Fill Out Your Worksheet Form

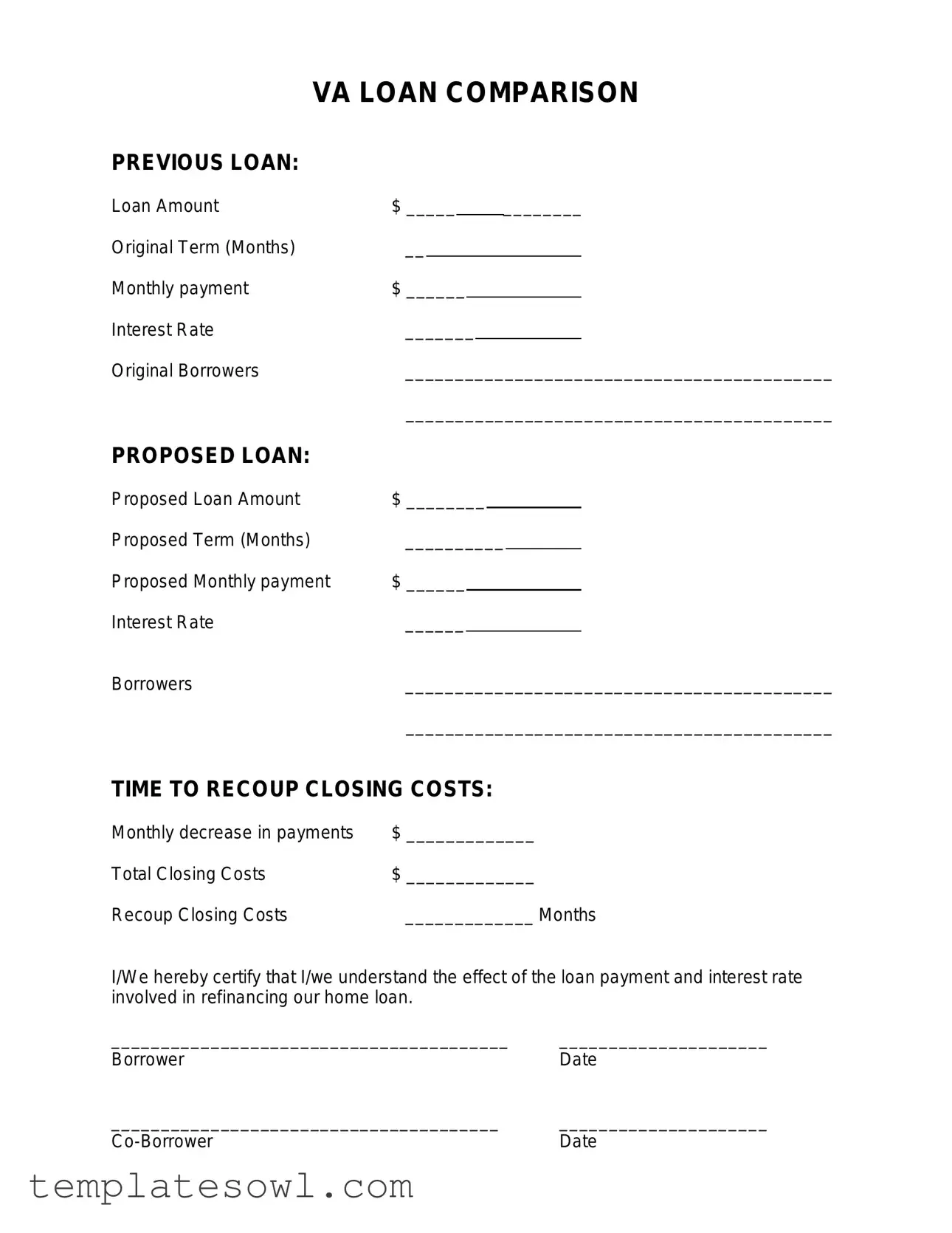

The Worksheet form serves as a vital tool in the realm of home financing, particularly when comparing existing and proposed VA loans. It includes essential information related to previous and proposed loans, such as loan amounts, terms, monthly payments, and interest rates. The design of the form allows borrowers to outline their original loan details and juxtapose them with the new financing options they are considering. This side-by-side comparison facilitates a clearer understanding of the financial implications of refinancing. Furthermore, the Worksheet features a section dedicated to assessing the time required to recoup closing costs, giving borrowers insight into potential savings. By calculating the monthly decrease in payments and total closing costs, individuals can evaluate how long it will take before they start benefiting financially from the refinancing process. This certification section at the end underscores the importance of borrower comprehension regarding the implications of their loan decisions, ensuring that informed choices can lead to better financial outcomes.

