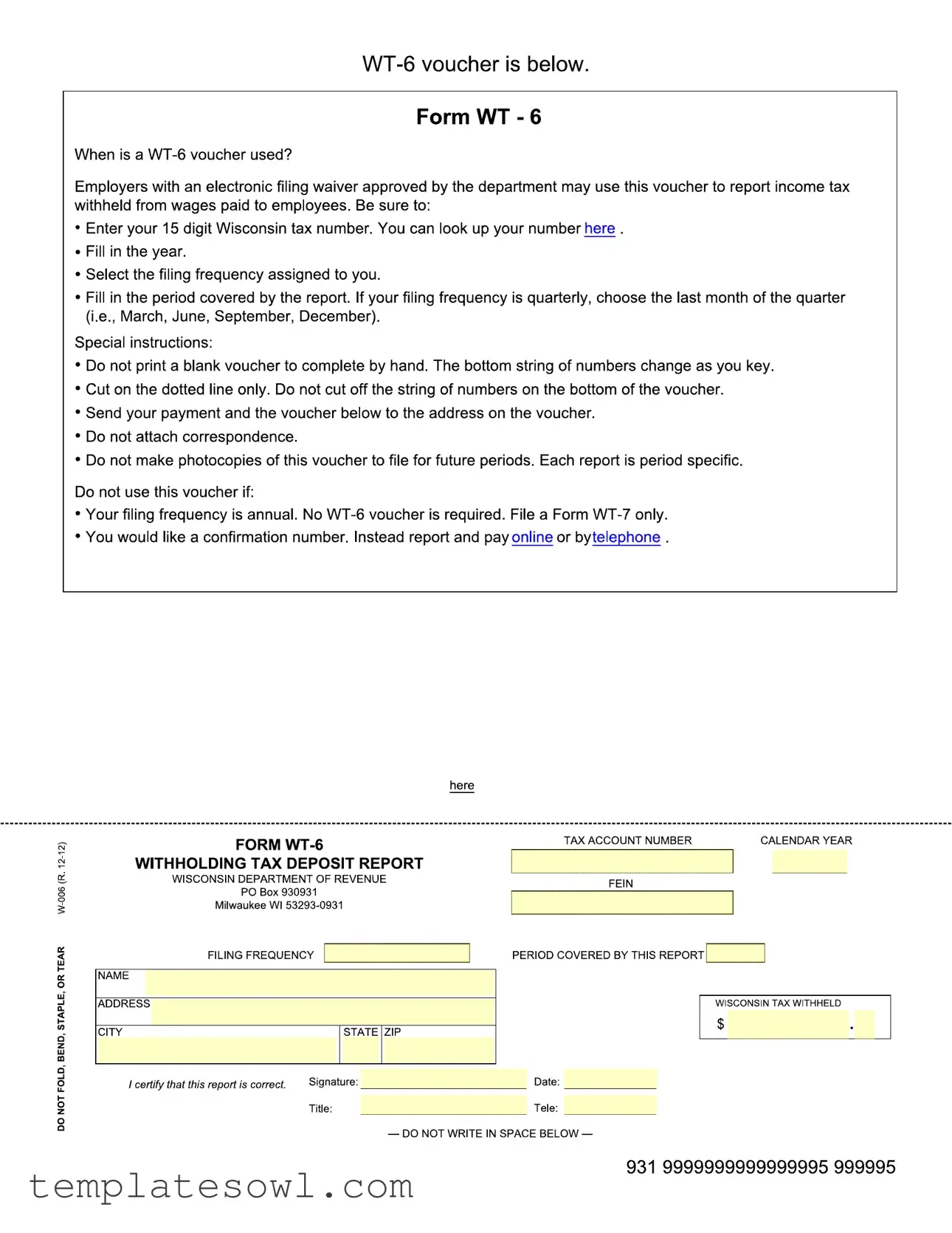

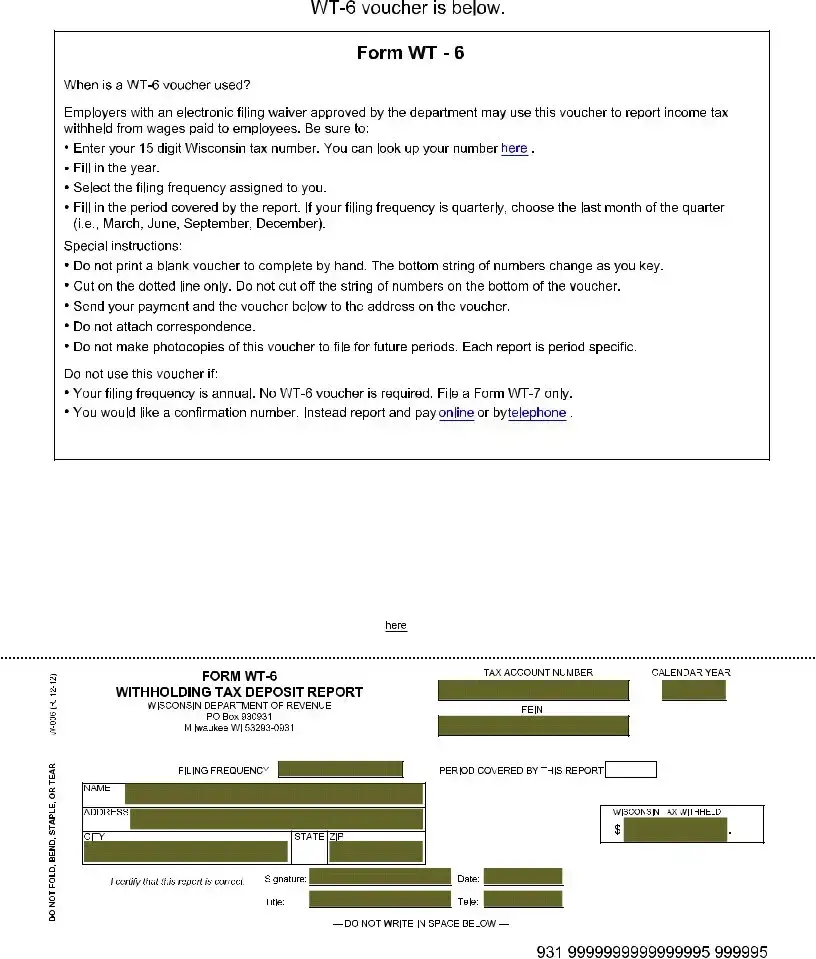

Fill Out Your Wisconsin Wt 6 Withholding Form

The Wisconsin WT-6 Withholding form is essential for employers who have been approved for an electronic filing waiver by the state. This document allows them to report income tax that has been withheld from employees' wages. To correctly use the WT-6 voucher, an employer must enter their unique 15-digit Wisconsin tax number, specify the year, and select the correct filing frequency assigned to them. Each completed form must detail the specific period it covers, particularly noting that employers filing quarterly should use the final month of the quarter—March, June, September, or December. Clear instructions are provided to ensure accuracy; for instance, employers should never print a blank voucher or photocopy it for future submissions, as each report must be uniquely tied to its specific period. Sending the payment along with the properly completed voucher to the designated address is crucial, as is the directive to avoid including any additional correspondence. If an employer’s filing frequency is annual, they must skip the WT-6 altogether and file a separate Form WT-7. Any desire for a confirmation number can be fulfilled through online reporting or by telephone, further emphasizing the form's accessibility and importance in maintaining compliance with Wisconsin tax regulations.

