Fill Out Your World Bank St Payment Request Form

The World Bank Short-Term Payment Request Form serves a crucial purpose for consultants and temporaries engaged in various projects globally. This online form is specifically designed for short-term consultants (STCs) and short-term temporaries (STTs) to streamline their payment requests. By utilizing this system, users can easily submit their requests, ensuring a more efficient payment process. The form offers several benefits, including automated payment entry and approval, real-time tracking of payment statuses, and enhanced security features through a confidential passkey system. Before using the form, users must meet certain prerequisites such as providing precise bank account details and an active email account. Moreover, understanding the payment process is essential, which involves multiple steps including the issuance of a Letter of Appointment, submission of payment requests, and necessary approvals by relevant authorities. Key policies governing short-term appointments outline the conditions under which individuals may work, the limits on working days, and the procedures for handling payments and advance fees. This article will explore the complete landscape surrounding the ST Payment Request Form, detailing its components and guiding users through the payment process with clarity and comprehensiveness.

World Bank St Payment Request Example

S T Payment

S T Payment

Contents

A primer for

Overview of the Payment Request Form for |

2 |

What is the Payment Request Form? |

2 |

What are the benefits of using ST Request? |

2 |

What are the prerequisites for using ST Request? |

2 |

What is the payment process for consultants or temporaries? |

3 |

What are the key policies on |

3 |

Access |

5 |

Activate Your PassKey |

5 |

Log on to ST Payment |

6 |

ST Request Home: Current Assignments |

7 |

View Mailing Address and Bank Account Details |

8 |

Select a Task to Enter Time |

9 |

Resubmit a Rejected Payment Request (if applicable) |

12 |

Payment Request Form |

13 |

Review Project Details |

14 |

Complete a Payment Request |

15 |

Submit Overtime (for Temporaries Only) |

18 |

S

T Payment

Payment

For Official Use Only

Overview of the Payment Request Form for

What is the Payment Request Form?

The Payment Request Form is available on the ST Request site (http://strequest.worldbank.org). This form allows short term consultants and temporaries (STCs/STTs) to enter and submit their payment requests online.

In countries where web access is limited (for example, remote areas or fragile states), Form 2370 or Request for Payment (RFP) will continue to be accepted. Approval of the task team leader (TTL)/ reviewer is required. The administrative contact then creates a service entry sheet (SES) in SAP. The SES is automatically routed to the approving manager.

In countries where web access is limited (for example, remote areas or fragile states), Form 2370 or Request for Payment (RFP) will continue to be accepted. Approval of the task team leader (TTL)/ reviewer is required. The administrative contact then creates a service entry sheet (SES) in SAP. The SES is automatically routed to the approving manager.

What are the benefits of using ST Request?

•Streamlines the payment process by automating payment request entry and approval.

•Provides online tracking of payment status.

•Maintains confidentiality through a secure passkey, whether you are accessing ST Request outside of headquarters or country offices.

•Provides automatic validation of available days or hours of the STC/STT’s commitment noted against a purchase order and source of funding. This feature is particularly helpful when an STC/STT is working on multiple projects.

•Displays submitted payment requests, enabling you to filter by project and duration.

What are the prerequisites for using ST Request?

Bank Account |

|

Email Account |

|

|

|

Submit accurate and complete bank account details to the administrative contact.

•Full name and street address of bank branch

•Bank account number and/or IBAN number (for certain banks outside the United States)

•For banks in the United States: ABA or routing number

•For banks outside the United States: Bank routing number or SWIFT code

*International Bank Account Number

**Routing information is not required for Bank Fund Staff Federal Credit Union (BFSFCU) account holders.

•Submit only one personal

•If the hiring unit activates a Lotus Notes account, then this account overrides the personal

Payment updates are sent by

2 |

|

Updated April 3, 2012 |

|

S

T Payment

Payment

For Official Use Only

What is the payment process for consultants or temporaries?