Worksheet Example

VA LOAN COMPARISON

PREVIOUS LOAN:

Loan Amount |

$ _____ |

|

|

|

|

________ |

||

Original Term (Months) |

__ |

|

|

|

|

|

|

|

Monthly payment |

$ ______ |

|

|

|

|

|

||

Interest Rate |

_______ |

|

|

|

|

|||

Original Borrowers |

___________________________________________ |

|||||||

|

___________________________________________ |

|||||||

PROPOSED LOAN: |

|

|

|

|

|

|

|

|

Proposed Loan Amount |

$ ________ |

|

|

|

||||

Proposed Term (Months) |

__________ |

|

|

|||||

Proposed Monthly payment |

$ ______ |

|

|

|

|

|

||

Interest Rate |

______ |

|

|

|

|

|

||

Borrowers |

___________________________________________ |

|||||||

|

___________________________________________ |

|||||||

TIME TO RECOUP CLOSING COSTS:

Monthly decrease in payments |

$ _____________ |

Total Closing Costs |

$ _____________ |

Recoup Closing Costs |

_____________ Months |

I/We hereby certify that I/we understand the effect of the loan payment and interest rate involved in refinancing our home loan.

________________________________________ |

_____________________ |

Borrower |

Date |

_______________________________________ |

_____________________ |

Date |

Form Characteristics

| Fact Name | Description |

|---|---|

| Loan Amount | The form requires you to specify the amount of the previous and proposed loans, indicating the principal amount you wish to finance. |

| Original Term | You must indicate the duration of the previous loan in months. This information helps in determining the remaining time of repayment. |

| Monthly Payment | The form asks for the previous and proposed monthly payments. This is essential for comparing current and new financial obligations. |

| Interest Rate | You need to provide the interest rates of both the previous and the proposed loans. This helps in calculating the total cost of the loan over its lifetime. |

| Borrower Information | Both the original and proposed borrowers must be identified. This ensures that all parties are aware of and agree to the refinancing terms. |

| Time to Recoup Closing Costs | The form includes calculations for the decrease in monthly payments and total closing costs, helping to visualize when the savings begin. |

| Certification | The borrowers must sign and date the form, confirming their understanding of the loan's implications. This is crucial for legal accountability. |

| Governing Laws | Each state may have different regulations governing loan refinancing. In Virginia, for example, the relevant law can be found under the Virginia Code Section 6.2-1700. |

Guidelines on Utilizing Worksheet

Completing the Worksheet form is an important step in the loan comparison process. This form allows you to compare your previous loan with the proposed loan. Take your time while filling it out to ensure all information is accurate. Follow the steps below to complete the form effectively.

- Locate the section titled PREVIOUS LOAN.

- In the first blank, write the loan amount of your previous loan in dollars.

- Next, enter the original term of the loan in months.

- Then, provide the monthly payment amount for the previous loan.

- Fill in the interest rate of the previous loan.

- List the names of the original borrowers in the space provided.

- Move to the section labeled PROPOSED LOAN.

- Write the proposed loan amount in dollars.

- Enter the proposed term of the loan in months.

- Fill in the proposed monthly payment amount.

- Provide the interest rate for the proposed loan.

- List the names of the proposed borrowers in the space indicated.

- Now, find the section TIME TO RECOUP CLOSING COSTS.

- Indicate the monthly decrease in payments, if applicable.

- Fill in the total closing costs associated with the new loan.

- Calculate and provide the number of months it will take to recoup closing costs.

- Lastly, sign and date the certification section at the bottom of the form as both the borrower and co-borrower, if applicable.

What You Should Know About This Form

What is the purpose of the Worksheet form?

The Worksheet form is designed to help individuals evaluate the financial implications of refinancing their home loan. By filling out this form, borrowers can compare their current loan details with those of a proposed loan. This includes analyzing loan amounts, terms, monthly payments, and interest rates, which ultimately assists them in making informed decisions about refinancing.

What information do I need to provide for my previous loan?

To complete the Worksheet for your previous loan, you will need to provide details such as the loan amount, original term in months, monthly payment, interest rate, and the names of the original borrowers. This information serves as a baseline for comparison with the proposed loan, helping to clarify your current financial situation.

What should I include when describing the proposed loan?

When outlining the proposed loan, you will include the proposed loan amount, term in months, proposed monthly payment, interest rate, and the names of the new borrowers if applicable. It’s important to ensure that these figures are as accurate as possible, as they will directly impact your comparison analysis.