Wisconsin Wt 6 Withholding Example

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The WT-6 voucher is used by employers to report income tax withheld from employee wages if they have an electronic filing waiver. |

| How to Fill | Employers need to enter their 15-digit Wisconsin tax number, the year, and select the appropriate filing frequency for accurate reporting. |

| Filing Frequency | Do not use the WT-6 voucher if your filing frequency is annual; instead, submit a Form WT-7. |

| Governing Law | This form is governed by Wisconsin state tax regulations, specifically under the Department of Revenue guidelines. |

Guidelines on Utilizing Wisconsin Wt 6 Withholding

Filling out the Wisconsin WT-6 withholding form is an important step for employers who need to report income tax withheld from employee wages. Ensuring accuracy while completing this form will facilitate smooth processing. Follow these steps carefully to avoid errors.

- Locate the appropriate WT-6 voucher form.

- Enter your 15-digit Wisconsin tax number in the designated field. If you're unsure of your number, you can look it up on the Wisconsin Department of Revenue website.

- Fill in the calendar year for which you are reporting.

- Select your filing frequency from the options provided. Ensure this matches the frequency assigned to you by the revenue department.

- Indicate the period covered by this report. If you're filing quarterly, select the last month of the quarter (March, June, September, or December).

- Do not print a blank voucher to fill out by hand. Always use a new, official voucher.

- Cut the form on the dotted line only. Do not cut off the string of numbers at the bottom.

- Prepare to submit the voucher along with your payment to the address indicated on the form.

- Ensure not to attach any correspondence or make photocopies of the voucher for future periods, as each report is specific.

- Sign and date the voucher. Include your title and telephone number.

After completing the form, mail it to the designated address to ensure your payment is processed correctly and on time. Make sure all information is correct to avoid any issues with your filing.

What You Should Know About This Form

What is the Wisconsin WT-6 voucher used for?

The Wisconsin WT-6 voucher serves as a report for employers who are required to withhold income tax from their employees' wages. It is specifically designed for those employers who have received an approved electronic filing waiver from the Wisconsin Department of Revenue. When using this voucher, employers report the total income tax withheld during a specific period and submit payment at the same time, ensuring compliance with state tax obligations.

How do I complete the WT-6 voucher correctly?

Completing the WT-6 voucher requires careful attention to detail. Begin by entering your 15-digit Wisconsin tax number and the calendar year. Next, select the filing frequency assigned to your business, such as monthly or quarterly. It’s essential to provide the specific period covered by your report. For quarterly filing, make sure to choose the last month of the quarter (March, June, September, or December). Remember to only cut along the dotted line, avoiding any alterations to the string of numbers at the bottom.

What should I avoid when using the WT-6 voucher?

A few important things to remember: Do not print a blank voucher to fill out by hand as the bottom string of numbers will change with each entry. It is crucial not to make photocopies of the voucher for future periods since each report is specific to that tax period. Additionally, do not attach any correspondence or supporting documents to the submission and make sure to send your payment and the voucher to the correct address listed on the form.

Is the WT-6 voucher necessary for all filing frequencies?

No, the WT-6 voucher is not required for every filing frequency. If your filing frequency is annual, you must submit a Form WT-7 instead of the WT-6 when reporting your withheld taxes. For those who prefer to receive a confirmation number for their submission, it is recommended to use online platforms or telephone services provided by the Wisconsin Department of Revenue instead of employing the voucher.

What is the process if I need assistance with the WT-6 voucher?

If you encounter any difficulties or have questions regarding the completion of the WT-6 voucher, the Wisconsin Department of Revenue offers resources and support. Reach out to their customer service for guidance tailored to your specific predicament. It’s important to ensure that you understand the process fully, as accurate tax reporting is crucial for your business’s compliance with state laws.

Common mistakes

Filling out the Wisconsin WT-6 Withholding form can be straightforward, but there are common mistakes that individuals can easily make. One frequent error occurs when taxpayers forget to enter their 15-digit Wisconsin tax number. This number is crucial for proper identification and ensures that the payment is matched to the correct account. Without it, the form may be processed incorrectly, leading to potential delays or complications.

Another common mistake involves failing to indicate the correct filing frequency. Each employer is assigned a specific frequency, such as monthly or quarterly, and marking the wrong frequency can affect how the state processes the payment. It's essential to review the assignment carefully and select the correct option on the form.