By

In ST Payment

In SAP

1

Issue Letter of Appointment (LOA)

Human Resources Service Center (HRSSC) or Country Office HR Administrator or Officer

•Specify the terms and conditions of employment.

•Trigger the creation of accounts (for example, UPI, PassKey, Lotus Notes) through the hiring unit. A passkey is required to access select World Bank Group websites.

•Provide the contract details to access ST Request online.

2

Complete and Submit Payment Request

Consultant or Temporary

•Ensure LOA is signed and submitted. This is a one- time verification at the start of a contract.

•Enter payment request for specific task. Describe services rendered and deliverables.

•Validate bank account information.

•Track submitted payment requests.

3

Approve or Reject Payment Request

Task Team Leader (TTL)/ Reviewer

•Review payment request with corresponding deliverables.

•Enter comments for rejected payment requests.

•Reassign payment requests to alternate TTL/reviewer (if applicable).

4

Approve or Reject Payment

Manager

•Review SES in SAP. An SES is automatically created when the TTL/reviewer approves the payment request.

•Approve or reject payment.

What are the key policies on

1.Appointment Status – As an STC/STT, you hold a staff appointment. Consequently, you cannot be hired through a firm.

2.Allowed Number of Days – The maximum number of days you can work in a given fiscal year (FY) depends on your appointment type with the World Bank Group. The fiscal year for the Bank Group begins on July 1 and ends on June 30 of the following year. For additional information, consult the TTL or refer to your LOA.

3.Start Date – You can begin work on or after the start date in the contract and only after HR has received the signed letter of appointment issued to you. Failure to comply with this policy exposes both the Bank Group and the STC/STT to serious insurance and liability issues.

Payments cannot be processed for any work done before the start date in the contract.

Payments cannot be processed for any work done before the start date in the contract.

3 |

|

Updated April 3, 2012 |

|

S

T Payment

Payment

For Official Use Only

4.Payment

(a)Access – Your access to the ST Request site is limited to your contract end date.

For example, if your contract ends by June 30, you must submit your timesheet on or before June 30. Your access to ST Request will automatically be revoked on July 1, and you will no longer be able to enter your timesheet.

(b)Direct Deposit – Payments are made to a commercial bank account or a Credit Union account.

Submit your bank account information to the administrative contact assigned to your contract. This information is mandatory for HQ consultants and temporaries.

Exception: Local consultants in the country office, who may not have access to direct deposit, can call or send an

(c)Advance Fees – You can request for advance payment of fees to cover travel subsistence costs and services beyond June 30. These advance payments must be charged to the current fiscal year and are considered on a

Call or send an

(d)Record keeping – Keep a record of your time against each project, particularly if you are working on multiple assignments.

5.Overtime for Temporaries

•Secure authorization in advance from your approving manager.

•Verify the specific purchase order and line item for charging overtime with the administrative contact.

4 |

|

Updated April 3, 2012 |

|

S

T Payment

Payment

For Official Use Only

Access

Activate Your PassKey

For security reasons, the ST Payment system is passkey protected. Follow these steps to activate your passkey:

1.Go to http://strequest.worldbank.org.

2.On the Sign In page, click Forgot/Request Password.

3.Enter the

4.Enter the characters displayed for Registration Verification.

5.Click Submit. You will receive an

Reset your password immediately for security reasons.

Reset your password immediately for security reasons.

For Additional Assistance

•For IBRD/MIGA, call ISG Global Support Center at (202)

•For IFC, call the IFC Helpdesk at (202)

Service centers Service centers are available 24 hours a day, 7 days a week.

•A series of

•A UPI is necessary to activate the account.

The PassKey site automatically:

The PassKey site automatically:

•locks you out after you type the incorrect password five times successively.

•times out if you are inactive for more than one hour.

Access to the ST Payment system is tied to the start and end dates of your contract.

Access to the ST Payment system is tied to the start and end dates of your contract.