How can I calculate the time to recoup closing costs?

The time to recoup closing costs can be determined by taking the monthly decrease in payments and dividing it into the total closing costs. The Worksheet form provides spaces for you to input these figures. By doing this calculation, borrowers can understand how long it will take them to recover any costs associated with refinancing their home loan.

What does the certification statement at the end of the Worksheet mean?

The certification statement at the bottom of the Worksheet is an acknowledgment by the borrowers that they understand the implications of the loan payment and interest rate involved in their refinancing decision. By signing and dating this section, borrowers agree that they have reviewed the information and are aware of the financial consequences of their refinancing choice.

Is it necessary to complete this Worksheet before refinancing?

While it is not legally required to complete this Worksheet before refinancing, it is highly recommended. This tool aids in assessing the pros and cons of the refinancing process, allowing borrowers to make educated decisions based on their financial circumstances. Taking the time to fill out the Worksheet can ultimately lead to better financial outcomes.

Common mistakes

Filling out a Worksheet form for a VA loan comparison can be a straightforward process, but there are common mistakes that individuals often make. Each detail matters, as inaccuracies may lead to significant complications in securing favorable loan terms. Understanding these pitfalls is essential for a smooth application experience.

One of the primary mistakes is **failing to complete all required fields**. The form asks for specific information, such as loan amounts and monthly payments. Omitting this information can hinder the entire process, making it crucial to double-check that no spaces remain blank.

Another common error involves the entry of **incorrect figures**. When entering the loan amount or interest rate, even a single misplaced digit can change the calculations dramatically. It is advisable to take a moment to verify each entry to ensure that all numbers are accurate and reflect the intended figures.

People often neglect to **clearly distinguish between the previous and proposed loans**. The form requires a comparison, but some users may mix the details, leading to confusion about the current versus the new loan terms. Clarity in this section helps create a better understanding of the benefits of refinancing.

Some applicants fail to **consider the total closing costs** accurately. This figure is essential in understanding the overall expenses associated with refinancing. A hasty calculation can result in overlooking significant costs, which might affect the decision to proceed with the loan.

Another mistake concerns the **monthly decrease in payments** section. Sometimes, individuals might skip this calculation or misinterpret how to assess potential savings. Knowing exactly how much the monthly payments will decrease is vital to weighing the benefits of refinancing.

Additionally, individuals may forget to **calculate the time required to recoup closing costs** accurately. This essential figure informs applicants how long it will take to regain their investment from the refinance. Failing to estimate this period can lead to unexpected financial pressure down the line.

People also commonly misinterpret the significance of the **certification statement** at the bottom of the form. It is crucial to recognize that signing this statement indicates understanding the implications of the refinancing terms. Therefore, rushing to sign without comprehension can lead to regret later.

Finally, signatures and dates are sometimes **omitted**. The form requires the borrower and co-borrower to certify their information with their signatures and the appropriate date. Both are necessary for the form's validity, and both parties must ensure that they fulfill this requirement.

Avoiding these mistakes can streamline the VA loan comparison process and ensure that the information is both accurate and complete. Each step taken to minimize errors will contribute positively to the refinancing experience.

Documents used along the form

When considering a VA loan or any refinancing effort, it's important to gather several other documents to support your application and decision process. Here’s a list of common forms that are often used alongside the Worksheet form, providing essential details and facilitating a clearer understanding of your financial situation.

- Loan Estimate: This document provides a detailed breakdown of the estimated interest rate, monthly payment, and closing costs. It helps borrowers compare different loan offers effectively.

- Closing Disclosure: Issued before finalizing a loan, this form outlines the final terms of the mortgage. It includes the loan amount, interest rate, and all closing costs required for the transaction.

- Credit Report: Lenders will review your credit history to assess the risk of lending to you. A credit report summarizes your credit accounts, payment history, and any outstanding debts.

- Income Verification: This document proves your earnings, typically in the form of pay stubs, tax returns, or bank statements. Lenders need this to evaluate your ability to repay the loan.

- Employment Verification: A lender may request this to confirm your employment status and income. It usually involves a direct check with your employer.

- Debt-to-Income Ratio (DTI) Calculation: This calculation helps lenders evaluate your financial health by comparing your monthly debt payments to your gross monthly income.

- Property Appraisal: Conducted by a licensed appraiser, this document assesses the market value of the property, ensuring that the loan amount aligns with the property's worth.

- Loan Application: Often required, this form gathers personal and financial information, helping lenders understand your background and assess your eligibility for the loan.

