $300.

Line 9 Married Couple Credit If you are married and you and your spouse were both employed in 2017, you may claim the married couple credit. Complete the following steps:

(1)Fill in your 2017 taxable wages on line 9a. Fill in your spouse’s taxable wages on line 9b.

(2)Fill in the smaller of line 9a or 9b (but not more than $16,000) in the space provided on line 9c.

(3)Multiply the amount determined in Step 2 by .03 (3%).

(4)Fill in the result (but not more than $480) on line 9c.

Line 12 Sales and Use Tax Due on

Line 13 Donations You may designate amounts as a donation to one or more of the programs listed on lines 13a through 13h. Your donation will either reduce your refund or be added to tax due.

Line 16 Wisconsin Income Tax Withheld Fill in the total amount of Wisconsin income tax withheld as shown on your withholding statements

withheld for any state other than Wisconsin.

Lines 17 - 21 If this is an amended return, see the instructions for lines 33 - 38 of Form 1A.

Line 22 – If line 15 is more than line 20, subtract line 20 from line 15. But, if line 20 is a negative number because line 19 exceeds line 18, treat the amount on line 20 as a positive number and add (rather than subtract) line 15 to line 20. This is the amount you owe. Paper clip your check or money order to Form

credit card or online.

Sign Your Return If married, your spouse must also sign.

Enclosures Enclose a copy of your

Form

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The WI-Z form is used for filing a simple income tax return for Wisconsin residents with basic tax situations. |

| Eligibility Criteria | This form is intended for individuals with income below a specified threshold, typically for those with relatively simple tax situations. |

| Amended Return Indication | Taxpayers must check the box at the top of the form if it is an amended return, indicating that it modifies a previously filed return. |

| Filing Deadlines | The Wisconsin income tax return must be filed by April 15 of the year following the tax year in question. |

| Governing Law | The use and requirements of the WI-Z form are governed by the Wisconsin Statutes, specifically under the Wisconsin Department of Revenue regulations. |

| Income Reporting | Taxpayers fill in their adjusted gross income from the line 4 of federal Form 1040EZ, ensuring accuracy in tax amount calculation. |

Guidelines on Utilizing Wisconsin Wi Z

Once you have gathered the required documents and information, you can begin filling out the Wisconsin WI-Z form. This process involves providing personal details, calculating taxable income, and determining whether you owe tax or are due a refund. It is important to be thorough and accurate as you complete each section to ensure your return is processed without issues.

- Determine if you are filing an amended return: If this is an amended return for 2017, check the box at the top of the form.

- Provide your personal information: Fill in your legal last name, first name, middle initial, and your Social Security number. If applicable, include your spouse’s information.

- Enter your home address: Fill in the street address, apartment number (if any), city or town, state, and zip code. Ensure you indicate the tax district.

- Select your filing status: Check the appropriate box for your filing status—single, married filing jointly, or other options outlined on the form.

- Report your adjusted gross income: Fill in the amount from line 4 of your federal Form 1040EZ on line 1.

- Check for dependent status: Mark line 2 if someone else can claim you or your spouse as a dependent.

- Fill in the standard deduction: Report the standard deduction amount applicable to your filing status on line 3. If you marked line 2, use the provided worksheet.

- Calculate your taxable income: Subtract the amount on line 3 from line 1 and enter the result on line 4. If line 3 is greater than line 1, enter 0.

- Determine deductions for exemptions: Fill in the exemption deduction amount on line 5 based on your filing status and previous selections.

- Calculate your taxable income again: Subtract line 5 from line 4 to get your taxable income on line 6. Enter 0 if line 5 exceeds line 4.

- Find your tax: Use the applicable tax table to determine your tax liability based on the amount on line 6 and record it on line 7.

- Apply credits: Report any applicable school property tax credits on lines 8a and 8b, and complete the married couple credit if eligible.

- Add total credits: Sum the amounts on lines 8a, 8b, and any computed amounts on line 9c, entering the total on line 10.

- Calculate your net tax: Subtract line 10 from line 7 and record the result on line 11.

- Include any sales and use tax owed: If applicable, enter the amount due on line 12.

- Fill in donations: If you wish to make donations, enter the amounts on line 13a through 13h and total them on line 13i.

- Compute final amounts: Add lines 11, 12, and 13i to find the total amount on line 14.

- Detail tax withheld: Write in the total Wisconsin income tax withheld from your W-2 on line 16.

- Account for payments: If this is an amended return, list the amount previously paid or refunded on lines 17 and 19 respectively.

- Final calculations: Complete lines 20, 21 (your refund) or 22 (the amount you owe), ensuring all figures are accurate.

- Authorization for designee (optional): If you wish to allow someone else to discuss your return with the department, complete the designee section.