5 |

|

Updated April 3, 2012 |

|

S

T Payment

Payment

For Official Use Only

Log on to ST Payment

The user profile determines the type of access and actions you can perform in the ST Payment system.

•Access is confined to active projects in the current fiscal year.

•Each profile (for example, consultants/temporaries, task team leader/reviewer, or administrative contact) has a unique site to carry out specific actions.

Consultants and Temporaries

Can perform these tasks online:

•Verify mailing address and bank account

•Review project details

•Complete a payment request

•Attach a deliverable

•Submit overtime (for temporaries only)

•Display a submitted payment request

For

Access is tied to the start and end dates of your contract.

Access is tied to the start and end dates of your contract.

Task Team Leaders (TTLs) or Reviewers

Can perform these tasks online:

•Review project details

•Approve or reject a payment request

•Download a deliverable

•Reassign TTL

•Display a submitted payment request

Administrative Contacts

•Can view submitted payment requests and track status for monitoring purposes

•Can reassign TTL when the primary TTL is unavailable

To log on as a consultant or temporary using:

•The intranet within the Bank, IFC, or MIGA offices, go to http://strequest.

•External access* (from any PC or Macintosh with internet access that is not on the Bank’s network), go to http://strequest.worldbank.org.

*Requires a passkey. If you encounter any errors, contact the service center for assistance.

To log on as a TTL/reviewer using the intranet within the Bank, IFC, or MIGA offices, go to http://stapprove.

To log on and view timesheets using the intranet within the Bank, IFC, or MIGA offices, go to http://stapprove.

6 |

|

Updated April 3, 2012 |

|

S T Payment

Payment

Quick Reference Guide for Consultants and Temporaries

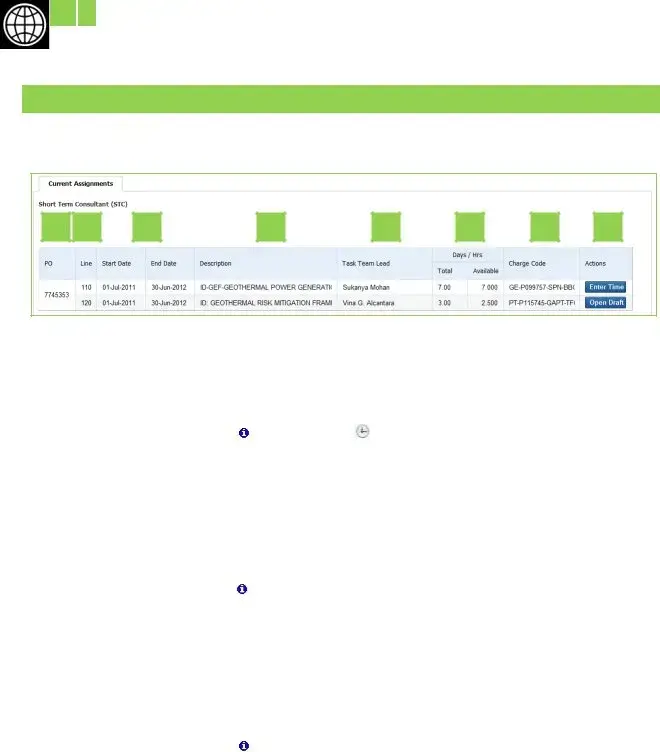

ST Request Home: Current Assignments

1 |

For Official Use Only

2 |

3 |

4 |

|

Contents |

1 |

View Mailing Address and Bank Account Details |

2 |

Select Task to Enter Time |

3 |

Display a Submitted Payment Request |

4Resubmit a Rejected Payment Request (if applicable)

