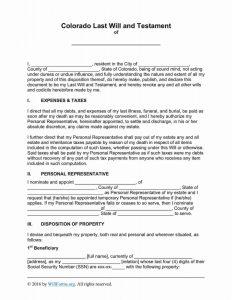

Free Colorado Last Will and Testament Template

Creation of A Last Will and Testament

You can regulate the allocation of your hard-earned property upon your death by preparing the last will document. Death is unpredictable, and your family might suffer, especially if you are the sole breadwinner. What will happen to your spouse and children after you die without a will? Outsiders might come and claim your estate fraudulently. Therefore, it is vital to protect your family by preparing a will that will award your heirs all of your wealth as per your wishes.

You may have a life insurance policy, acres of land, shares in a multi-million dollar corporation, or savings under your name. If you fail to list beneficiaries of your wealth, the state will take control. Therefore, it is critical to prepare a last will in Colorado because unwritten wishes are invalid.

As a testator, you must indicate all of your particulars in the document such as full name, address, assets, and signature. You must also choose an executor who will ensure the court follows all your last wishes unopposed. But, you must inform the person before you name them as the executioner. To prevent conflict of interest, the person should not be a beneficiary or relative.

Then, list down the details of all the beneficiaries with the proposed asset portion. Finally, ensure that you have two witnesses who will sign the document in the presence of a certified legal officer.

Apart from estate planning, the last will and testament template is used to choose a legal guardian for your underage children. However, it would be best if you informed the chosen parties before listing them in the last will. You can also appoint your pet’s caregiver in the will upon your death. Colorado permits testators to create a trust fund for their children or pets.

How the Court Process Works

A Colorado last will and testament document has legal requirements that you must follow to the letter. First, the will must comprise correct particulars of all the parties involved – the testator, executioner, beneficiaries, and estate in question. The terms of the will must be acceptable in the probate court.

After the court approves the will, the executor can go ahead and fulfill the testator’s will. The will can also instruct the executor to pay debts or accrued taxes using the estate’s proceeds. The executor must immediately file the will after the testator’s death within ten days for the will to be validated. The state does not recognize oral wills, but holographic wills are valid under exceptional circumstances with evidence.

However, if you have a small estate, the executor will not go through the probate court process. He or she will only need to file an affidavit for personal property collection in the probate court.

Requirements of the Last Will and Testament

The last will is a powerful document that is recognized by the Colorado State. Although the executioner must complete some legal process before asset distribution, it is for a worthy cause. According to Colorado laws (§15-11-501), the last will must have a testator aged 18 years and over plus at least two witnesses with proper judgment.

Below are the requirements for a legally valid Colorado last will and testament:

- Testator’s details–18 years and above

- Sound mentality

- Particulars of two witnesses

- Legal presentation

- Hand-written will

- Particulars of all beneficiaries and property allocation.

Creating A Last Will and Testament Online

Get a free last will and testament template from our site and complete your will creation with ease and convenience. We offer a downloadable form that you can fill and print within no time. It comes in a fillable PDF format that allows you to append all the required details. Why waste money in legal consultations and searching for expensive law firms?

Write your will within minutes using our free template and tailor it as per your estate size and beneficiary list. Generate a high-quality document testament form with all the legal jargon in place. Your dependents are important, don’t compromise their future.

Other Last Will and Testament Templates

- arizona will form

- california last will and testament

- florida will form

- georgia will template

- illinois will form

- maryland will template

- michigan will form

- mn last will and testament

- new jersey will form

- new york last will and testament

- nc will template

- ohio last will and testament

- oregon will form

- pa will template

- sc last will and testament

- tennessee will form

- texas last will and testament

- virginia will template

- washington state will template

- wisconsin last will and testament