People often overlook the importance of the period covered by the report. For those who file quarterly, it’s vital to select the last month of the quarter accurately. This oversight can lead to discrepancies in records, hampering the reconciliation process later on. Being mindful of the reporting period helps avoid such issues.

A somewhat less obvious error involves the handling of the voucher itself. The instructions clearly state: do not print a blank voucher and complete it by hand. This stipulation may be ignored, but handwritten entries can create confusion and misinterpretation by the processing staff. To prevent this, it's advisable to use the electronic version instead.

Cutting the voucher incorrectly is yet another mistake people make. The guidelines specify that you should only cut on the dotted line. If the string of numbers at the bottom is cut off, it can make it difficult for the Department of Revenue to process the form accurately.

Additionally, some individuals mistakenly think they can file a WT-6 voucher when their filing frequency is annual. In these cases, employers should file a Form WT-7 instead. Ignoring this distinction can lead to unnecessary complications and delays.

Finally, many people forget to check if they need a confirmation number. If this is needed, it is better to report and pay online or by telephone instead of filing the WT-6 voucher. It's easy to overlook this option, but it can save a lot of time and hassle down the road.

Documents used along the form

The Wisconsin WT-6 Withholding form is an essential document for employers who need to report income tax withheld from employee wages. Alongside this form, several other documents are often used to ensure compliance with state tax regulations. Below are some of these important forms and documents, each serving a unique purpose within the context of tax reporting and withholding.

- Form WT-7: This form is required for employers who file on an annual basis. It serves as a summary of the total withholding amounts from all employees for the entire year. Unlike the WT-6, which is used for periodic reporting, the WT-7 consolidates annual data.

- Form W-2: Employers must complete this form to report wages paid and taxes withheld for each employee. Employees receive a copy of the W-2 at the end of the year for their personal tax filings. The accuracy of this form is crucial for both the employer and employee.

- Form W-3: This is a transmittal form that accompanies W-2 submissions. Employers use the W-3 to provide a summary of the W-2s being submitted to the Social Security Administration, ensuring that accurate totals are recorded and matched with individual employee records.

- Form 941: Used by employers as a quarterly tax return to report income taxes withheld, as well as Social Security and Medicare taxes. This form is more comprehensive and touches on employer tax obligations beyond just state withholding.

- Form 1099: Although not directly linked to employee wages, this form is critical for reporting payments made to contractors. If an employer pays a contractor $600 or more, they must issue a Form 1099 to report these payments, ensuring appropriate tax withholding is addressed.

In sum, when completing the Wisconsin WT-6 Withholding form, it is important to be aware of these accompanying documents. Each form has specific purposes and requirements that contribute to the overall responsibility of tax compliance. Understanding and correctly utilizing these forms can help ensure a smoother tax filing process for both employers and employees.

Similar forms

- W-2 Form: This form reports wages paid to employees and taxes withheld. Like the WT-6, it is used for income tax purposes but is submitted annually instead of periodically.

- WT-7 Form: The WT-7 is an annual withholding income tax return used when employers do not have a WT-6 voucher to report. Employers submit it once a year, summarizing their withholding throughout the year.

- Form 941: This is the federal employer's quarterly tax return. Similar to the WT-6, it reports income taxes withheld, Social Security, and Medicare, but it is used at the federal level and requires quarterly submissions.

- Form 940: This year-end federal form reports unemployment taxes. While it focuses more on unemployment insurance contributions, it is another document reflecting income tax responsibilities involving employers.

- Schedule C: This form is used by sole proprietors to report income and expenses for their businesses. Like the WT-6, it is relevant for tax reporting, although it focuses on self-employment income instead of employee withholdings.

- Form 1099-MISC: This form reports income other than wages, salaries, or tips. While it serves a different purpose, it overlaps in that it involves reporting income and tax responsibilities for non-employee compensation.

Dos and Don'ts

When filling out the Wisconsin WT-6 Withholding form, it is important to follow specific guidelines to ensure accuracy and compliance. Here are some essential dos and don’ts:

- DO enter your 15-digit Wisconsin tax number correctly.