7 |

|

Updated April 3, 2012 |

|

S

T Payment

Payment

For Official Use Only

Profile

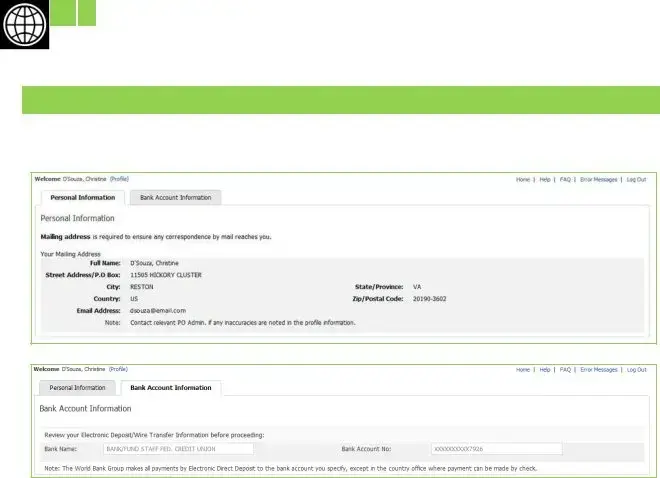

View Mailing Address and Bank Account Details

1.Click Profile to the right of your name on the home page.

2.Review the mailing address and bank information on the relevant tabs. Bank information is mandatory for HQ consultants and temporaries.

For security reasons, the last four digits of your Bank Account No. are displayed.

For security reasons, the last four digits of your Bank Account No. are displayed.

To update your records, send an

•Full name and street address of bank branch

•Bank account number and/or IBAN* number (for certain banks outside the United States)

•For banks in the United States – ABA or routing number**

•For banks outside the United States – Bank routing number or SWIFT code

*International Bank Account Number

**Routing information is not required for Bank Fund Staff Federal Credit Union (BFSFCU) account holders.

8 |

|

Updated April 3, 2012 |

|

S

T Payment

Payment

For Official Use Only

Current Assignments Section

Select a Task to Enter Time

A |

B |

C |

D |

E |

F |

G |

H |

|

Label |

|

|

Field |

Description |

|

|

|

|

|

A purchase order (PO) number is generated in SAP*. A PO is a legal |

|

|

|

|

|

document specifying the type of services, conditions, |

|

A |

|

|

PO |

predetermined rate, and delivery dates. |

|

|

|

|

||

|

|

|

|

|

An Overtime icon displays next to the PO number for pre- |

|

|

|

|

|

authorized overtime. This applies only to temporaries. |

|

|

|

|

|

|

|

B |

|

|

Line |

PO line item number in SAP* |

|

C |

|

|

Start Date and |

Duration of each task or PO line item |

|

|

|

End Date |

||

|

|

|

|

|

|

|

D |

|

|

Description |

Brief description of the assignment(s) or task(s) to be performed |

|

|

|

|

|

|

|

|

|

|

|

Designated approver of your payment request and deliverables (if |

|

|

|

|

|

any) in ST Payment. |

|

E |

|

|

Task Team Lead |

|

|

|

|

|

|

Note that manager approval in SAP is still required for payment |

|

|

|

|

|

to be processed. |

|

|

|

|

|

The number of days or hours depends on the terms of your |

|

|

|

|

|

contract. |

|

F |

|

|

Days/Hrs |

• Total hours or days allocated for each task or PO line item. |

|

|

|

|

|

• Available balance is the maximum number of hours or days |

|

|

|

|

|

that can be claimed against the task or PO line item. |

|

|

|

|

|

|

|

|

|

|

|

Indicates how the PO is funded or where services are charged. |

|

G |

|

|

Charge Code |

A PO may be broken down into various line items charged |

|

|

|

|

|

|

|

|

|

|

|

against different charge codes. |

|

|

|

|

|

|

|

|

|

|

|

• Enter Time – to enter timesheet details |

|

H |

|

|

Actions |

• Open Draft – to modify details in a timesheet that was saved as |

|

|

|

|

|

draft |

*SAP is the financial and accounting system used by the World Bank Group.

9 |

|

Updated April 3, 2012 |

|

S

T Payment

Payment

For Official Use Only

1.Review the fields under Current Assignments to ensure that you enter time against the correct task for the current fiscal year.

