Fill Out Your Wrap Around Mortgage Form

The Wrap Around Mortgage form serves as an important tool in real estate financing, allowing a borrower to obtain a loan that wraps around an existing mortgage. This type of mortgage can be beneficial when the existing loan has a lower interest rate than current market rates. Essentially, the borrower makes payments to the new lender, who then uses a portion of those payments to cover the costs of the original mortgage. This arrangement allows for smoother transactions and can facilitate the purchase of properties under certain financial conditions. Major aspects of this form include provisions regarding taxes and insurance, which the borrower must comply with, as well as the potential consequences of default. If the borrower fails to meet these obligations, it could trigger a default under both the original and the wrap-around mortgages, giving the lender certain rights and remedies. Furthermore, should the lender default on the mortgage payments, the borrower has the right to advance funds to cover that default. Any funds advanced will be credited against the borrower's next payments, creating a mechanism for resolution that benefits both parties in the mortgage arrangement.

Wrap Around Mortgage Example

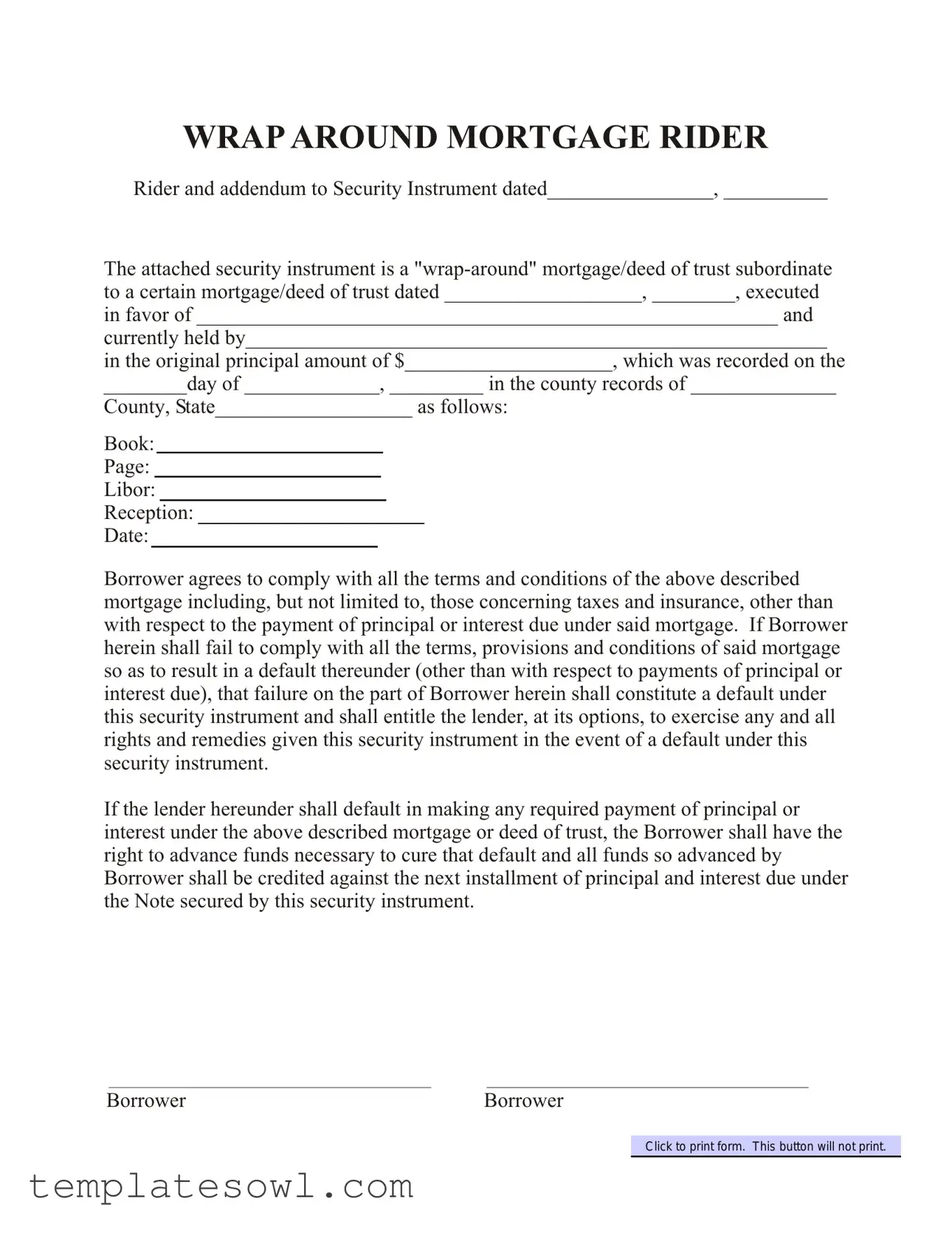

WRAP AROUND MORTGAGE RIDER

Rider and addendum to Security Instrument dated________________, __________

The attached security instrument is a

in favor of ________________________________________________________ and

currently held by________________________________________________________

in the original principal amount of $____________________, which was recorded on the

