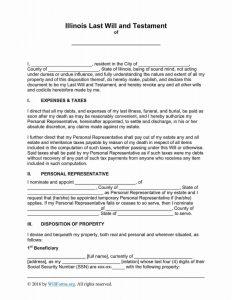

Free Illinois (IL) Last Will and Testament Template | Fillable Forms

One of the most important things about the last will is that this legal instrument can protect your marital partner and children, along with other beneficiaries, and even your household pets.

The best about the last will is that it gives you free rein of how and who stands to inherit your property. Hence, whether you want to leave everything to your kids or let your significant other, sibling, or a friend inherit your assets, this juridical document will allow you to do so even if you leave a widowed spouse. The only snag is, the last will might be challenged, so it is highly advised to appoint your inheritors and distribute your estate in a way that won’t make the court contest your last will and testament.

The last will specifies your instructions by analogy with an advance directive, even though these documents differ significantly. An advance directive or a living will takes effect only if a person is alive but incapacitated and unable to make crucial decisions. Such a legal paper loses its validity upon your passing. On the contrary, the last will declares your desires and instructions and ensures they are carried out correspondingly.

What Are the Benefits of Having a Last Will?

Although there are no legislative requirements for creating a last will and testament in Illinois, it is better if you do. If you don’t have a will, you allow the state to dispose of your assets according to the intestacy laws. The latter stand for the property distribution laws, applicable if a person passes away without drawing up a will.

It implies that your last wishes won’t be fulfilled because they weren’t mentioned in a written form. Thus, when the intestacy law comes into force, your successors won’t get a share of your wealth as you would have desired.

Yet, with the use of the last will, your directives, no matter how “standard” or “normal” they are, will be followed. In brief, such a legal document lets you do the next:

- Protect your offspring.

- Protect your pets.

- Expedite the process of registration of inheritance.

- Ensure business continuity and asset protection.

Before you can proceed to use a free printable template for a will in Illinois on our site or create a highly customized last will resorting to our step-by-step builder, let’s take a closer look at the advantages of having a will.

Protection of Your Descendants

It may happen that, at the time of your demise, you leave behind minor children. In this case, the guardian specified in your will (once they assume the functions of guardian) will look after your descendants and help manage their share of your legacy until the achievement of legal age. A last will and testament will help you establish a trust under will to protect the future of your children or grandchildren.

When you have grown kids at the time of your passing, it is also possible to allocate them as your heritage stakeholders. If you leave behind several children, you need to divide their inheritance accordingly, splitting it into equal proportions.

It is also crucial to split your wealth appropriately between your offspring and your surviving wife or husband.

Provision of Care for Your Household Animals

The testator who has pets they wish to be taken care of after their demise may set up a pet trust. The trust ceases to exist when the named animal dies if no other animals are covered by this pet trust, of course.

The Acceleration of the Process of Inheritance Registration

At the availability of a valid Illinois last will and testament, the estate division procedure at the Probate Court (or P.C.) takes less time. It represents a court-supervised process organized to supervise the distribution of the deceased person’s assets under the instructions designated in the will.

The P.C. expects the executor of the will to submit it with the court clerk in the relevant district so that the court could issue official service letters that recognize the executor. As soon as it happens, the executor receives the right to share the heritage between heirs and beneficiaries.

Protection of Assets and Business Succession

In other situations, the estate-leaver can use a last will to write a business inheritance plan, especially if they want the business to go to their blood relatives. It is also allowed to establish a trust, which would later secure the rights of the legatees.

What Makes a Last Will Valid?

To become a valid legal instrument, a valid last will and testament must be drawn up and confirmed by a hand-written signature by the testator of the age of majority and older. The one who devises estate has to be sane. At this, a couple of reliable witnesses should be present, and they are not supposed to become inheritors of the property.

It is worth mentioning that intestacy law usually grants your marital partner and your children with your belongings in Illinois. However, if you don’t leave behind kids or a surviving spouse, your closest relatives will become rightful owners of your assets.

To make the process of will creation more straightforward for you, use our simple Illinois last will and testament form. Download a fillable PDF file online on our website and write the will that meets your needs.

Other Last Will and Testament Templates

- arizona will form

- california last will and testament

- colorado last will and testament

- florida will form

- georgia will template

- maryland will template

- michigan will form

- mn last will and testament

- new jersey will form

- new york last will and testament

- nc will template

- ohio last will and testament

- oregon will form

- pa will template

- sc last will and testament

- tennessee will form

- texas last will and testament

- virginia will template

- washington state will template

- wisconsin last will and testament