For additional information, check with the administrative contact listed in your Letter of Appointment.

For additional information, check with the administrative contact listed in your Letter of Appointment.

2.Click Enter Time or Open Draft against the relevant task under the Actions column. The Payment Request Form displays.

Submitted Timesheets Section

A |

B |

C

D |

E |

F |

G |

H |

I |

J |

Display a Submitted Payment Request

|

Label |

Field |

|

Description |

|

A |

PR Number |

|

A payment request (PR) number is generated when the consultant |

|

|

or temporary submits the request. |

||

|

|

|

|

|

|

|

|

|

A purchase order (PO) number is generated in SAP*. A PO is a legal |

|

|

|

|

document specifying the type of services, conditions, |

|

B |

PO Number |

|

predetermined rate, and delivery dates. |

|

|

|

||

|

|

|

|

An Overtime icon displays next to the PO number for pre- |

|

|

|

|

authorized overtime. This applies only to temporaries. |

|

|

|

|

|

|

C |

Line |

|

PO line item number in SAP* |

|

|

|

|

|

|

D |

Description |

|

Brief description of the assignment(s) or task(s) to be performed |

|

|

|

|

• From and To indicate the period specified in the payment |

|

E |

Date |

|

request for the completed work. |

|

|

• Submitted is the date when the payment request is sent for TTL |

||

|

|

|

|

|

|

|

|

|

approval. |

|

|

|

|

|

|

F |

Claimed Qty |

|

Number of days or hours claimed against a task or PO line item |

|

|

|

|

|

|

G |

Payment Amt |

|

Automatically displays the amount based on the Claimed Quantity |

|

|

multiplied by the rate |

||

|

|

|

|

|

|

|

|

|

|

10 |

|

Updated April 3, 2012 |

|

Form Characteristics

| Fact Name | Description |

|---|---|

| What is the Payment Request Form? | The Payment Request Form is an online tool available on the ST Request site that allows short-term consultants and temporaries to submit their payment requests easily. It streamlines the process, making it more efficient. |

| Benefits of Using ST Request | Utilizing ST Request helps automate payment request entries, allows online tracking of payment status, and ensures confidentiality through a secure passkey. Users can also filter submitted requests by project and duration, which aids in managing multiple assignments. |

| Payment Process Overview | The payment process involves issuing a Letter of Appointment, submitting a payment request, and obtaining approval from the Task Team Leader or Manager. Each of these steps must be followed to successfully process payment requests. |

| Prerequisites for ST Request | Users must provide accurate bank account details and a personal email address. Specific banking information like routing numbers and IBANs is needed to facilitate payments. Failure to provide this information can delay payment processing. |

Guidelines on Utilizing World Bank St Payment Request

After gathering all necessary information, you can begin filling out the World Bank Short-Term Payment Request form. Follow the steps below carefully to ensure a smooth submission process.

- Go to the ST Request website: http://strequest.worldbank.org.

- Activate your passkey if you haven't done so already by clicking "Forgot/Request Password" and following the prompts.

- Log on to the ST Payment system using your passkey.

- Access your current assignments on the ST Request home page.

- Review your mailing address and bank account details for accuracy.

- Select the appropriate task for which you want to enter time.

- Enter your payment request, detailing the services rendered and deliverables achieved.

- Validate your bank account information is complete and correct.

- Track the status of your submitted payment requests in the system.

- If needed, resubmit any rejected payment requests as per the feedback provided.

- Submit your request and keep a copy for your records.

After submission, you will receive updates via email regarding your payment request status, including any approvals or rejections made by the Task Team Leader or reviewer.

What You Should Know About This Form

What is the Payment Request Form?