________day of _____________, _________ in the county records of ______________

County, State___________________ as follows:

Book:

Page:

Libor:

Reception:

Date:

Borrower agrees to comply with all the terms and conditions of the above described mortgage including, but not limited to, those concerning taxes and insurance, other than with respect to the payment of principal or interest due under said mortgage. If Borrower herein shall fail to comply with all the terms, provisions and conditions of said mortgage so as to result in a default thereunder (other than with respect to payments of principal or interest due), that failure on the part of Borrower herein shall constitute a default under this security instrument and shall entitle the lender, at its options, to exercise any and all rights and remedies given this security instrument in the event of a default under this security instrument.

If the lender hereunder shall default in making any required payment of principal or interest under the above described mortgage or deed of trust, the Borrower shall have the right to advance funds necessary to cure that default and all funds so advanced by Borrower shall be credited against the next installment of principal and interest due under the Note secured by this security instrument.

Borrower |

Borrower |

Click to print form. This button will not print.

Form Characteristics

| Fact Name | Description |

|---|---|

| Definition | A wrap-around mortgage is a type of financing that allows a new mortgage to be issued while keeping an existing mortgage in effect. This arrangement can benefit both the borrower and the lender in certain scenarios. |

| Subordination | The wrap-around mortgage is subordinate to another existing mortgage. This means that if a payment default occurs, the existing mortgage must be settled before the wrap-around lender can claim any rights. |

| State-Specific Laws | In states like California, wrap-around mortgages are governed by specific provisions under the California Civil Code. Understanding state laws is crucial for both borrowers and lenders. |

| Borrower's Rights | If the lender defaults on the original mortgage, the borrower has the right to advance the funds needed to cover that default. These funds will then be applied to the next payment, ensuring the borrower remains protected. |

Guidelines on Utilizing Wrap Around Mortgage

Completing the Wrap Around Mortgage form requires careful attention to detail. Each section must be accurately filled out to ensure clarity and legality. Following this guidance will help in filling out the form correctly, facilitating a smooth transaction.

- Begin by locating the section labeled "Rider and addendum to Security Instrument dated". Enter the date of the original security instrument here.

- In the next blank, input the name of the county where the property is located.

- Fill in the date of the previous mortgage or deed of trust. This should be found in records related to the property.

- Provide the name of the lender associated with the original mortgage in the designated space.

- Next, input the name of the current holder of the current mortgage as mentioned in the form.

- Enter the original principal amount of the existing mortgage. Ensure that the amount is accurate to avoid issues later.

- Document the recording date in the county records of the previous mortgage. This often requires checking local property records.

- Fill in the corresponding details: Book, Page, Libor, Reception, and Date. Each piece of information can typically be found on the mortgage document.

- Review the Borrower’s agreement regarding compliance with the terms and conditions of the previous mortgage. Ensure all necessary information is present.

- Confirm that the statement about defaults clearly describes the responsibilities and rights of both the Borrower and the lender.

Once all fields are filled out, it is advisable to review the form for any errors before submitting or filing it. Ensuring correctness will aid in preventing challenges related to the mortgage in the future.

What You Should Know About This Form

What is a Wrap Around Mortgage?

A wrap around mortgage is a form of secondary financing where a new mortgage wraps around an existing one. This allows a buyer to make payments on the new loan that cover both the existing loan and the difference in the financing provided by the seller. Essentially, the seller's original mortgage remains in place, and the new borrower makes payments to the seller, who in turn continues to pay the original lender.

How does a Wrap Around Mortgage benefit borrowers?

A wrap around mortgage can offer several advantages to borrowers, including potentially lower interest rates and the ability to finance a home without having to go through traditional lenders. It can also provide more flexible terms and conditions, making home buying more accessible, especially for those with credit difficulties.

Are there any risks associated with a Wrap Around Mortgage?

Yes, there are risks involved. If the seller defaults on their underlying mortgage, the new buyer could face foreclosure despite continuing to make their payments. It’s crucial for borrowers to ensure that the seller is current on their payments and that the wrap around agreement is drafted clearly to protect their interests.

What should be included in a Wrap Around Mortgage agreement?

A comprehensive wrap around mortgage agreement should detail the terms of the loan, including the interest rate, repayment schedule, and any obligations regarding taxes and insurance. It’s also essential to specify the conditions under which the borrower can advance funds to cover defaults on the original mortgage.

Who is responsible for taxes and insurance in a Wrap Around Mortgage?