- DO fill in the year for which you are reporting.

- DO select the filing frequency assigned to you.

- DO specify the period covered by the report, using the last month of the quarter if filing quarterly.

- DON'T print a blank voucher to complete by hand.

- DON'T cut off the string of numbers at the bottom of the voucher.

- DON'T attach any correspondence to the voucher.

- DON'T make photocopies of the voucher for future reporting.

By adhering to these guidelines, you can ensure that the WT-6 form is filled out correctly and submitted appropriately.

Misconceptions

There are several misconceptions surrounding the Wisconsin WT-6 Withholding form. Understanding these misunderstandings can help employers navigate their tax obligations more effectively. Below is a list of common myths and the truths behind them.

- Myth 1: You can use a blank WT-6 voucher and fill it in by hand.

- Truth: You should not print a blank voucher to complete by hand. Only use the pre-printed version, as the bottom string of numbers will change as you key them.

- Myth 2: The WT-6 voucher is required for annual filings.

- Truth: No WT-6 voucher is required for annual filings. Instead, you should file a Form WT-7.

- Myth 3: All employers need to use the WT-6 voucher regardless of their filing frequency.

- Truth: The WT-6 is only required for employers with an electronic filing waiver and for specific filing frequencies. Make sure to know your assigned frequency.

- Myth 4: You should send additional correspondence with your WT-6 voucher.

- Truth: Do not attach any correspondence to the voucher. Only send the payment and the voucher itself.

- Myth 5: You can make photocopies of the WT-6 voucher for use in future periods.

- Truth: Each voucher is period-specific. Never use a photocopy of a WT-6 voucher for future filings.

- Myth 6: Cutting off the bottom string of numbers is allowed for clarity.

- Truth: You must not cut off the string of numbers at the bottom of the voucher. Cut only on the dotted line.

- Myth 7: You automatically receive a confirmation number when using the WT-6 voucher.

- Truth: If you seek a confirmation number, you should report and pay online or by telephone instead of using the WT-6 voucher.

- Myth 8: There are no specific requirements for filling out the WT-6 voucher.

- Truth: You have to carefully enter your 15-digit Wisconsin tax number, fill in the year, and select your assigned filing frequency.

- Myth 9: The WT-6 form is only for state income tax withholding.

- Truth: The WT-6 is specifically designed for reporting income tax withheld from wages paid to employees, so it is essential for compliance with state tax obligations.

By debunking these myths, employers can better understand their responsibilities regarding the Wisconsin WT-6 Withholding form and ensure compliance with state regulations.

Key takeaways

Here are key takeaways for effectively using the Wisconsin WT-6 Withholding form:

- The WT-6 form is designed for employers who have an electronic filing waiver approved by the Wisconsin Department of Revenue.

- Ensure to enter your 15-digit Wisconsin tax number. If you do not have it, you can look it up on the Department of Revenue's website.

- Fill in the appropriate tax year for the report.

- Select the correct filing frequency assigned to your business. This could be annually, quarterly, or monthly.

- When filling out the form, ensure to specify the period covered by the report. For quarterly filings, choose the last month of the quarter (March, June, September, December).

- It is imperative not to print a blank voucher and fill it out by hand. The voucher is uniquely generated to contain a specific string of numbers.

- Only cut along the dotted line and do not remove the string of numbers from the bottom of the voucher.

- Mail the payment along with the completed voucher to the address indicated on the form.

- Do not attach any correspondence or make photocopies of the voucher for future use; each report must be period-specific.

- For annual filing frequencies, you do not need a WT-6 voucher. Instead, file a Form WT-7.

These guidelines help streamline the process of reporting and ensure compliance with Wisconsin's tax regulations.

Browse Other Templates

How to Do Invoice - Simplifies the process of invoicing and client approval.

Va Form 21p-4718a - The form expires on December 31, 2024, and may require updates thereafter.

How to Take Ged - Document your enrollment in a high school program if required.