The Payment Request Form is an online tool available on the ST Request site, specifically designed for short-term consultants and temporaries (STCs/STTs). This form allows users to enter and submit payment requests conveniently. In areas with limited web access, a paper version (Form 2370) may still be used, but it requires the approval of the task team leader (TTL). Once approved, the administrative contact creates a service entry sheet (SES) in SAP, which is then routed for final approval.

What are the benefits of using ST Request?

Using ST Request offers several advantages. Firstly, it streamlines the payment process by allowing online entry and approval of payment requests, which reduces delays. Secondly, it provides real-time tracking of payment status, giving users clear insight into where their request stands. Additionally, the system maintains confidentiality using a secure passkey, whether accessed remotely or from country offices. It also automates the validation of available work hours or days, a useful feature for those working on multiple projects. Lastly, users can view and filter their submitted payment requests by project and duration.

What are the prerequisites for using ST Request?

To use ST Request effectively, users must meet certain requirements. Firstly, they need to provide complete and accurate bank account details to their administrative contact. This includes the full name and address of the bank branch, bank account number or IBAN (for non-U.S. banks), and the appropriate routing information for U.S. banks. Users should also have a single personal email address submitted for updates and notifications regarding their payment requests. If a Lotus Notes account is activated by the hiring unit, it will replace the personal email account for communication purposes.

What is the payment process for consultants or temporaries?

The payment process involves several steps. Initially, the Human Resources Service Center issues a Letter of Appointment (LOA) to the consultant or temporary worker, outlining employment terms. After the LOA is signed, the worker submits a payment request detailing their services and deliverables. The TTL reviews the request, provides comments if necessary, and then the request is reviewed by a payment manager who ultimately approves or rejects the payment based on the details in SAP.

What are the key policies on short-term appointments?

Short-term consultants and temporaries hold staff appointments, meaning they cannot be hired through a firm. Each appointment has a limit on the maximum number of working days per fiscal year, which runs from July 1 to June 30. The work must start only after the LOA is signed, as any work before the official start date will not be compensated. Access to ST Request is temporary and based on the contract timeline, ending when the contract itself does.

How can I activate my PassKey for accessing the ST Payment system?

To activate your PassKey, visit the ST Request website and click on “Forgot/Request Password.” Enter the email associated with your account and complete the registration verification challenge. Once submitted, you will receive an email with a temporary passkey and further instructions. It is crucial to reset your password after logging in for enhanced security. This step ensures that only authorized users have access to their payment information.

Common mistakes

Filling out the World Bank Short-Term Payment Request form can be a daunting task. Many individuals inadvertently make mistakes that can delay their payment. Here are nine common pitfalls to avoid.

First, incomplete bank account details are a frequent error. It’s crucial to provide accurate and complete information about your bank account. Missing details, such as the routing number or the bank account number, can hinder the payment process. Double-check this information before submitting the form.

Secondly, many people forget to review their project details carefully. This step is essential, as discrepancies between the submitted claim and the actual work performed can lead to rejections. Always ensure that the project information is correctly matched with the deliverables you provided.

Another common mistake is not validating email information. The email address you submit must be correct and actively monitored since updates about your payment status will be sent to it. Miscommunication can lead to serious delays.

Some individuals fail to activate their PassKey before attempting to log in. This critical security measure must be addressed first to access the ST Payment system. An activated PassKey ensures that your account remains secure while allowing you to manage your payment requests efficiently.

In addition, many candidates neglect to track the submitted payment requests. Once a request is submitted, it’s essential to keep track of its status. Regularly checking helps you to respond promptly if any issues arise, particularly if your request is rejected.

Furthermore, a significant oversight is failing to submit a signed Letter of Appointment (LOA) along with the request. This verification is mandatory at the beginning of a contract and can lead to delays if overlooked. Always ensure that the LOA is signed and submitted as one of the initial steps.

Additionally, some applicants do not keep proper records of their time against each project. Especially for those working on multiple assignments, accurate record-keeping is vital to ensure that all work is accounted for and accurately reported on your payment request.