The borrower is typically responsible for complying with all terms related to taxes and insurance as outlined in the wrap around mortgage agreement. However, the obligations around the payment of principal and interest on the underlying mortgage remain with the seller unless otherwise specified.

Can a Wrap Around Mortgage affect the seller's credit?

If the seller defaults on the original mortgage, it can negatively impact their credit score. The wrap around arrangement does not shield the seller from consequences related to the underlying debt; therefore, they need to maintain timely payments to ensure their credit remains intact.

What happens if the buyer fails to make payments?

If the buyer fails to make payments on the wrap around mortgage, the lender may have the right to exercise any remedies specified in the security instrument. This could include initiating foreclosure proceedings to recover the property. Clear terms outlining the consequences of missed payments are important to protect both parties.

Is it necessary to involve a lawyer in drafting a Wrap Around Mortgage?

While it is not legally required, it is highly advisable to involve a lawyer in the drafting and review of a wrap around mortgage agreement. This professional guidance can help ensure that the agreement is legally sound and adequately protects the interests of both the buyer and the seller.

Can a Wrap Around Mortgage be used for investment properties?

Yes, a wrap around mortgage can be utilized for investment properties. However, both buyers and sellers should be aware of the specific regulations and market implications that may apply to investment real estate. Proper due diligence and understanding of the terms involved are essential for a successful transaction.

Common mistakes

Filling out the Wrap Around Mortgage form requires careful attention to detail. One common mistake is failing to provide accurate dates. The first section of the form asks for the execution date of both the wrap-around mortgage and the original mortgage. Incorrect or missing dates can lead to confusion and potential legal disputes.

Another frequent error involves inaccurately recording the lender’s details. The form includes a section where the name and current holder of the original mortgage must be specified. If this information is incorrect or incomplete, it compromises the validity of the wrap-around mortgage and may impact future transactions.

Additionally, borrowers often overlook the specific terms and conditions outlined in the original mortgage. Incomplete understanding of these terms can lead to unintentional defaults. The wrap-around mortgage is designed to be subordinate to the original mortgage, and failing to comply with the terms can result in significant financial consequences.

Finally, neglecting to sign and date the document properly is a critical mistake. Each borrower’s signature is necessary for the mortgage to be legally binding. A missing signature can render the entire document ineffective, leaving all parties at risk of complications in future dealings.

Documents used along the form

The Wrap Around Mortgage form is an essential component of certain financing agreements. To effectively navigate a wrap-around mortgage transaction, several additional documents may be involved. Each serves a specific purpose in outlining the terms and protecting the interests of the parties involved.

- Promissory Note: This document outlines the borrower's promise to repay the loan under specified terms, including the loan amount, interest rate, and payment schedule. It serves as a legal agreement between the lender and borrower.

- Deed of Trust: Similar to a mortgage, this document conveys the property title to a third party, known as a trustee, who holds it as security for the loan. It details the conditions under which the trustee can reclaim the title if the borrower defaults.

- Mortgage Application: This form collects the borrower's personal and financial information necessary to assess creditworthiness. Lenders use it to evaluate the loan risk and approve or deny the mortgage request.

- Closing Disclosure: This document outlines the final terms of the loan, associated costs, and fees. It ensures transparency and allows borrowers to understand their financial obligations before finalizing the mortgage.

- Loan Estimate: Provided within a few days of receiving a mortgage application, this document gives borrowers a summary of their loan options. It includes estimated interest rates, monthly payments, and other essential details.

- Power of Attorney: In some cases, this form allows one party to act on behalf of another in financial or legal matters. It might be necessary when individuals cannot be present to sign the closing documents.

- Escrow Agreement: This document explains the terms under which escrow funds will be held and released between parties. It usually involves managing funds for property taxes and insurance payments.

- Addendum: An addendum may include any additional agreements or modifications to the original wrap-around mortgage. It serves to clarify terms and conditions in case there are changes to the transaction.

Familiarizing oneself with these accompanying documents can enhance understanding and facilitate smoother transactions in real estate financing. Each document plays a critical role in outlining the responsibilities and protecting the rights of the parties involved in a wrap-around mortgage agreement.

Similar forms

The Wrap Around Mortgage form serves a specific purpose in financing real estate transactions. Here are five documents that are similar to the Wrap Around Mortgage, highlighting how they relate:

- Subordination Agreement: This document establishes the priority of loans when one mortgage is placed behind another. Like the Wrap Around Mortgage, it outlines the terms under which the subordinate mortgage(s) will be managed, ensuring that the lender has clear rights in the event of default.

- Deed of Trust: A deed of trust secures a loan using real property as collateral. Similar to a Wrap Around Mortgage, it involves three parties: the borrower, the lender, and a trustee, facilitating the transfer of the property title without judicial foreclosure.