- Sign and date the return: Ensure both you and your spouse sign if filing jointly. Also provide your daytime phone number.

- Prepare for submission: Enclose your W-2 forms, place a paper clip on your check or money order, and mail your return to the appropriate address indicated for your situation.

What You Should Know About This Form

What is the Wisconsin WI-Z form and who should use it?

The Wisconsin WI-Z form is designed for individuals with simple tax situations wishing to file their state income tax return. It is ideal for those who have adjusted gross income less than a certain threshold, typically fitting the criteria of single individuals or married couples with straightforward financial circumstances. If you are claiming few credits or deductions, or if your income is primarily from wages, the WI-Z form can simplify the filing process.

How do I fill out the WI-Z form correctly?

To complete the form accurately, begin with your adjusted gross income, which you can find on line 1 and fill in appropriately. Remember to use black ink and to avoid any commas or cents in your entries. Pay close attention to the instructions for each line. If someone can claim you as a dependent, check line 2. For married couples, both spouses must sign the form if filing jointly. It’s important to paper clip any checks or money orders to the form rather than stapling, as this can cause processing issues.

What should I do if I need to amend my Wisconsin tax return?

If you have filed your original tax return and now need to make changes, you must mark the amended return box at the top of the WI-Z form. Ensure to include a copy of Schedule AR along with any other relevant supporting documents that justify your amendments. This helps clarify the changes you are making to the Wisconsin Department of Revenue. Ensure you follow the amendment instructions carefully, as doing so may affect your tax refund or amount owed.

When is the deadline for submitting the WI-Z form?

Typically, the Wisconsin income tax return – including the WI-Z form – is due on April 15. If this date falls on a weekend or holiday, the deadline may shift to the next business day. For those who require additional time, you can file for an extension, but keep in mind that any taxes owed still need to be paid by the deadline to avoid penalties. It’s advisable to submit your return well in advance of the deadline to ensure it is processed on time.

Common mistakes

Filling out the Wisconsin WI-Z form can seem straightforward, but many people make common missteps. One frequent error is failing to check the appropriate box when filing an amended return. If you have previously filed a return and are making changes, it is crucial to mark the “amended return” box at the top of the form. Neglecting this step can lead to confusion and delays in processing your tax return.

Another common mistake involves incorrect personal information entry. Many taxpayers mistakenly miswrite name details or social security numbers. Even a small error can hinder the processing of the return and might even prompt the tax authorities to reach out for clarification. Always double-check this information to ensure it matches your official documents.

People often overlook the specific instructions concerning deductions and credits. For instance, incorrectly calculating the standard deduction can significantly impact your taxable income. It's essential to reference the correct figures based on filing status and ensure you are following the guidance laid out in the instructions. Additionally, some taxpayers skip over the requirements for the school property tax credit, leading to missed opportunities for savings.

Lastly, many individuals forget to include their withholding statements with the WI-Z form. This omission can delay the processing of any refund you might be expecting. Always remember to attach these documents to support the amounts you are reporting. By being mindful of these common mistakes, you can ensure a smoother filing process and avoid unnecessary complications.

Documents used along the form

When preparing your tax return in Wisconsin, the WI-Z form is just one of several important documents you may need. Each document serves a specific purpose and ensures that your tax filing is complete and accurate. Below is a list of key documents often used in conjunction with the WI-Z form.

- Federal Form 1040EZ: This form is the U.S. individual income tax return used by taxpayers with simple tax situations. It is often a starting point for those filling out the WI-Z, as certain information from this return will feed into your state taxes.

- W-2 Forms: Issued by employers, W-2 forms report the annual wages and the taxes withheld from your paycheck. These figures are essential for accurately completing the WI-Z form.

- Schedule A: This is used for itemizing deductions if you choose not to take the standard deduction. While the WI-Z form generally implies a standard deduction, some taxpayers may need to reference Schedule A for specific deductions relevant to their circumstances.

- Schedule AR: If you are amending a prior tax return, the Schedule AR outlines adjustments and corrections being made. It must accompany the WI-Z if you're submitting an amended return.

- Form 1A: This document provides detailed instructions on how to fill out various Wisconsin tax forms, including the WI-Z. It is an invaluable resource for understanding credits, deductions, and filing procedures.

These documents, when utilized alongside the WI-Z form, can simplify the tax filing process and help ensure compliance with Wisconsin tax laws. Make sure to gather all necessary forms before you begin your filing to avoid any delays or errors.

Similar forms

The Wisconsin WI-Z form is specifically designed for individuals filing their income tax returns in the state of Wisconsin. It shares similarities with several other tax documents across different states and various tax situations. Below is a list of eight documents that are comparable to the WI-Z form, detailing how they are similar:

- Form 1040EZ: This is a simplified federal tax return form for individuals with basic financial situations. Like the WI-Z, it allows for easier filing with straightforward calculations for income and deductions.