Moreover, many individuals overlook the requirement to secure advance authorization for overtime work. Always confirm with your approving manager before logging any additional hours. Failing to do so can cause significant issues when it comes time for payment.

Finally, a common mistake is submitting the timesheet after the contract end date. Once your contract expires, you will lose access to the ST Request site, jeopardizing your ability to submit for payment. It is critical to submit timesheets and payment requests on or before your contract end date.

By being mindful of these common mistakes, individuals can navigate the World Bank Short-Term Payment Request process more smoothly, ensuring that they receive their payments in a timely manner.

Documents used along the form

The World Bank Short-Term Payment Request form is an essential document for short-term consultants and temporaries. Along with this form, several other documents may be required to ensure a smooth payment process. Each plays a unique role in the overall payment and approval mechanism. Here is a list of important documents often used in conjunction with the Payment Request form.

- Letter of Appointment (LOA): This document outlines the specific terms and conditions of employment for a consultant or temporary staff. It serves as the initial agreement, triggering the creation of necessary accounts for online access and payment requests.

- Service Entry Sheet (SES): Generated in SAP when a payment request is approved, the SES captures all relevant task details for processing. It is an important reference for the approving manager when reviewing the payment request.

- Bank Account Information Form: This form is required to provide the necessary details about the bank account where payment will be directed. It must include full bank branch information, account numbers, and other relevant banking details.

- Email Notification Records: Consultations and notifications about payment requests, approvals, or rejections are communicated via email. Keeping copies of these records helps track the request status and any comments made by the task team leader or reviewer.

- Time Sheet: A detailed record of the hours or days worked on various projects. This document is essential for validating payment requests and ensuring accurate compensation based on worked time.

Each document listed above plays a pivotal role in the payment process for short-term consultants and temporaries. Understanding their purpose can help ensure that your payment requests are processed smoothly and efficiently.

Similar forms

The World Bank ST Payment Request form shares similarities with various other documents used in financial and administrative processes. Here’s a list examining these similarities:

- Invoice: An invoice is a document requesting payment for services or goods. Like the ST Payment Request, it includes details such as the work performed, the amount due, and payment instructions.

- Expense Reimbursement Form: This document allows employees to request repayment for out-of-pocket expenses. Similar to the ST form, it requires itemized details for clarity and verification before payment can be made.

- Payment Voucher: A payment voucher is used to authorize payment to vendors. Both the payment voucher and ST form serve as formal requests that require signatures and approval prior to disbursement.

- Time Sheet: A time sheet records hours worked and is used for payroll purposes. The ST Payment Request form also tracks time, ensuring that consultants receive payment for hours worked on specific tasks.

- Purchase Order: This document formally requests the purchase of goods or services. Like the ST Payment Request, it lays out details about the transaction, including specifications and pricing, which must be validated against work performed.

- Contractor Agreement: A contractor agreement outlines the terms of engagement for services. The ST Payment Request references the contract to ensure that payments align with agreed-upon deliverables and timelines.

- Service Entry Sheet (SES): An SES is created in systems like SAP to indicate that services have been rendered. This is similar to the ST Payment Request, which must be approved before an SES is generated for payment.

- Request for Payment (RFP): An RFP is often used in environments with limited access to online systems. Like the ST Payment Request, it authorizes funds and specifies instructions necessary for payment processing.

- Payroll Submission Form: This form details employee compensation. The ST Payment Request functions similarly as it documents required payment for contractors and temporaries based on specified work.

- Funding Release Form: This form is used to request the release of funds for projects. The ST Payment Request also seeks the release of funds for specific contracted services, requiring approvals and validations.

Dos and Don'ts

When filling out the World Bank Short-Term Payment Request form, being cautious and informed is essential. Here’s a guide to help navigate this process effectively, outlining actions you should and shouldn't take.

- Do: Ensure you have accurate bank account information ready before starting the form. Double-check the details to minimize errors.

- Do: Use the designated email address you provided to the World Bank. This is crucial for receiving notifications about your payment request status.