- Promissory Note: This is a financial instrument wherein the borrower agrees to repay a loan. It’s closely related to the Wrap Around Mortgage because it typically includes the terms of repayment, which are essential for understanding the financial obligation secured by the wrap-around structure.

- Assumption Agreement: This document allows a buyer to take over the seller's existing mortgage and its obligations. Like the Wrap Around Mortgage, it often includes terms that protect the interests of the lender while allowing the borrower to continue making payments.

- Loan Modification Agreement: This modifies the existing terms of a mortgage, such as interest rate or payment schedule. Similar to the Wrap Around Mortgage, it seeks to establish clear terms and obligations for both parties, particularly in response to financial difficulties faced by the borrower.

Dos and Don'ts

When filling out the Wrap Around Mortgage form, precision is key to avoid complications down the line. Here’s a list of important dos and don’ts that can guide you through the process.

- Do provide complete and accurate information in all required fields.

- Do ensure that the date fields are filled correctly to maintain legal consistency.

- Do read the terms of the existing mortgage carefully to ensure compliance.

- Do verify the names of all parties involved to avoid any potential disputes.

- Do maintain copies of the completed form for your records.

- Don’t leave any fields blank, as this may lead to delays in processing the mortgage.

- Don’t sign the form without thoroughly understanding all terms and conditions outlined in the document.

- Don’t use incorrect legal descriptions or information that could misrepresent the property.

- Don’t ignore existing agreements or conditions from the primary mortgage, as this is crucial for avoiding defaults.

Misconceptions

Here are some common misconceptions about the Wrap Around Mortgage form. It's essential to understand these points to avoid confusion and make informed decisions.

- Misconception 1: A wrap-around mortgage is only for buyers with poor credit.

- Misconception 2: Wrap-around mortgages are illegal or not recognized.

- Misconception 3: The borrower fully owns the property immediately.

- Misconception 4: Wrap-around mortgages eliminate the original lender.

- Misconception 5: All wrap-around mortgages require a large down payment.

- Misconception 6: Only sellers can offer a wrap-around mortgage.

- Misconception 7: Payments under a wrap-around mortgage include all costs.

- Misconception 8: Wrap-around mortgages are risky for everyone involved.

- Misconception 9: All wrap-around mortgages have the same terms.

This isn’t true. Wrap-around mortgages can be appealing to various buyers, including those with good credit. They often provide flexibility in financing.

In fact, wrap-around mortgages are legal and are recognized in many states. However, the regulations can vary, so it's crucial to check local laws.

Not necessarily. The existing mortgage remains in place, and the borrower pays the wrap-around lender while the original mortgage is still active until it's paid off.

This is incorrect. The original lender remains involved because the primary mortgage is not eliminated; it exists alongside the wrap-around mortgage.

While some may require a down payment, many wrap-around mortgage agreements can be structured with little to no down payment based on the seller's terms.

While sellers often use wrap-around mortgages to finance the sale of their property, buyers can also use this method to negotiate better financing terms with private lenders.

This isn't entirely accurate. Borrowers are responsible for complying with other mortgage terms, including taxes and insurance, as outlined in the agreement.

While they do carry some risks, such as the original mortgage default, they can also provide unique benefits like lower closing costs and expedited sales.

Wrap-around mortgage terms can vary widely depending on the negotiations between the buyer and the seller or lender. Each agreement is unique.

Key takeaways

Here are some key takeaways to keep in mind when filling out and using the Wrap Around Mortgage form:

- Understand the Basics: A Wrap Around Mortgage allows one mortgage to be secured by an existing mortgage, enabling a borrower to make a single payment that covers both loans.

- Detail the Existing Mortgage: Clearly note the details of the original mortgage, including the lender's name, principal amount, and recording information.

- Compliance is Crucial: The borrower must agree to comply with all terms of the original mortgage, including taxes and insurance, except for principal or interest payments.

- Defaults Count: If the borrower fails to meet any terms (excluding payment of principal or interest), it may be considered a default under the Wrap Around Mortgage.

- Rights of the Lender: If there’s a default, lenders have the right to take specific actions as outlined in the security instrument.

- Borrower's Right to Cure: In the event the lender defaults on payment of principal or interest, the borrower can advance the necessary funds and have those credited toward future payments.

- Documentation Matters: Ensure all provisions of the Wrap Around Mortgage form are accurately filled out to avoid future legal complications.

- Consult a Professional: If unsure about the terms or how the Wrap Around Mortgage works, consulting a legal professional is always a wise choice.

Keeping these points in mind will help navigate the complexities of the Wrap Around Mortgage form with greater confidence.

Browse Other Templates

University of Maryland Global Campus Student Login - Processing times may vary, especially during peak periods.

What College Department Handles Transcripts - Make sure to double-check your email address before sending the form.