- Proof of Homeowners Insurance: Many lenders require proof of homeowners insurance to safeguard their investment. This document shows that the property is insured against potential damages.

Having these documents organized and ready can streamline the loan process, making it more efficient. Understanding each document’s role will empower you to make informed decisions about refinancing your home loan.

Similar forms

The Worksheet form is often utilized in real estate transactions, particularly when dealing with loans. It shares similarities with several other financial documents. Below is a list of seven documents that echo the structure and intent of the Worksheet form, each with its specific traits.

- Loan Estimate: This document provides details about the estimated costs associated with a mortgage. Like the Worksheet form, it outlines the loan amount, monthly payment, and terms but provides additional clarity about fees and closing costs.

- Closing Disclosure: Issued before the finalization of a mortgage, this document summarizes the actual terms and costs of the loan. Similar to the Worksheet, it includes information on lender and borrower details, including the loan amount and interest rate.

- Debt-to-Income Ratio Analysis: This analysis helps lenders evaluate a borrower’s financial health. Both documents address monthly payments and might indicate what the borrower can afford, affecting their financial decisions.

- Budget Worksheet: This personal finance tool assists individuals in tracking income and expenses. Like the Worksheet form, it emphasizes understanding financial obligations, including loan payments.

- Credit Report Summary: This document outlines an individual's creditworthiness. Both the Credit Report Summary and the Worksheet form assess financial responsibility, focusing on loan repayment ability.

- Final Loan Application: The loan application requires detailed information about the borrower. Similar to the Worksheet form, it gathers information about loan amounts and borrower details before approval.

- Refinancing Analysis Report: This report evaluates the benefits of refinancing an existing loan. Like the Worksheet form, it focuses on the differences in loan amounts and payments, guiding borrowers to make informed decisions.

Each of these documents plays a significant role in the loan process, providing clarity and helping individuals navigate their financial landscapes more effectively.

Dos and Don'ts

When filling out the Worksheet form for a VA loan comparison, it’s essential to be thorough and accurate. Here are five important dos and don’ts to ensure you complete the form effectively.

- Do double-check all entered figures for accuracy.

- Do provide complete information for each borrower to avoid delays.

- Do clearly write in the provided spaces to enhance readability.

- Do review the terms and conditions carefully before signing.

- Do keep a copy of the completed form for your records.

- Don’t leave any fields blank unless instructed; missing information can complicate processing.

- Don’t use abbreviations or shorthand that may be unclear.

- Don’t rush through the form; take your time to understand each section.

- Don’t overlook the importance of the recoup time for closing costs.

- Don’t forget to sign and date the form where indicated.

Misconceptions

Misconceptions about the Worksheet form can lead to confusion and mismanagement of important loan details. Here are four common misunderstandings:

- The form is only for first-time homebuyers. Many believe the Worksheet form is exclusively for those purchasing their first home. In reality, it is beneficial for anyone looking to refinance an existing loan or compare different loan options.

- All fields must be completed to be valid. Some people think that every section of the Worksheet must be filled out for it to have utility. While providing information is helpful, the form can still serve its purpose if some fields are left blank, particularly if they are not relevant to the situation.

- The closing costs are always the same. There is a misconception that the total closing costs will not vary between lenders or loans. However, closing costs can differ significantly based on the lender's policies and the specific terms of the loan being considered.

- The recoup period guarantees savings. Some assume that a shorter recoup period for closing costs equates to overall savings in the long run. This is not always true. A thorough analysis should consider various factors, including loan terms and future interest rates, before concluding potential savings.

Key takeaways

Here are five key takeaways for filling out and using the Worksheet form:

- Accuracy is Crucial: Make sure to fill in all the amounts correctly. Errors can lead to confusion when comparing loans.

- Understand Your Existing Loan: Before entering details about the proposed loan, take a moment to summarize your previous loan. This includes the loan amount, terms, payment, and interest rate.

- Proposed Loan Details: Clearly outline the proposed loan’s amount, term, monthly payment, and interest rate. This information is vital for accurate comparisons.

- Calculate Closing Costs: Be aware of total closing costs and calculate the time it will take to recoup these costs. This will help you determine if refinancing is a good option.

- Certification: Both the borrower and co-borrower need to sign and date the form. This confirms that you understand the refinancing implications.

Browse Other Templates

Course Registration Form - Specify if you are a Cornell employee or an EDP participant for the summer or winter sessions.

New Jersey Lemon Law Used Car - Ensure that your signature is included as a testament to the accuracy of your claims.