- Do: Review project details thoroughly before submitting the payment request. This helps ensure that all services rendered and deliverables are properly described.

- Do: Submit your payment request on or before the end date of your contract, as access to the ST Request site will be revoked afterward.

- Do: Keep a record of hours worked for each project, especially if you are juggling multiple assignments. Accurate record-keeping can prevent disputes later on.

- Do: Request advance payment for travel subsistence costs if necessary, but confirm your eligibility with the administrative contact first.

- Don't: Submit a payment request if your Letter of Appointment (LOA) has not been signed. This could lead to complications in processing your payment.

- Don't: Fill out the form without checking that all required fields are complete. Missing information can result in delays or rejection.

- Don't: Attempt to submit payments for work completed before your contract start date. This can expose both you and the organization to liabilities.

- Don't: Ignore notifications from the Task Team Leader (TTL) about your request. These can provide vital feedback on approval or required revisions.

- Don't: Wait until the last minute to submit your request. Earlier submissions allow time for unexpected issues to be resolved.

- Don't: Forget to reset your passkey after receiving it. This step is critical to ensure the security of your account.

Following these guidelines can significantly enhance the smoothness of your payment request process. Remember, careful preparation and attention to detail can save time and avoid potential complications.

Misconceptions

Understanding the intricacies of the World Bank Short-Term Payment (ST Payment) Request form is essential for short-term consultants and temporaries. Here are eight common misconceptions regarding this form:

- The Payment Request Form is only for full-time employees. This is incorrect. The Payment Request Form is specifically designed for short-term consultants (STCs) and temporaries (STTs) to submit their payment requests online.

- You can use the Payment Request Form without prior approval. Approval from the task team leader (TTL) or reviewer is mandatory before the payment request can be processed.

- The ST Payment system is not secure. In reality, the system is passkey protected, ensuring that only authorized users can access and submit their payment requests.

- All payment requests must be submitted in person. Submission can be done online, making it more convenient, especially for those in remote areas.

- You can submit a payment request at any time, regardless of contract status. Access to the ST Request site is limited to the duration of your contract. Once the contract ends, so does your access.

- Overtime for temporaries can be claimed without prior approval. It is necessary to secure authorization in advance from your approving manager before claiming overtime hours.

- Payment information does not have to be accurate for transactions to be processed. Accurate bank account information is crucial. Inaccuracies may lead to delays or failed payment requests.

- You cannot track the status of your payment request. The ST Request system allows users to monitor the status of their payment requests, providing real-time updates.

Addressing these misconceptions can streamline the payment process for short-term consultants and temporaries, ensuring a smoother experience overall.

Key takeaways

Filling out the World Bank ST Payment Request form is an important process for short-term consultants and temporaries. Below are key takeaways to keep in mind when utilizing this form:

- The Payment Request Form is accessible online at the ST Request site.

- It streamlines payment processing for consultants and temporaries by automating payment requests and approvals.

- Online tracking of payment status is available, helping users stay informed about their requests.

- Confidentiality is maintained through a secure passkey, which is essential for access outside of headquarters or country offices.

- The form validates available hours or days worked against purchase orders, simplifying management for those involved in multiple projects.

- Accurate bank account details must be submitted to avoid delays. This includes branch name, account number, and routing information.

- Payments cannot be processed for work done before the contract starts; compliance is crucial to avoid insurance issues.

- Only one personal email address should be provided for receiving updates about payment requests.

- Direct deposits are mandatory for payments, ensuring timely crediting to bank accounts.

- If overtime is needed, prior authorization from the approving manager is essential.

By keeping these key points in mind, short-term consultants and temporaries can navigate the ST Payment Request process more effectively.

Browse Other Templates

Player Evaluation Form - Rates physical strength as shown in tackling and aerial challenges.

America First Credit Union External Transfer Limit - Incoming wire transfers are an efficient way to receive funds.