- Form 1040A: This federal tax form also offers a middle ground for taxpayers with simpler filing needs. Both forms streamline the process and minimize the need for itemization.

- California Form 540 2EZ: Similar in purpose, this California tax form is designed for residents with basic tax situations. It emphasizes straightforward figures, just like the WI-Z, to simplify the tax filing process.

- New York State IT-201: This form is for individual income tax returns in New York. It mirrors the WI-Z in that it provides options for various levels of income complexity while focusing on ease of completion.

- Michigan Form MI-1040: Known for its straightforward approach, this form addresses the needs of single and joint filers, similar to the Wisconsin WI-Z, by offering simple calculations for tax credits and deductions.

- Massachusetts Form 1: This form is the resident income tax return for Massachusetts. It simplifies tax filing for residents much like the WI-Z, allowing for direct calculations of standard deductions and credits.

- Florida Form DR-15: Although Florida does not have a state income tax, this form is utilized for various tax obligations. It shares the same emphasis on clarity and ease of use as seen in the WI-Z structure.

- Oregon Form 40S: This form is for individuals with simple income tax situations in Oregon. It embraces a straightforward design, paralleling the WI-Z in its user-friendly format intended for quick filing.

By understanding these similarities, taxpayers can navigate their tax obligations more effectively, regardless of the state in which they reside or file.

Dos and Don'ts

When filling out the Wisconsin Wi Z form, keep these guidelines in mind:

- Use black ink. Always complete the form using black ink to ensure clarity.

- Round amounts correctly. Round cents to the nearest dollar, dropping amounts under 50¢ and increasing amounts from 50¢ to 99¢ to the next dollar.

- Check for dependents. If someone can claim you or your spouse as a dependent, ensure to check the appropriate box.

- Do not use commas or cents. Avoid using commas in the form. Also, do not include cents when filling in amounts.

- Double-check information. Verify that names, addresses, and social security numbers are accurate to avoid delays.

- Do not staple documents. If sending a check, use a paper clip instead of a staple to attach it to the form.

Misconceptions

-

Misconception 1: The WI-Z form can be used for any tax year.

This form is specific to the 2017 tax year. Using it for other years could result in incorrect filings and potential penalties.

-

Misconception 2: Everyone qualifies to use the WI-Z form.

Only those with a simple tax situation and specific income limits can use this form. If your income exceeds the threshold or if you have more complex tax issues, you may need to use a different form.

-

Misconception 3: You can file the WI-Z form without supporting documents.

Filing requires enclosures such as W-2 forms and any other necessary supporting documentation. Failure to include these may delay processing or result in your return being rejected.

-

Misconception 4: The WI-Z form will automatically calculate my taxes for me.

The form provides instructions for you to calculate your taxable income and credits. You must complete the necessary calculations manually to determine your tax liability.

-

Misconception 5: Signing the WI-Z form isn't important if you file electronically.

Even when filing electronically, you are still required to provide a signature. This confirms that all information submitted is truthful and accurate, which is a legal obligation.

Key takeaways

Here are key takeaways to keep in mind when filling out and using the Wisconsin WI-Z form:

- Accurate Information Required: Provide correct details including your name, social security number, and address. This will help ensure that your return is processed without delays.

- Check Filing Status: Indicate your filing status accurately by checking Single or Married filing jointly. This affects deductions and tax rates.

- Use Black Ink: Complete the form using black ink and avoid using commas or cents. Round amounts to the nearest dollar to meet the form’s requirements.

- Adjusted Gross Income First: Start with your adjusted gross income from your federal return as this figure is essential to complete the rest of the form.

- Understand Deductions: Familiarize yourself with your standard deduction and any applicable exemptions. They play a crucial role in determining your taxable income.

- Credits Affecting Taxes: Be sure to calculate all eligible credits, such as the school property tax credit and married couple credit, accurately. These could reduce your overall tax liability.

- Enclose Necessary Documents: Attach copies of your W-2 forms and, if applicable, documentation for any amended changes or claimed credits. This ensures smooth processing.

- Submit on Time: File your return by the deadline to avoid penalties. Mail it to the appropriate address based on whether you're due a refund or owe taxes.

These takeaways serve as a guide to efficiently and correctly complete your Wisconsin WI-Z form. Take action promptly to ensure you meet all requirements and deadlines.

Browse Other Templates

Complex J,Symbolic J,J Variant Alpha,J Cipher,J Code,Abstract J,J Formulation,Special J,J Representation,J Sequence - A clear understanding of its intent might require expert analysis.

Medicaid Application Louisiana - Medicaid offers a toll-free number for help in filling out the application.

Aetna Flex Card for Seniors - Returning customers can place new prescriptions or refills using the same sections.